Pound / Dollar to Fall 1.25% on Dovish Bank of England Outcome: Analyst

- Written by: Gary Howes

Image © Adobe Stock

Investment bank TD Securities says there is a 25% chance the Bank of England on Thursday acts in such a way to trigger a 1.25% fall in the value of the Pound, while eyeing a 15% chance the Bank triggers a 1.0% gain.

But a base case scenario assigned a 60% probability sees James Rossiter - Head of Global Macro Strategy at TD Securities - and his team see a -0.25% move in the Pound against the Dollar.

The various setups form part of TD Securities' approach to the Bank of England policy decision and Monetary Policy Report that is widely expected to result in a 25 basis point, a decision driven by a recognition of the UK's surging inflation levels.

"Markets are well priced for the BoE to hike at the upcoming meeting," says Rossiter. "Data released since Dec shows that the economy was in much better shape than expected heading into Omicron, and high inflation is lifting inflation expectations."

- GBP/USD reference rates at publication:

Spot: 1.3552 - High street bank rates (indicative band): 1.3176-1.3270

- Payment specialist rates (indicative band): 1.3428-1.3482

- Find out about specialist rates and service, here

- Set up an exchange rate alert, here

The strategist does however think "the profile skews more negatively for GBP on the day, especially as positioning looks relatively long."

As part of the base case scenario the Monetary Policy Committee (MPC) is expected to hike rates 25 basis points but stays decisively ambiguous regarding the timing and shape of future rate hikes.

The all important inflation forecasts will meanwhile only be revised "just a touch higher" with the medium-term projection showing inflation falls back under 2.0% over the forecast horizon.

Here, the Pound to Dollar exchange rate would fall by approximately a quarter of a percent.

A dovish scenario (25% chance) sees the MPC spring another surprise - echoing the November hold - by opting to keep Bank Rate at 0.25%.

"The MPC leaves Bank Rate on hold, and says that future hikes will be data-dependent. Backs further hikes this year, but implies that yield curve has priced too much in. Inflation at Year 2-3 comfortably below target, with previous warning repeated that slack emerges by end of the projection," says Rossiter.

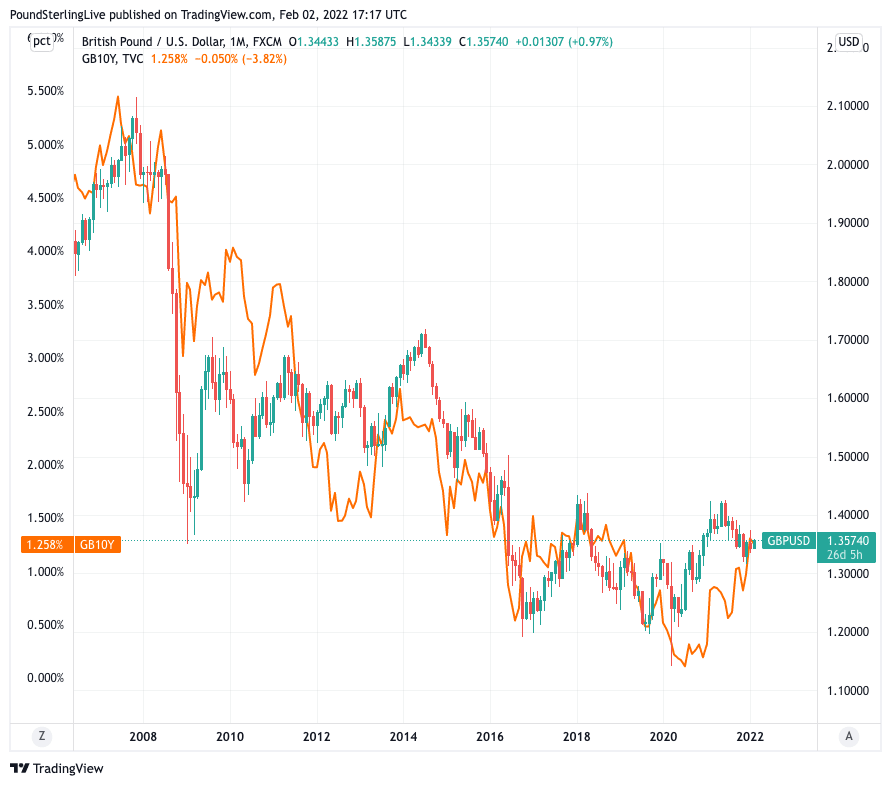

Above: Higher interest rates in the UK = a higher Pound-Dollar exchange rate. Chart shows UK ten year gilt yields (orange) and GBP/USD.

Here, the Pound to Dollar exchange rate falls a more significant 1.25%.

A hawkish outcome (just a 15% chance) sees the MPC hikes and explicitly back the pace of hikes implied by the yield curve.

Currently money market pricing - the yield curve - shows up to 100 basis points of rises could fall over the coming year.

Furthermore the Bank revises up its inflation forecast to 2.0% in the medium-term and some concerns are expressed about rising inflation expectations.

Here, the Pound to Dollar rate rises 1.0%.