"Hawkish FOMC Surprise would Turbo Charge USD" - CBA

- Written by: Gary Howes

Image: U.S. Government Works

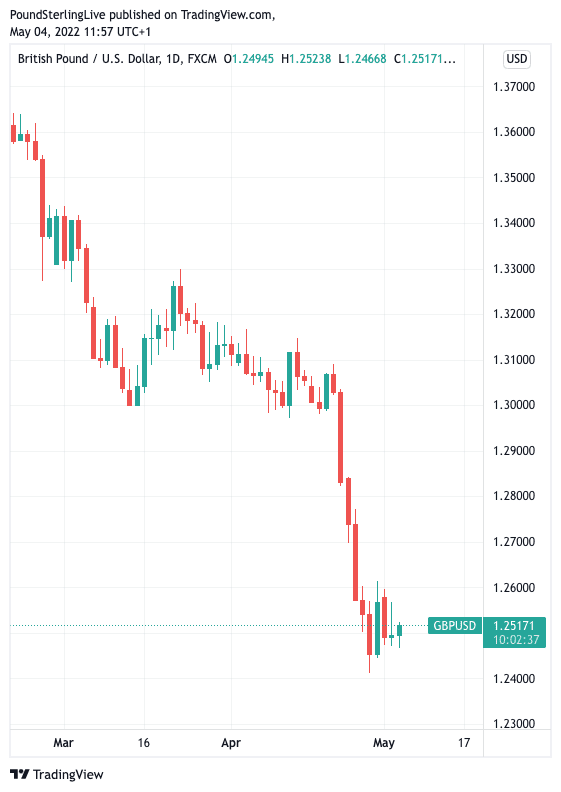

The Pound suffered its biggest monthly loss against the Dollar since October 2016 in April and those looking for a recovery will be hoping the outcome of the U.S. Federal Reserve's policy announcement later today can offer some relief.

The Fed is expected to raise rates by 50 basis points and announce it will start selling bonds back to the market as part of its quantitative tightening agenda.

The market expects the Fed’s balance sheet to shrink by $95BN per month following a quantitative tightening announcement.

These are the broad parameters of the market's expectations; how they are met, exceeded or underdelivered will likely impact on financial markets and the Dollar. Guidance on the extent of future hikes will also be key.

"USD will likely pullback from recent highs if the FOMC simply delivers on Fed pricing and/or leans against elevated interest rate expectations," says strategist Elias Haddad at Commonwealth Bank of Australia.

Ahead of the Fed's announcement - due at 19:00 BST - the Pound to Dollar exchange rate trades tentatively just above 1.25. The recent low from April 28 is at 1.2411.

The market has therefore arguably priced in a degree of the decision expected today and it would take an overtly hawkish surprise to push fresh Dollar gains.

"I continue to believe that today’s FOMC meeting will sound dovish relative to the hawkish psychology going in. This does not mean the Fed will pause its hiking campaign or push back on pricing, it just means that there is a lot of tightening in the market and the Fed has regained some credibility," says Brent Donnelly, CEO of Spectra Markets.

Above: The GBP/USD remains in a committed downtrend ahead of the FOMC.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

A pro-USD surprise could come in the form of a 75 basis point hike, something the market only anticipates to come at the June meeting.

"The risk is the FOMC front‑load future rate hikes and lift the funds rate by 75bps. US domestic demand activity is robust, inflation pressures remain elevated and the labour market is very tight. A hawkish FOMC surprise would turbo charge USD and short‑term Treasury yields," says Haddad.

The Pound-Dollar exchange rate would potentially retest the April lows on such an outcome and make a bid for fresh lows.

The exchange rate is currently quoted at 1.2515. (Set your FX rate alert here).

But holding the Fed back from such an aggressive stance would be growing expectations for a slowdown in both inflation and U.S. economic activity over coming months.

A survey of economists, fund managers and strategists conducted by CNBC shows the Fed's funds rate hitting 2.25% by year end and rising to a terminal rate of 3.08% by August 2023.

The quick pace of tightening and the stubbornness of inflation leads a majority of respondents to believe the Fed will not achieve a soft landing.

Asked if the effort to bring down inflation to 2% will create a recession, 57% said it would, 33% said it would be avoided and 10% didn’t know.

The risk therefore that going too hard on interest rates precipitates a 'hard landing' for the economy that triggers recession, and this could prompt a 'dovish' outcome relative to expectations.

This could aid Sterling higher against the Dollar.

Oscar Munoz, Macro Strategist at TD Securities, says the Fed will likely communicate a 'soft landing' is still possible even with the expected 50 basis point rate hike and an announcement on quantitative tightening.

Fed Chair Jerome Powell is expected by TD Securities to keep the door open to further 50bp rate hikes while not ruling out a potential 75bp increase.

Under such an outcome - which they weigh at 65% likelihood - the Dollar would be expected to appreciate.

"The USD remains in the driver's seat. With Powell likely to maintain more aggressive tightening options on the table, the market could continue to reprice terminal," says Mazen Issa, Senior FX Strategist at TD Securities.

Expect even stronger U.S. Dollar gains if the Fed suggests that financial conditions are still very easy, requiring more rapid policy tightening.

Such an 'hawkish' outcome would prompt the Dollar to break recent highs against the Euro says Issa, ensuring similar advances are likely against the Pound and other currencies.