U.S. Dollar Could Benefit if Fed Creates a Dot-plot Dilemma for Markets

- Written by: James Skinner

- USD outlook aided as Fed nears hawkish shift

- Taper 2, Fed dot-plot review to bolster further

- Amid scope to impact market’s pricing of Fed

- In ongoing headwind for vulnerable GBP/USD

Image © Adobe Images

The U.S. Dollar is one of the biggest risers for 2021 and its outlook would be bolstered if December’s Federal Reserve (Fed) policy decision prompts financial markets to accommodate a more ‘hawkish’ dot-plot of policymakers’ forecasts for interest rates.

Wednesday’s Fed policy announcement is widely expected to include a decision to speed up the pace at which the bank’s $120BN per month quantitative easing programme is wound down so that it closes completely around the end of the first quarter next year.

That would be around three months sooner than provided for in November’s policy decision, although this came before inflation data showed the consumer price index rising above 6% during October and approaching 7% in November.

“Inflation will be so high at the time of the March meeting that we expect the Fed to signal an “insurance” rate hike in May; they could even act in March,” says Ian Shepherdson, chief economist at Pantheon Macroeconomics.

“If the rate hike comes after several more employment reports showing flat labor participation, the Fed will have to acknowledge the clear risk of sustained high inflation, requiring further rate increases. This would play badly across all asset markets,” Shepherdson also warned this week.

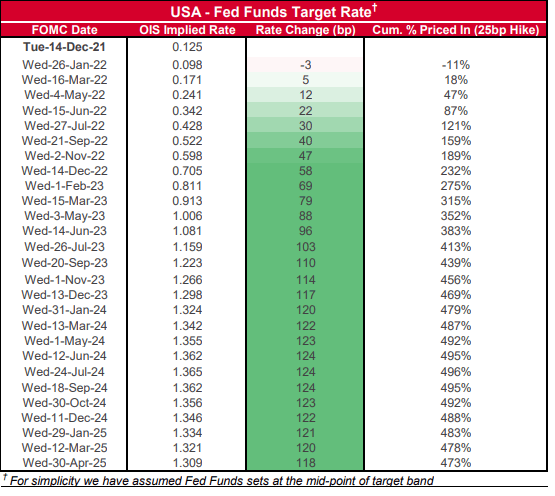

Above: Market expectations for midpoint of Fed Funds interest rate range. Source: Westpac.

- GBP/USD reference rates at publication:

Spot: 1.3250 - High street bank rates (indicative band): 1.2880-1.2980

- Payment specialist rates (indicative band): 1.3130-1.3185

- Find out about specialist rates, here

- Set up an exchange rate alert, here

- Book your ideal rate, here

A majority of Federal Open Market Committee members have since indicated they’d support a faster move to lighten the Fed’s footprint in the U.S. bond market, which would open the door to an earlier decision to begin lifting the Fed Funds rate from its current 0% to 0.25% range.

This has already lifted the Dollar broadly against other currencies but could yet help it advance further if on Wednesday the Fed’s policymakers respond by indicating that they themselves expect rates to begin rising sooner.

“I’m sticking with the idea that the tremendous political pressure on the Fed, the Brainard ordering of inflation over jobs, and the Powell renomination mean the Fed can fully pivot and will look to cement credibility tomorrow by sounding hawkish,” says Brent Donnelly, president at Spectra Markets.

“This will run headlong into 18 months of rabid speculation and narratives of crypto-utopian USD debasement which never came to pass,” Donnelly wrote in a Tuesday market commentary.

September’s projections had suggested only one interest rate rise next year but many other forecasters now expect up to three and the market is pricing-in only two, which leaves scope for market pricing to respond favorably to any large change in the projections this Wednesday.

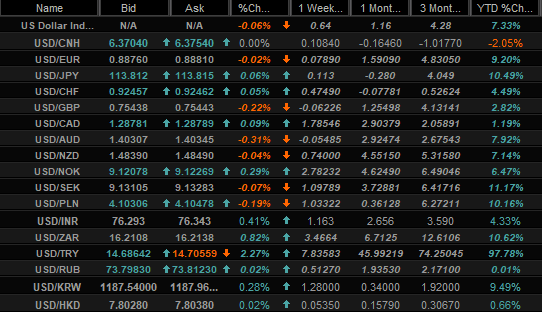

The Fed’s steady pivot since June to what is fast becoming a hawkish monetary policy stance has decisively revived the Dollar’s fortunes in recent months, taking the greenback from the bottom of the major currency bucket in January to near the top of it by December.

Above: U.S. Dollar exchange rate quotes and performances over selected timeframes.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

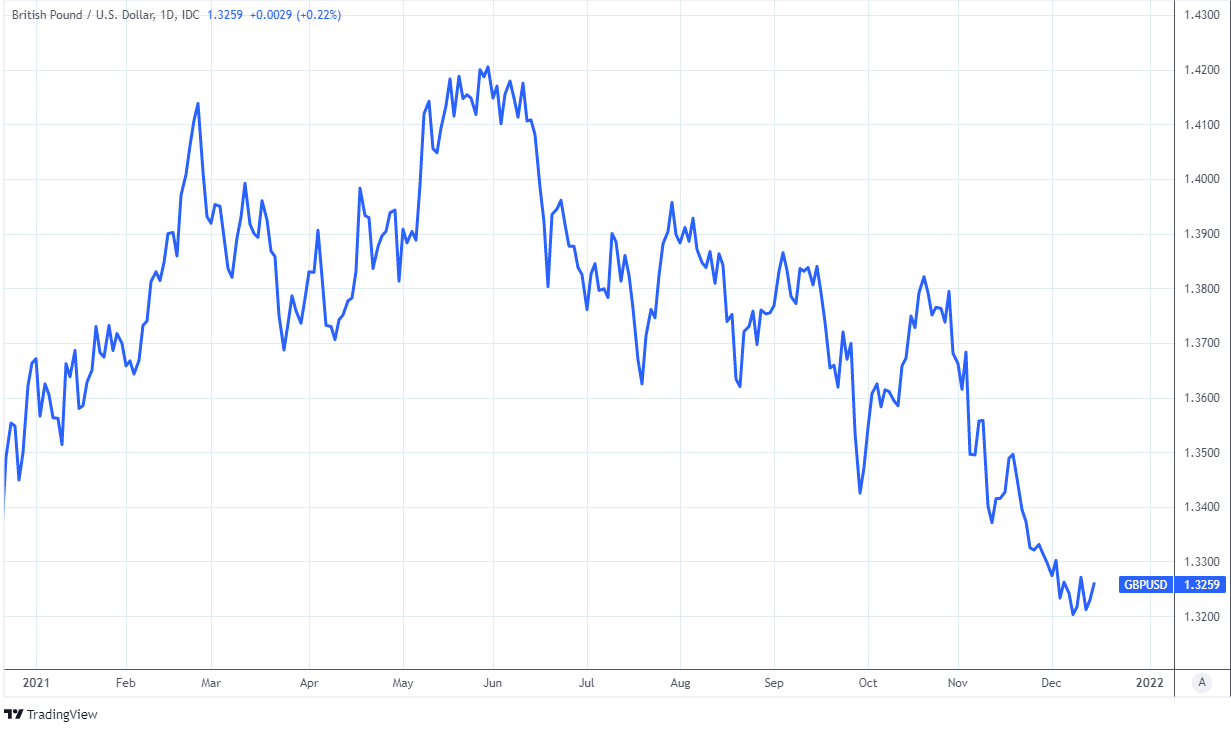

Only the Chinese Renminbi has so far been able to keep its head above water when measured against the Dollar for 2021, while the Pound-Dollar rate had fallen more than four percent in the three months to December, which left it on a three percent decline for the year.

“Treasury yields still would have to rise, but rising real yields due to strong non-inflationary growth are vastly preferable to rising inflation expectations. High-multiple stocks and loss-making tech would be vulnerable even in the benign scenario,” says Pantheon’s Shepherdson.

“The dollar has further to rise in either scenario. The U.S. ultimately will enjoy a stronger growth than other developed economies in 2022, and rates will have to rise over the next couple of years,” Shepherdson wrote in a review of the U.S. policy outlook this week.

The prospect of a more hawkish Federal Reserve comes at an inopportune moment of vulnerability for the Pound-Dollar rate with Sterling also on the eve of what many expect will be a decision by the Bank of England to leave Bank Rate on hold at 0.10%.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

Much now depends for the Pound on what the BoE says about the outlook for UK interest rates and on whether there is an escalation in the recent return of coronavirus-related restrictions on business activity and social practices.

“Given the headwinds from Omicron, from rising energy and food prices and given next year’s National Insurance tax hike, we only expect bank rate to be raised by a total of 40 bps next year, far lower than the almost 100 bps that is priced in. We have lowered our GBP forecasts on anticipation that this expectation will be reduced in the months ahead,” writes Jane Foley, head of FX strategy at Rabobank, in a note this week.

Above: Pound-Dollar rate shown at daily intervals.