Pound-Dollar Week Ahead Forecast: Steadying Above 1.38 as Data and Fed Risks Dominate

- Written by: James Skinner

- GBP/USD may be bottoming, looks to hold 1.38

- Faces UK data minefield ahead & uphill struggle

- As USD eyes Fed speech, minutes & taper talk

Image © Adobe Images

- GBP/USD reference rates at publication:

- Spot: 1.3853

- Bank transfers (indicative guide): 1.3468-1.3565

- Money transfer specialist rates (indicative): 1.3730-1.3756

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The Pound-to-Dollar rate was finding a firmer footing above the recently-tested 1.38 support level on entry into a busy week that could see Sterling’s resilience tested again by the greenback as the Federal Reserve (Fed) edges closer toward a tapering of its quantitative easing programme.

Sterling was the underperformer among major currencies for the week into Monday after last quarter's GDP data neglected to give grounds for the Bank of England (BoE) to move further in the direction of an interest rate rise any time soon, although losses for the Dollar have since helped the Pound back onto its feet and given it a shot at stabilising during the week ahead.

Dollars were sold heavily after July’s inflation data suggested that consumer price pressures may be peaking, with the resulting gains for Sterling prompting some analysts to call a bottom for the Pound-Dollar rate following more than two months of steady losses.

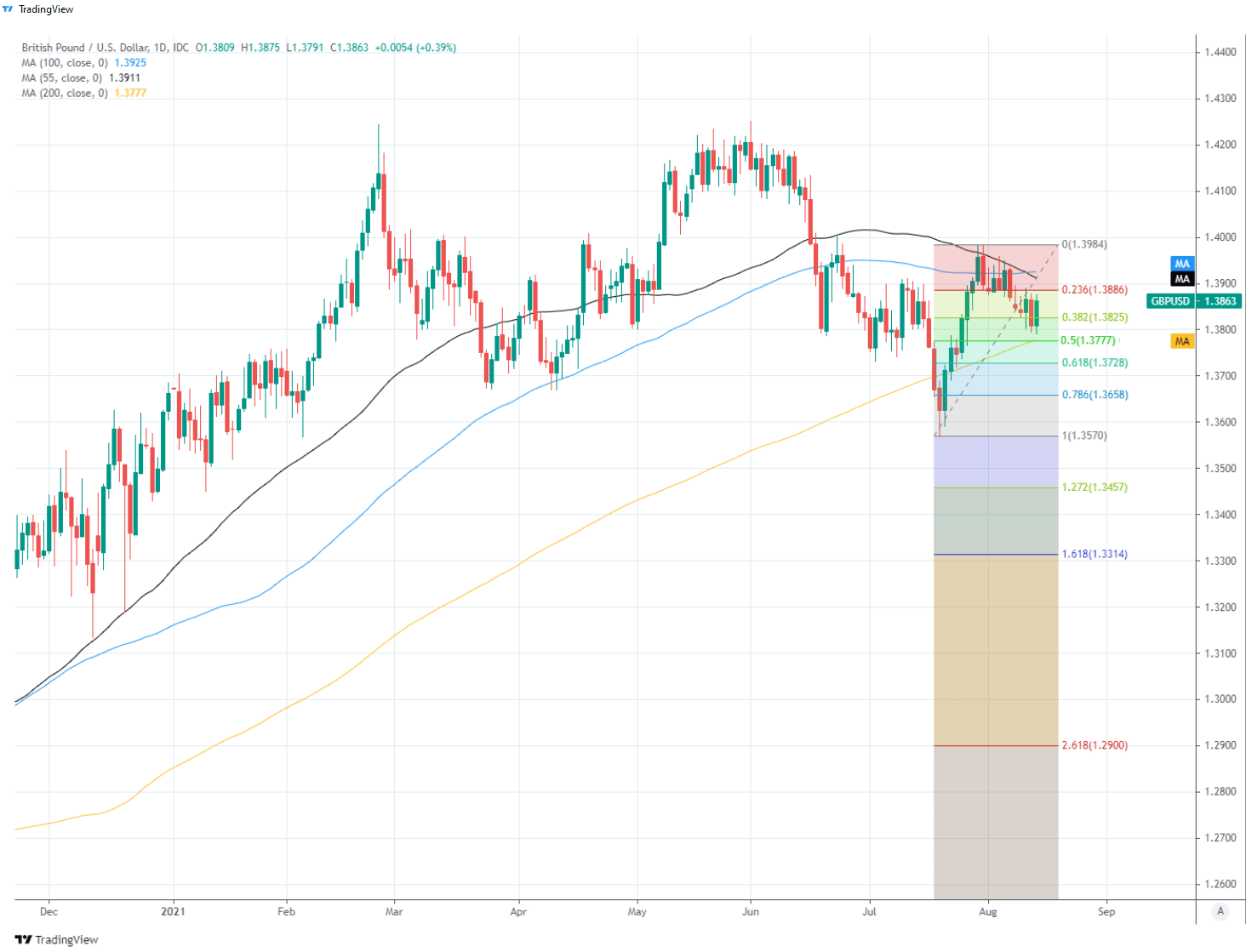

“GBPUSD weakness has been arrested at 1.3803, just ahead of the rising 200-day average, now seen at 1.3773 and the subsequent recovery has seen a bullish “reversal day” established to suggest a low may be in place,” says David Sneddon, head of technical analysis at Credit Suisse.

“Support is seen at 1.3835 initially, then 1.3803. Below this latter level would see the “reversal day” neutralized for a fall to the 200-day average at 1.3773, potentially even the 61.8% retracement of the July rally and price support at 1.3736/20,” Sneddon adds.

Sneddon told clients last week that Sterling’s corrective downtrend is showing signs of fading but that a move above the rough 1.4010 area is necessary to “mark the completion of a “head & shoulders” base and a more important turn higher.”

Above: Pound-to-Dollar rate shown at daily intervals with key moving-averages and Fibonacci retracements of late July recovery indicating possible areas of support. 200-day average in yellow.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Both 1.3895 and the 1.3920 level have been flagged as likely areas of resistance along the way however, while analysts at Commerzbank have warned that Sterling will paint a bearish picture onto the charts the entire time the Pound-Dollar rate remains stuck below 1.4018.

“While capped by the 1.4018 pivot, the market maintains a negative bias,” says Karen Jones, Head of Technical Analysis for Currencies, Commodities and Bonds at Commerzbank, who’s a seller of the Pound-Dollar rate from 1.3949. “The 200-day ma lies at 1.3776. Our target is the 1.3571 July low.”

The Pound has now several times resisted a daily close below 1.38, an area also recently flagged by Jones as a likely site of support, although indecisive charts leave much to be determined by this week’s action-packed economic calendar the first highlights of which are Tuesday’s job data and July’s inflation figures from the UK on Wednesday.

“We’ve pencilled in a small rise in employment of 40,000 m/m in June,” says Ruth Gregory at Capital Economics, of Tuesday’s UK job data. “July’s CPI inflation figures (due Wednesday) take top billing. While inflation probably fell, it still looks on track to reach 4.5% this year. We are not too concerned about the signs that the retail recovery went into reverse in July (data due Friday) as the sector has recovered the ground lost during the pandemic.”

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

UK data are important pieces in a medium-term puzzle for Sterling but at least as important in the short-term is if the Dollar continues to be buoyed by the seemingly growing likelihood of a policy change at the Federal Reserve over the coming months, which makes Tuesday’s 18:30 appearance by Fed Chair Powell at an online town hall event the highlight of the week for both currencies.

“When the Fed starts tapering its asset purchases is among the most important macroeconomic issues facing global markets today. Our base case, as we outline below, is a November taper announcement,” says Kevin Cummins, chief U.S. economist at Natwest Markets. “The modalities of how the Fed will taper are critical for both the pace of future asset purchases as well as the timing of potential future rate hikes.”

Tuesday’s address comes ahead of July’s meeting minutes at 19:00 on Wednesday and is potentially a headwind for a Pound-Dollar rate that will be sensitive to any insights on the likely timing and finer details of an eventual decision by the Fed to wind down its $120BN per month quantitative easing (QE) programme, which analysts and economists increasingly see coming in September.

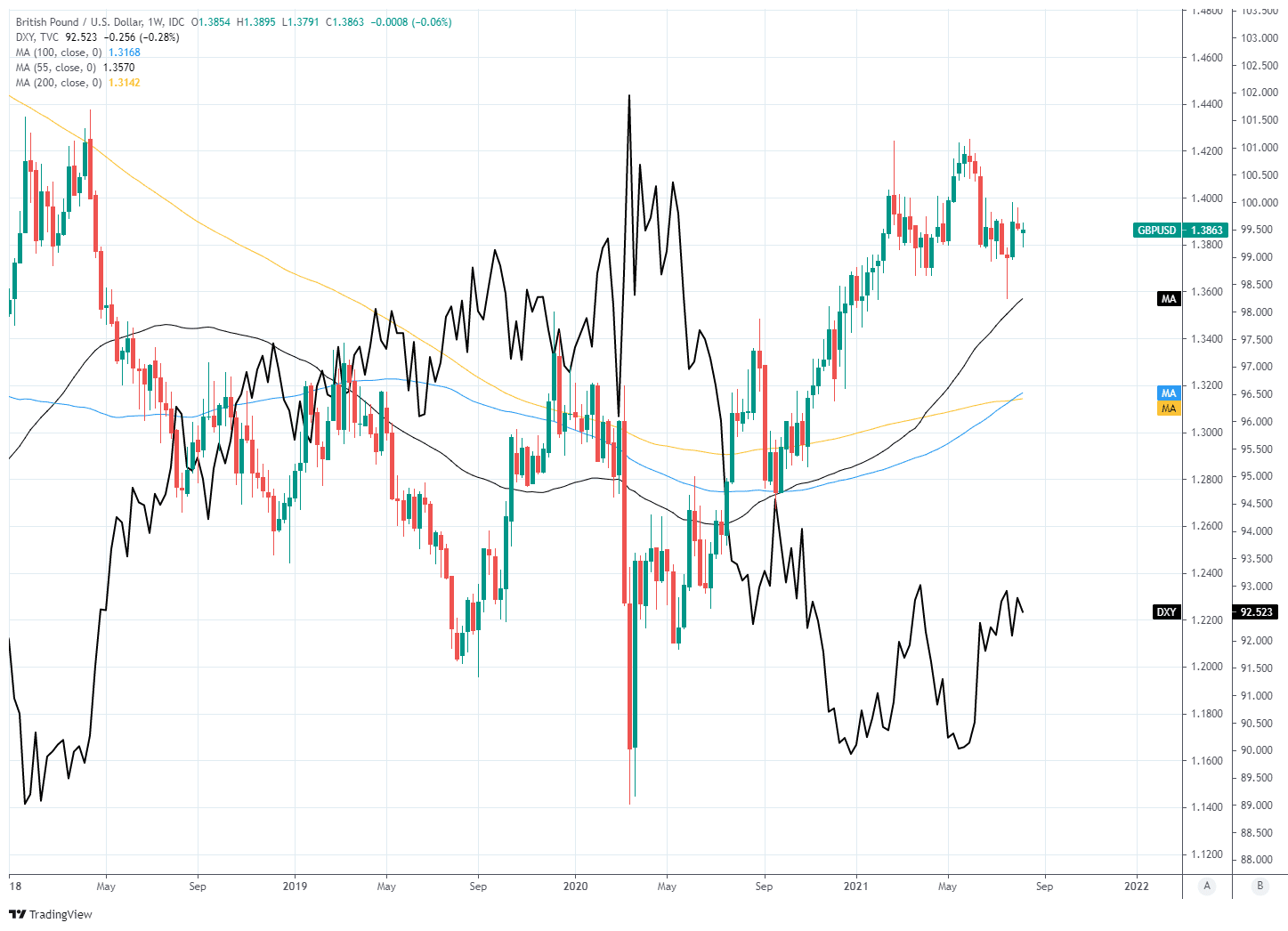

“The strong non-farm payrolls print last Friday has confirmed to us that the US recovery is strong enough for the Fed to take the first step towards policy normalization. The August NFP numbers have to be very weak to change our view,” says Athanasios Vamvakidis, head of FX strategy at BofA Global Research, who tips the Pound-Dollar rate for a slide to 1.35 by the end of September and broad gains for the Dollar elsewhere too.

Above: Pound-Dollar rate shown at weekly intervals alongside U.S. Dollar Index.

The Fed’s shifting guidance has grown in weight around the ankles of the Pound since June and more so during recent weeks after policymakers began suggesting they could vote to taper as soon as next month after July’s payrolls data effectively delivered the “substantial further progress” sought as a prerequisite for policy changes to the bank’s doorstep.

“There are more job openings than unemployed in the US now, which in the old world would have led the Fed to turn super hawkish already this autumn. We still lean that way,” says Andreas Steno Larsen, a strategist at Nordea Markets. “Expect an explosion (in a positive sense) in employment ratios once the extraordinary benefits end across the country in September.”

The U.S. calendar and its impact on appetite for the greenback will likely dominate much of the week for the Pound-Dollar rate before Friday when Sterling’s attention turns back to the UK and July’s etail sales data that will provide early insight into the health of the consumer in the third quarter.

“Retail footfall was at 80% of the equivalent week of 2019 in the week to August 7, a two-month peak. And according to the ONS’ latest BIC survey, the proportion of businesses’ workforces on full or partial furlough leave fell to 3.7% in late July from 4.6% in the first half of the month, the smallest share since the pandemic began,” says Andrew Goodwin, chief UK economist at Oxford Economics.

“The risk of the recovery stalling looks small. We still expect GDP to expand by an above-consensus 7.3% this year and the economy to exceed its pre-pandemic size during Q4 2021,” Goodwin wrote in a note last week.