Pound / Dollar Rate a Sell Near 1.31, Says J.P. Morgan FX Trader

- Written by: James Skinner

- -GBP/USD slipping back near 1.30

- -J.P. Morgan a seller on any rallies

- -Remarks from BoE & Fed in focus

Image © Adobe Images

The Pound to Dollar exchange rate slipped back toward 1.30 in the penultimate session of the week as Sterling underperformed many others, and one trader at J.P. Morgan says he would be a seller on any rally back near 1.31.

Sterling was lower against all G20 currencies except the Chinese Renminbi, South African Rand and Mexican Peso on Thursday ahead of scheduled remarks from Federal Reserve (Fed) Chairman Jerome Powell and Bank of England (BoE) Governor Andrew Bailey in Washington.

Governor Bailey speaks at the Peterson Institute for International Economics’ Macro Week 2022 event in Washington on Thursday at around 17:30 London time and any published remarks would be scrutinised closely by the market.

“UK fixed income [government bond market] continues to suffer and price in an aggressive change in tack from the Old Lady, with a hike now priced at every meeting (6) for the rest of the year,” says Taylor Bloom, a Paris-based currency trader at J.P. Morgan.

Above: Interbank reference rates from Thursday. Source: Netdania Markets. Click image for closer inspection.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

“We are short cable [selling GBP/USD] here and looking to add towards 1.31. 1.2970/80 needs to break on the downside for an extension,” J.P. Morgan’s Bloom said in a market commentary sent out to institutional and professional clients on Wednesday.

The BoE said in March and Governor Bailey reiterated in April that cost-of-living pressures could slow the economy later this year and may mean that interest rates need not rise to the same extent that financial markets currently anticipate.

The Pound to Dollar exchange rate had slipped back near to 1.30 ahead of the North American open on Thursday after trading up near to 1.31 during the European morning, while U.S. Dollar exchange rates were a mixed picture.

“USD is lower largely because of broad EUR strength. AUD/USD is range‑bound around 0.7440. Bond yields and stocks are a little higher in Europe and the US. Crude oil prices firmed,” says Elias Haddad, a senior currency strategist at Commonwealth Bank of Australia.

Soon after BoE Governor Bailey speaks on Thursday Fed Chairman Powell is set to participate in "Debate on the Global Economy" at the latest International Monetary Fund and World Bank Group meeting at around 18:00.

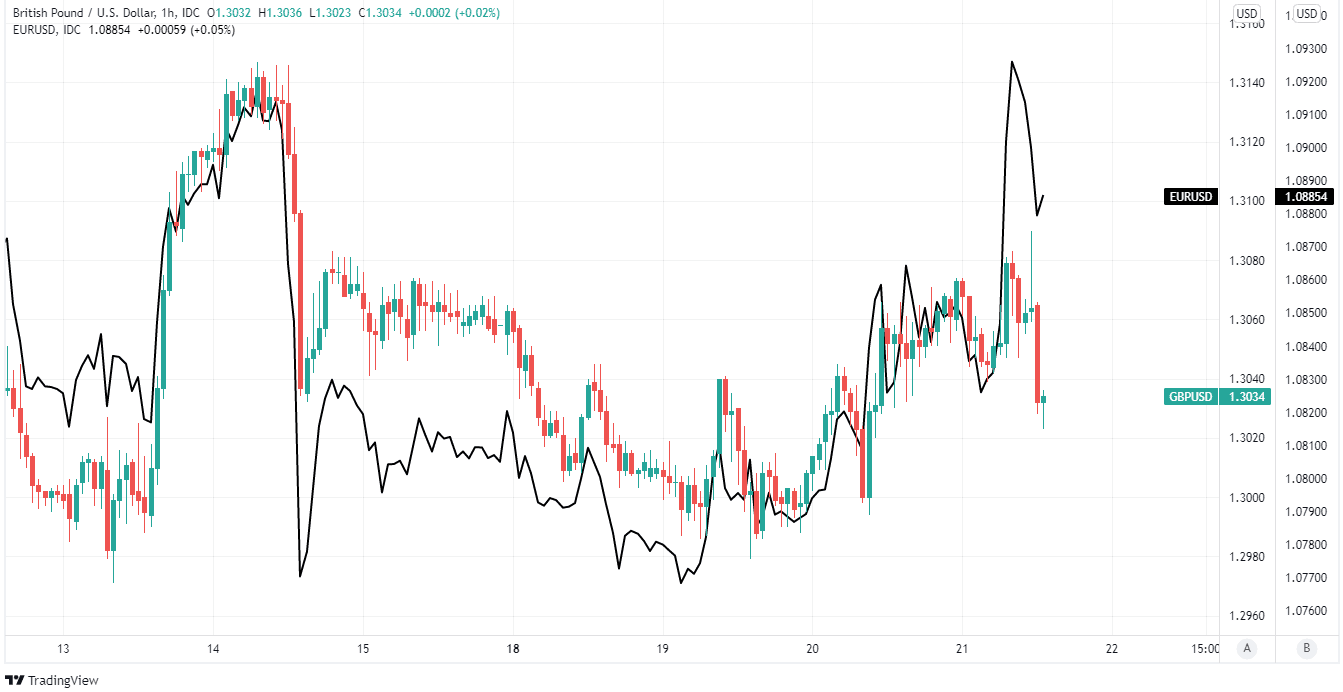

Above: Pound to Dollar rate shown at hourly intervals alongside EUR/USD. Click image for closer inspection.

Above: Pound to Dollar rate shown at hourly intervals alongside EUR/USD. Click image for closer inspection.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Chairman Powell’s is likely to garner much attention in light of expectations for an aggressive lift in the Fed Funds interest rate this year and given recent speculation that U.S. inflation pressures may be on the cusp of a peak.

Those expectations were incited further on Monday this week by Federal Reserve Bank of St. Louis President James Bullard.

He told a Council on Foreign Relations event that he wouldn’t personally rule out proposing and voting for the Federal Open Market Committee to lift the 0.50% Fed Funds rate by a 0.75% increment in one go at some stage as part of the Fed’s effort to rein in inflation.

“GBP/USD obviously reflects the broader rise of USD as well, and has tested levels below 1.30. A break could trigger a slide to support in the 1.2775- 1.2800 area. GBP needs a close above 1.3150 to reduce such pressure,” says Tim Riddell, a London-based macro strategist at Westpac.

“Surveys and updated BoE forecasts for MPC on 5th May will be critical in determining how aggressive the cost of living shock will be and so the vulnerability of GBP,” Riddell also said on Thursday.

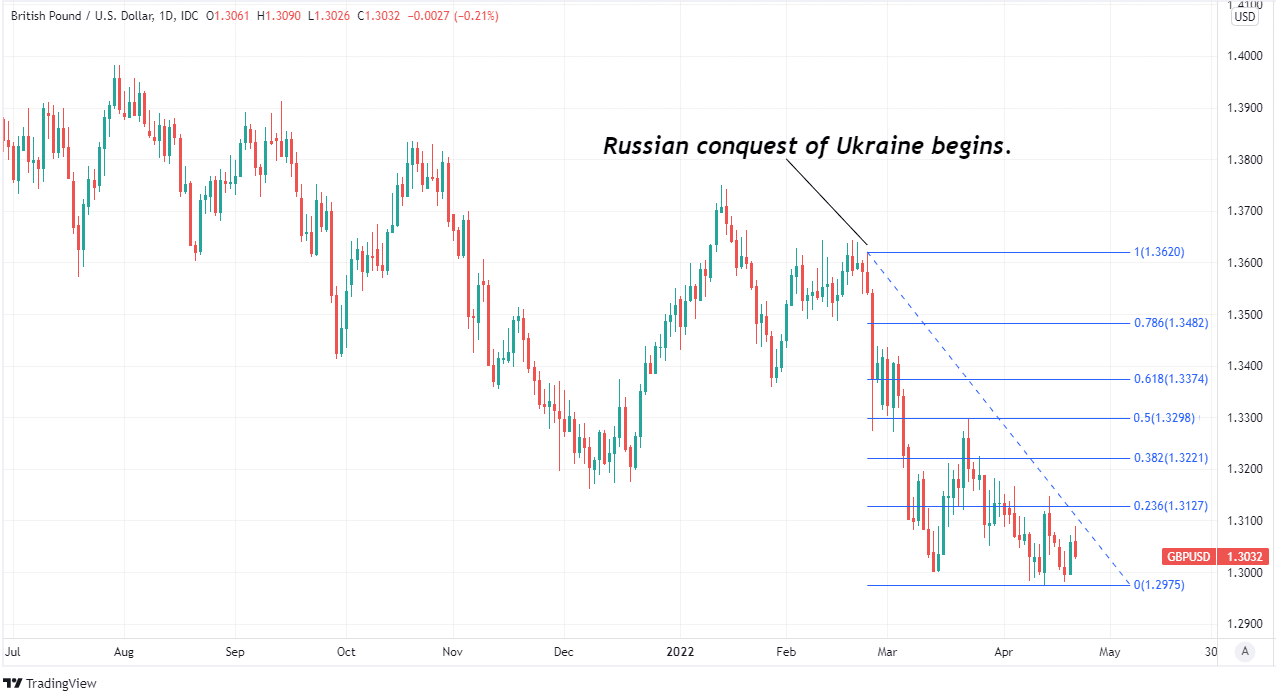

Above: Pound to Dollar rate at daily intervals with Fibonacci retracements of February decline indicating possible areas of technical resistance. Click image for closer inspection.

Above: Pound to Dollar rate at daily intervals with Fibonacci retracements of February decline indicating possible areas of technical resistance. Click image for closer inspection.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks