A Stronger June Possible for Pound-Dollar says Soc Gen

- Written by: Gary Howes

Image © Adobe Images

Seasonal factors could help extend a recent recovery in the Pound to Dollar exchange rate say foreign exchange analysts at Société Générale.

Researchers at the French banking giant say seasonal trends show June to be typically poor month for the U.S. Dollar, which if true in 2022 could mean a further extension in the young Pound-Dollar rebound.

Soc Gen analysis finds Sterling has rallied against the Dollar in eight of the last ten years in June.

"Seasonals traditionally turn negative USD in June, but this recurring trend could be tested if investors rushed too quickly to conclude that the Fed will be less aggressive in raising rates this year," says Société Générale strategist Kenneth Broux.

The Dollar has eased back from recent highs against the Euro, Dollar and other major currencies with Broux saying part of the decline can be attributed to a run of underwhelming U.S. macroeconomic data, which has led futures markets to price in less aggressive Federal Reserve tightening this year.

As of May 27 the market was pricing a peak in the Fed Funds rate of 2.90% by June 2023, this is down on the 3.05% priced in as of May 13.

This decline can have a mechanical drag on the U.S. Dollar given rising Fed hike expectations were a major engine of U.S. Dollar gains over recent months.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Sterling could meanwhile find help from a cementing in expectations for a June rate hike at the Bank of England in the wake of last week's fiscal boost from the UK government, aimed at easing the cost of living.

The additional spending could shore up economic activity and consumer confidence while potentially boosting UK inflation rates.

"The take-away for the BoE is that it may add to inflation and thus cements the outlook for another rate increase in June," says Broux.

Soc Gen technical analysis meanwhile finds GBP/USD has staged a steady bounce after forming low near 1.2155 earlier in May.

"It has overcome daily Kijun line which denotes further upside is not ruled out. A multi month trend line at 1.2770/1.2800 and 1.3000 are short-term resistances," says Broux.

Above: GBP/USD at daily intervals.

The Pound-Dollar rate edged further back above the 1.25 level last week following the release of minutes from the Fed's May policy meeting, which confirmed policymakers could be likely to rethink their interest rate stance if certain economic conditions are met in the months ahead.

While the meeting record mostly confirmed what had already been well telegraphed in the May press conference and subsequent remarks by Fed officials, there was at least one insight in there that may be informative of the outlook for Fed policy once nearer the final quarter.

"Many participants judged that expediting the removal of policy accommodation would leave the Committee well positioned later this year to assess the effects of policy firming and the extent to which economic developments warranted policy adjustments," the minutes said.

The line is creatively ambiguous in that it could be taken as merely a confirmation of Chairman Jerome Powell’s repeated acknowledgements that the FOMC members would be “prepared to do less” if U.S. inflation rates begin to recede meaningfully in the months ahead.

However, it could also be taken as creating scope for the Fed to shift its stance on the interest rate outlook in a meaningful fashion later this year following a further uplift in the Fed Funds rate at the June and July meetings that is now widely expected by financial markets.

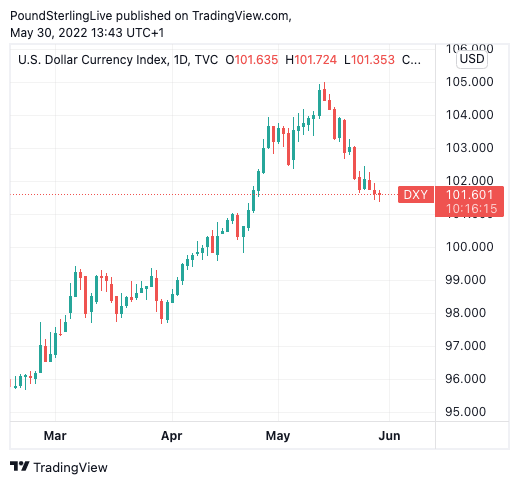

Above: The Dollar index.

Chairman Powell and others members of the Fed have been clear in recent weeks they will be responsive to forthcoming inflation figures and have emphasised to financial markets they are prepared to lift interest rates more aggressively than currently expected if price pressures build further.

But they've also been equally clear they’re prepared “to do less” if U.S. inflation rates begin to fall in a more convincing fashion during the months ahead while Federal Reserve Bank of Atlanta President Raphael Bostic acknowledged just this week the possibility of a pause in the bank’s rate cycle.

Should Fed hiking expectations come down further the Dollar could come under further pressure, helping a more sustained rebound in the Pound-Dollar rate.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks