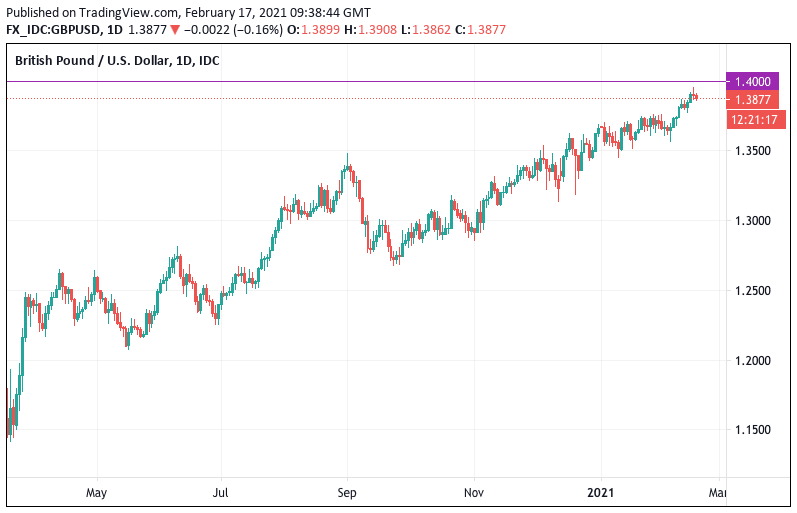

Pound-to-Dollar: 1.40 Could be a "Terminus" for the Rally says Analyst

Image © Adobe Images

- GBP/USD spot rate at publication: 1.3876

- Bank transfer rates (indicative guide): 1.3490-1.3587

- FX transfer specialist rates (indicative): 1.3728-1.3780

- More information on accessing specialist rates, here

The Pound-to-Dollar exchange rate's trend of appreciation means that a psychologically significant milestone is now on the horizon: the 1.40 level.

Sterling has risen in value by 1.75% against the U.S. Dollar in 2021, with a near-three year high at 1.3952 being achieved this week amidst a pulse of positive technical momentum and buying interest.

One part of the story behind GBP/USD's rise is the Dollar's lacklustre performance of late, but data shows the U.S. currency has outperformed some of its peers over the course of the past month suggesting genuine Sterling strength at play.

The Pound's gains rely on a combination of:

1) Fading Brexit anxieties

2) a fast vaccine rollout in the UK

3) fading expectations for a Bank of England rate cut, and

4) supportive global markets given Sterling's rising beta

But 1.40 could dent the Pound's advance against the Dollar; indeed there is a likelihood that investors will be laying orders in the run-up to this level which might explain why the pair reversed at 1.3950 over the course of the past 24 hours.

"The 1.4000 level is significant for GBP/USD, not only as a psychological threshold, but also a key option level, and may prove to be the terminus for recent gain," says Richard Pace, a Reuters market analyst.

Pace explains:

"There is a wealth of option-related binary barriers at 1.4000, which will pay predetermined amounts to holders, while others are set to lose, and will sell GBP to prevent 1.4000 trading. Regular GBP FX traders will typically piggy-back this defence."

"The 1.4000 level also contains a wealth of option-related triggers – they knock regular vanilla options in and out, and can have a similar effect to binary barriers in terms of defence. Reverse-knock-out GBP/USD trigger options were popular over recent weeks, giving holders the right to buy GBP/USD at lower levels, providing 1.4000 is intact at expiry," adds Pace.

The British Pound is expected by a number of analysts we follow to build on its recent gains over coming days thanks to positive technical momentum and improved fundamental underpinnings that include the country's rapid vaccine rollout and expectations for a sharp pick up in economic growth.

But some analysts are warning too that a period of consolidation could soon be expected after the strong rally, with Pace warning that if 1.40 is achieved owners of knock-in trigger options would suddenly become long GBP from lower levels, adding to expected profit-taking.

"We expect GBP to consolidate this week at current high levels. Vaccine rollouts continue at good pace, while this week’s data should not offer significant change in macroeconomic environment relative to January. The risks to GBP seem to be skewed to the downside, as market too easily priced out the possibility of negative rates in future, in our view," says analyst Juan Prada at Barclays.

{wbamp-hide start}

GBP/USD Forecasts Q2 2023Period: Q2 2023 Onwards |

But, foreign exchange analyst Shaun Osborne at Scotiabank says gains could ultimately extend beyond 1.40 towards 1.43.

Technical studies of the GBP/USD charts are bullish says Osborne: "GBP/USD is embarking on a sixth, consecutive weekly gain as it nears the psychological resistance point of 1.40."

"In effect, the round number is the only technical hurdle ahead of the GBP rally extending to the 1.43+ area. Trend signals are bullish on the short, medium and longer term oscillators. Look for limited, counter-trend corrections and ongoing progress through 1..40 as a result. Support is 1.3900 and 1.3850/60," he adds.

Osborne notes the fundamental backdrop remains supportive of Sterling owing to fading Brexit-related anxieties and hopes for a strong vaccine-fuelled recovery in the UK's economy.

"UK virus infections appear to be slowing, vaccines are progressing rapidly and there are signs that the post-Brexit kinks in cross border trade are getting smoothed out, adding to the positive GBP undertone," says Osborne.