Dollar Needs a Big CPI Inflation Beat to Restart its Fading Rally

- Written by: Gary Howes

Image © Adobe Images

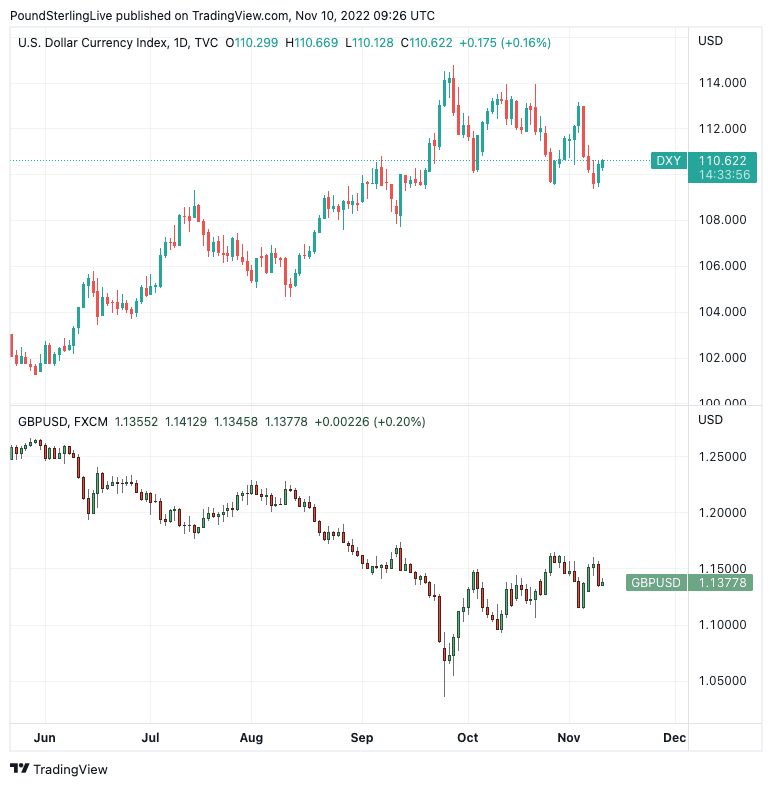

With the Dollar finding it harder to sustain rallies, a big upside surprise is required from Thursday's inflation data if the bulls are to regain the initiative.

U.S. inflation is due for release at 13:30 GMT, with markets looking for a rise of 0.6% month-on-month during October, taking the year-on-year increase to 8.0%, a touch lower than September's 8.2%.

The important core inflation reading is expected to read at 0.5% month-on-month and 6.5% year-on-year.

For the Dollar, the mechanics are simple: a beat would be consistent with a move higher as investors are forced into anticipating further interest rate hikes from the U.S. Federal Reserve.

A downside surprise would be consistent with Dollar weakness as it reinforces a narrative that 'peak rates' are finally in sight.

The scale of the deviation is important, the bigger the miss in either direction, the more reactive currency markets.

Ahead of the decision the GBP/USD exchange rate is quoted at 1.1386, the EUR/USD at 0.9987.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

The data comes amidst a pause in the Dollar's longer-term rally which appears to have topped out in September and there are indications that it is becoming increasingly harder for the Dollar to sustain rallies.

Of course, this uptrend could resume following the recent consolidation, but it would likely require a significant uptick in U.S. inflation followed by a renewed messaging by the Fed that it needs to maintain an aggressive approach to hiking rates.

Market expectations would need to upgrade their expectations for the December hike to 75 basis points, from the 50bp that is currently anticipated.

Furthermore, global economic conditions must deteriorate notably, which following months of incessant deterioration in investor sentiment, looks unlikely without a new and unforeseen catalyst.

"We think we have transitioned out of the easy trend trade for several markets, but certainly for the USD. The easy part of the USD rally is behind us, but the onus will be on other currencies to strengthen to dethrone the USD," says Mazen Issa, Senior FX Strategist at TD Securities.

If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found, here.

To better time your payment requirements, consider setting a free FX rate alert here.