U.S. Dollar Can Rise 5-20% from Current Levels: Soc Gen

- Written by: Gary Howes

- FX in grip of a USD surge

- Amidst strong demand for U.S. debt

- Can go higher says Soc Gen

- But it could kill global growth

Image © Adobe Images

- GBP/USD reference rates at publication:

- Spot: 1.3467

- Bank transfers (indicative guide): 1.3096-1.3190

- Money transfer specialist rates (indicative): 1.3346-1.3400

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The surging value of the Dollar is the latest talking point for global investors who fear it could become the latest addition to a growing list of headwinds to global economic growth.

Analysis from investment bank Société Générale finds that the U.S. currency can extend significantly higher, provided investors remain confident that the U.S. Federal Reserve is going to start tightening monetary policy within a reasonable timeframe.

"The expectation of policy divergence will likely drive currency trends in 2022," says analyst Kit Juckes at Société Générale.

The Federal Reserve's September policy update revealed the Fed was set on reducing its quantitative easing programme in November, surprising markets by saying the programme could be ended completely by mid-2022.

Money markets now show expectations for a late 2022 lift-off for rates have risen, while as many as three hikes are pencilled in for 2023.

This means the Federal Reserve will soon no longer be buying up new U.S. government debt, pushing down the value of government bonds which in turn raises the yield they pay investors.

Juckes says foreign investors will only be too happy to pick up discounted bonds to benefit from the superior yields they offer, thereby stoking demand for dollars.

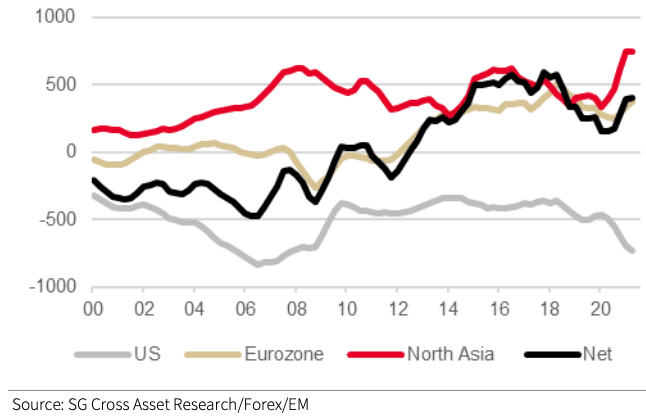

Above: Regional current account balances (USD bn, annual). Image courtesy of Societe Generale.

"The notion that the US deficit is bad for the currency is outdated when the world’s excess savings are gravitating towards the dollar because the US issues plenty of debt and offers higher yields than its major competitors," says Juckes.

Soc Gen says the significant savings surpluses generated by China, Japan and the Eurozone will all be gobbled up by the U.S. deficit, in turn raising a bid for the Dollar.

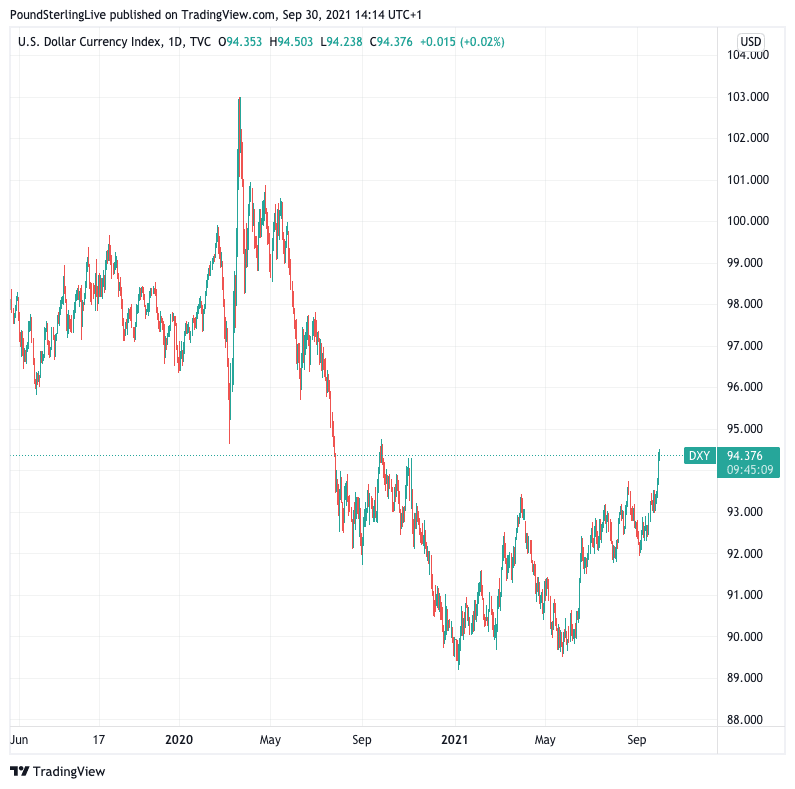

Accordingly, they forecast the Dollar index - a broader measure of the Greenback's value - can rise a further 5-10%.

Above: Daily chart for the Dollar index. The USD can go a great deal higher.

"The prospect of the ECB keeping rates below zero while the Fed hikes should keep EUR/USD in the post-2014 range, with a centre of gravity around 1.12-1.16," says Juckes.

Their current forecasts for the Pound-Dollar exchange rate show a range of 1.40-1.38 over the next year, suggesting no major loss in value for Sterling.

Soc Gen finds the likelihood the Bank of England also raises interest rates in 2022 to be a supportive factor for the UK currency, although confidence in the Dollar has somewhat been shaken by Sterling's loss of value in late September.

How far the Dollar appreciates will not only dictate direction in financial markets but will have implications for economies other than that of the U.S., and here lies a potential limiting factor for its upside.

This is because a strengthening Dollar acts as a deflationary force given it is the predominant funder of finance the world over.

According to the BIS, although the United States accounts for one quarter of global economic activity, around half of all cross-border bank loans and international debt securities are denominated in U.S. dollars.

"As to how far the USD move can extend, I suspect it can continue for a while, but will rapidly become self-limiting as USD strength becomes so destructive at anything approaching the current momentum," says John Hardy, Head of FX Strategy at Saxo Bank.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

Given Fed policy is a fundamental driver of the Dollar's advance it stands that it can shift stance to limit gains.

If a rising Dollar constricts global growth the Fed could take notice. Hardy says the Dollar index - a broad measure of the Greenback's value - is already within about two percent of the levels that triggered former Fed Chair Janet Yellen's abrupt slowing of rate normalisation plans back in early 2016.

According to Hardy, other fundamental factors that could help the USD lose speed would be:

- The U.S. economy losing speed

- German coalition forms quickly and the EU shows signs of getting its act together in responding to the current energy crisis with massive new fiscal stimulus – importantly geared towards supply-side on energy rather than as income replacement to keep demand elevated – the current global supply side can’t even cope with current demand levels.

Negotiations for the new German government are expected to extend for weeks and coalition governments are always the least likely to drive big fundamental policy changes, suggesting the Eurozone's savings glut and deflationary tendencies will be with us for a while yet.

On the matter of the U.S. economy; while it suffered slowing growth as the Delta variant spread during the summer the wave looks to be coming down, suggesting domestic headwinds are fading.

For now there is little to suggest the U.S. economy won't continue to grow at a clip given the improving pandemic situation and the still generous Fed, with further support coming from a government that looks in no mood to abandon an expansionary fiscal policy.