GBP/USD Rate "Could go Much Lower": Analysts

- Written by: Gary Howes

- GBP/USD reference rates at publication:

- Spot: 1.3625

- Bank transfers (indicative guide): 1.3248-1.3344

- Money transfer specialist rates (indicative): 1.3500-1.3550

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The British Pound has lost 1.75% over the course of the past week in what amounts to its worst weekly performance since mid-June, and further losses are likely says one analyst we follow.

Declines in the value of the Pound-to-Dollar exchange rate (GBP/USD) are set amongst a solid demand for the Dollar, linked to a combination of concerns global growth is set to slow and ongoing expectations for higher interest rates at the U.S. Federal Reserve in the medium-term.

GBP/USD is quoted at levels around 1.3622 ahead of the weekend, having opened on Monday at 1.3863.

The 2021 high is at 1.4250.

"The USD in a commanding position. Risk appetite is likely to remain checked by the ongoing spread of the delta variant, generating safe haven flows into the USD. Yet at the same time, the Fed is continuing their slow march toward tapering, providing crucial ongoing support for the USD," says Richard Franulovich, Head of FX Strategy at Westpac.

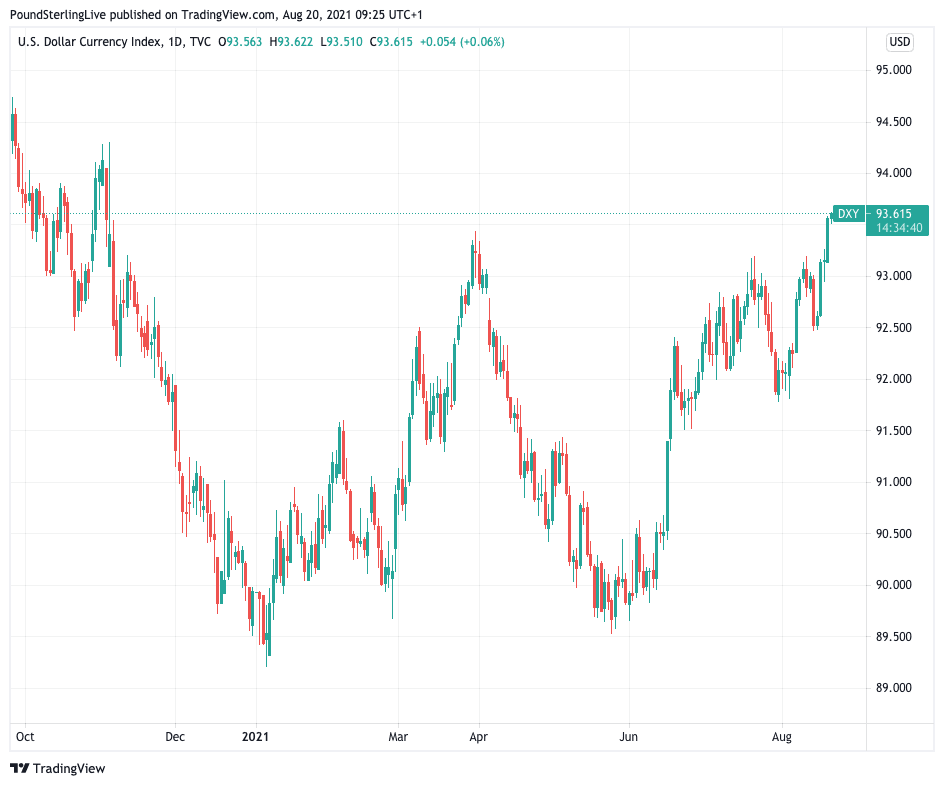

Above: The Dollar is at its strongest since November 2020.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The world's major stock markets are on course to record a fifth successive day of losses amidst a deterioration in global sentiment amidst a sense that the post-crisis rebound in economic activity that characterised the 12 months stretching from mid-2020 to mid-2021 is running out of steam.

A world of lower economic growth - at a time the U.S. Federal Reserve is looking to withdraw monetary stimulus - is one that does not lend itself to equity appreciation, leaving the Dollar to benefit.

The outlook for the Pound-Dollar exchange rate has deteriorated as a result.

"Technically, charts have turned significantly against sterling and, if the dollar drives home its current advantage, the pound could go much lower, triggering major support points," says Peter Stoneham, a Reuters market analyst.

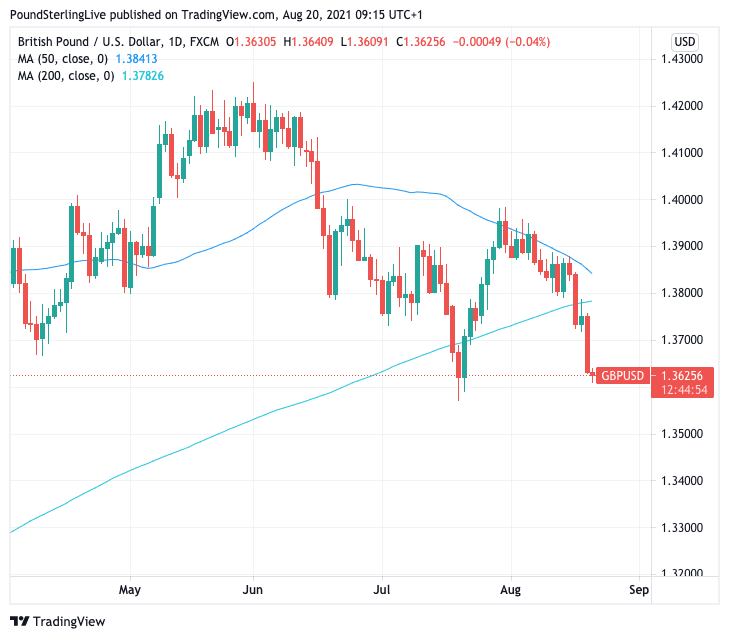

Above: the 50-day and 200-day moving averages are converging.

Karen Jones, Team Head of FICC Technical Analysis Research at Commerzbank says the GBP/USD sell off has already reached and eroded the 1.3669 April low, and she would allow for further losses to the 1.3571 July low.

"There is scope longer term for move back to the 200-week moving average at 1.3146. We have a 50% retracement level at 1.3457 of the move up from September 2020," says Jones.

The moving averages (as shown in the above chart) are attracting interest, Stoneham saying technical analysts are excited about a potential crossing of the 50-day moving average below the 200-day moving average, in a pattern called a death cross.

"This signal can point to a period of sustained weakness. The two averages are converging and a crossover is likely unless sterling stages a strong rebound from its current bear run," adds Stoneham.

His analysis suggests GBP/USD could effect a full retracement of the 1.3573 to 1.3983 July 20-30 rally.

"A minimum correction of the long-term climb from the 1.1413 March 2020 low to the 1.4250 June 2021 high comes in just ahead of the 1.3573 July low at 1.3580. Technically, these levels serve as viable sterling bear targets," says Stoneham.