How Low Can the GBP/USD Rate Go? Just Ask the Euro

- Written by: James Skinner

- GBP/USD under pressure alongside EUR/USD

- With Ukraine invasion stressing EU & CEE FX

- Risk of EUR/USD pulling GBP/USD to 1.3122

- Risking loss of major support & key average

- If trade-weighted GBP stays a sideways track

- GBP losses largely illusory as GBP TWI stable

Image © Adobe Images

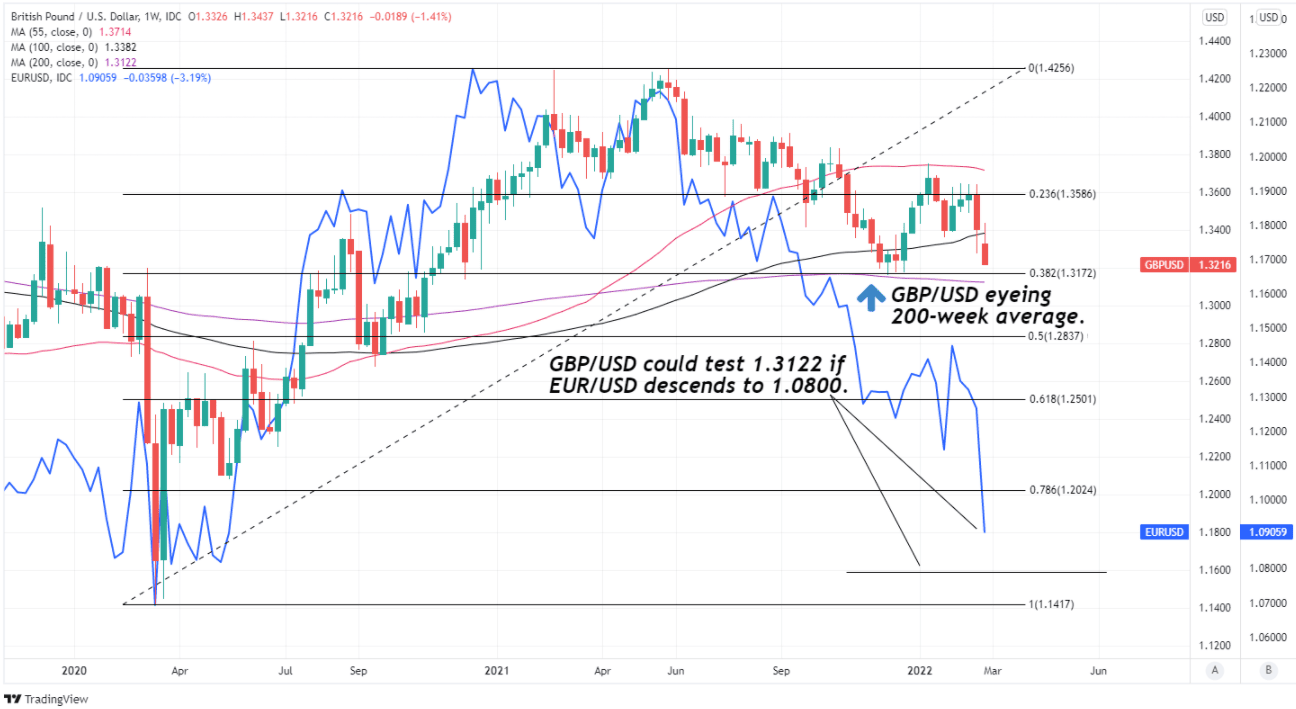

The Pound to Dollar exchange rate slumped in sympathy with the broader European currency complex ahead of the weekend and could be on course to slice through a major Fibonacci retracement and test key weekly moving average around 1.3122 over the coming days.

Pound Sterling came under significant pressure against all but the most volatile of continental and emerging market counterparts Friday as the European currency complex sank further in response to the escalating financial, economic and humanitarian fallout from Russia’s attack on Ukraine.

The Pound-Dollar rate’s losses have built in tandem with an even larger decline in the titanic EUR/USD exchange rate, which was this Friday on course for its largest one week decline since the most acute phase of the coronavirus crisis in March 2020.

“This has dragged the whole European currency complex with it,” says Stephen Gallo, European head of FX strategy at BMO Capital Markets.

Above: Pound to Dollar rate shown at weekly intervals with Fibonacci retracements of March 2020 recovery and key moving-averages, shown alongside Euro to Dollar rate.

- GBP/USD reference rates at publication:

Spot: 1.3205 - High street bank rates (indicative band): 1.2843-1.2935

- Payment specialist rates (indicative band): 1.3086-1.3140

- Find out about specialist rates and service, here

- Set up an exchange rate alert, here

Natural gas prices reached for the stars on Friday in price action that poses a further headwind to the European and global economic outlooks, which has likely exacerbated mutually reinforcing stresses in the Euro as well as Central and Eastern European currency complexes.

“The CZK and the PLN both rallied against the EUR following reported intervention by the Czech National Bank and the National Bank of Poland, although the PLN gave back its gains and was still trading weaker vs the EUR on the day by late morning (GMT),” BMO’s Gallo said on Friday.

Pressure on CEE currencies has already seen some central banks in the European neighborhood selling foreign reserves in an attempt to stem the depreciation of their currencies, and this has reinforced the decline in EUR/USD.

These stresses and their impact on the Euro-Dollar rate are a big part of what lifted the GBP/EUR exchange rate to its highest level since the immediate aftermath of the Brexit referendum on Friday, and this in turn is an important development.

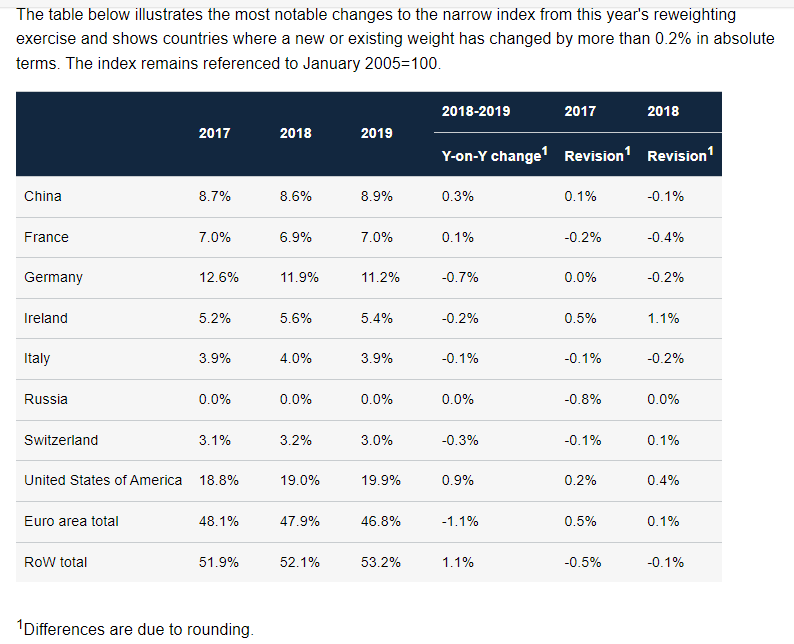

Source: Bank of England.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Sterling-Euro gained 1.5% for the week to Friday at its highest point and given the European single currency’s 46%+ share of the Sterling exchange rate index compiled by the Bank of England (BoE), this exchange rate has effectively neutralised the losses against other currencies including the Dollar.

Pound-Euro price action leaves the trade-weighted Sterling index unchanged for the week and continues a recent trend which, if sustained, would point the Pound to Dollar rate in the direction of 1.3122 in any market where the Euro-Dollar rate declines to 1.08.

“The signs in the financial markets that the fallout to the sanctions on Russia following its invasion of Ukraine is spreading beyond Russia are growing with Europe in particular beginning to show contagion. EUR/USD has broken key psychological support at 1.1000 and we expect the slide to continue,” warns Derek Halpenny, head of research, global markets EMEA and international securities at MUFG. “1.0884 could unfold quickly.”

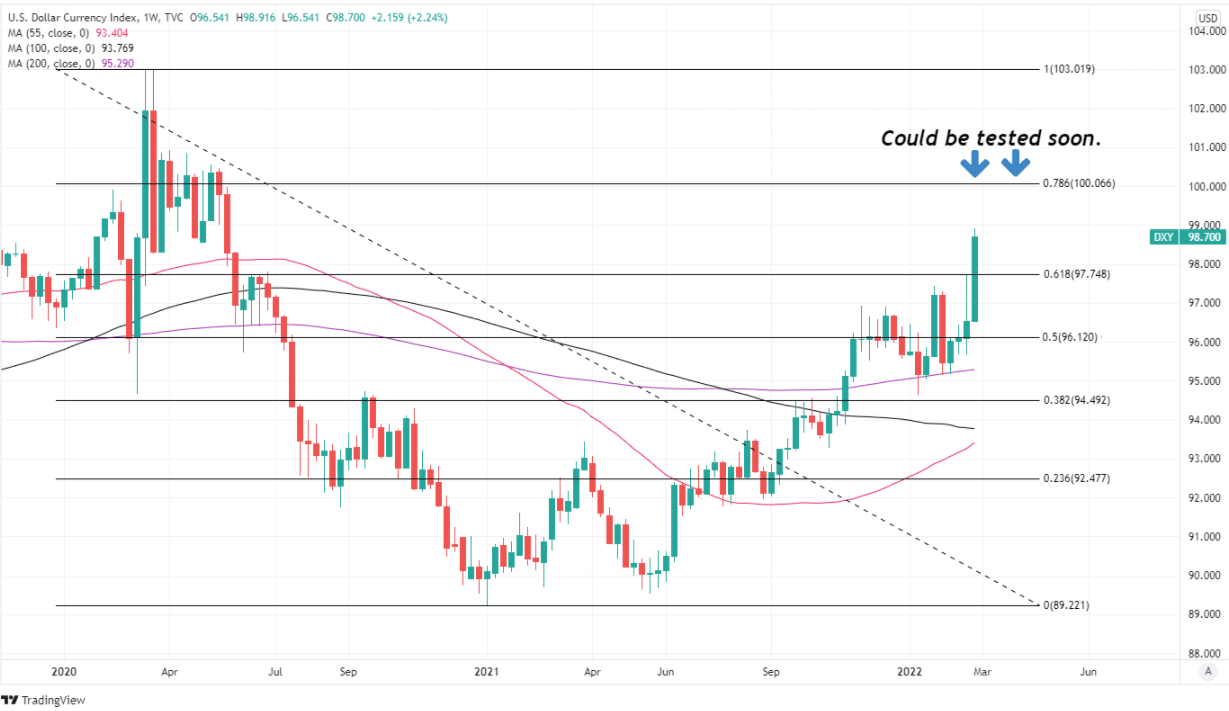

Government bonds were bought widely on Friday and crumbling stock markets got little help from what was a strong February non-farm payrolls report from the U.S., which potentially increases the appeal of the U.S. Dollar for investors.

Above: U.S. Dollar index shown at weekly intervals with Fibonacci retracements of 2020 decline indicating possible areas of technical resistance.