U.S. Dollar: Supersized 100bp Federal Reserve Rate Hike Firmly in Play

- Written by: Gary Howes

"Is the coast clear for a 100bps hike from the Fed on July 29th? Of course it is"

Above: File image of Raphael Bostic. Image: Center for American Progress, reproduced under CC conditions.

The drumbeat of a sizeable 100 basis point interest rate hike at the Federal Reserve is growing louder with markets, analysts and Fed board members recalibrating expectations as they chase inflation's tail.

U.S. CPI inflation read at 9.1% year-on-year in June.

This is higher than the market's anticipated reading for 8.8% and represents an increase on May's 8.6%.

The Dollar went higher as investors immediately raised bets the Federal Reserve would be required to accelerate the pace it raises interest rates to slow the economy and cool inflation.

Of concern to economists is that core CPI - that bit of the inflation bucket that excludes fuel - is rising well above target, a problem that is firmly within the Fed's remit.

"Market participants concluded the Fed might raise interest rates by one percent at its next meeting in two weeks, a scenario that Fed funds futures currently assign a 55% probability to. In other words, a 100bps rate hike in July is now the baseline according to market pricing, and if the Fed doesn’t push back, it is essentially endorsing it," says Marios Hadjikyriacos, Senior Investment Analyst at XM.com.

Following the inflation data there was, indeed, very little appetite by a number of Federal Reserve board members to push back against the market.

Atlanta Federal Reserve Bank President Raphael Bostic said "everything is in play" when asked about a 100bps hike later this month. "Today’s numbers suggest the trajectory is not moving in a positive way... How much I need to adapt is really the next question."

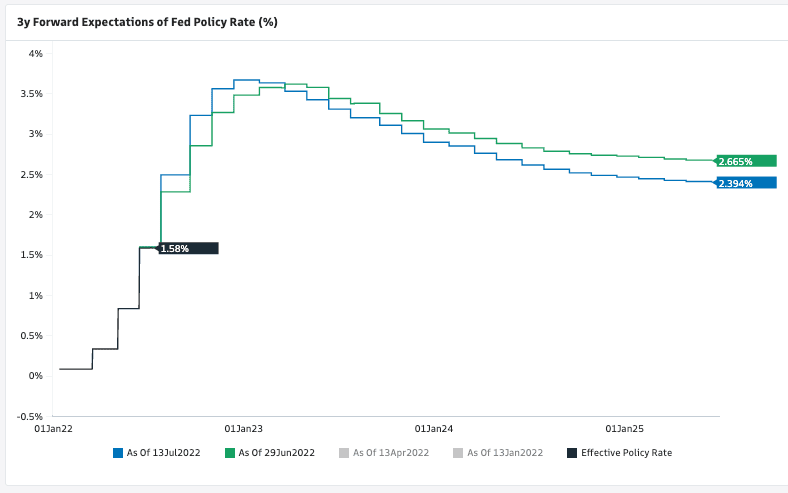

Above: Market pricing shows investors now price in a more rapid pace of hikes, but quicker cuts later out. Image courtesy of Goldman Sachs.

San Francisco Federal Reserve Bank President Mary Daly told the New York Times she favours a 75bp hike, but 100bp would now be on the table given the inflation surprise.

Federal Reserve Bank of Cleveland President Loretta Mester told Bloomberg she was not willing to rule out a 100bp move.

"Certainty the inflation report suggests that there’s no reason to say that a smaller rate increase than we did last time, right, because nothing moved in that direction," she said.

Federal Reserve Bank of Richmond President Tom Barkin said inflation must occupy the Fed's full attention and that he wants to see positive real rates in the next few years.

"So now that we’ve had a strong NFP report and a surprising CPI result, is the coast clear for a 100bps hike from the Fed on July 29th? Of course it is," says Bipan Rai, North America Head, FX Strategy, at CIBC Capital.

"Long USD is where it's at," he adds.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks