Pound-Dollar Rate Forecast to Make another Run on Monday's Highs Again, Democrats Close to Gaining Senate Control

Above: Reverend Raphael Warnock has been elected Senator in Georgia. Image in the public domain.

- GBP/USD spot rate at publication: 1.3660

- Bank transfer rate (indicative guide): 1.3280-1.3370

- FX specialist providers (indicative guide): 1.3502-1.3560

- More information on FX specialist rates here

Pound Sterling is being tipped to make a dash back towards the multi-month highs achieved on Monday, with analysts citing the outcome of the Georgia senate elections as being a key driver of Dollar weakness midweek.

"GBP/USD demand builds for a run at Monday's high," says Peter Stoneham, a currency analyst at Reuters. "Potential back-to-back 'up' days puts underlying bull trend back on track."

The Dollar struggled into the mid-week session amidst signs the two Democrat challenges in the rerun for Georgia's two Senate seats were pulling ahead in the vote count, an outcome that would give the party full control of the legislature and executive if confirmed.

"The market interpretation of the outcome is largely as expected – reflationary and USD bearish. The idea is that a slim Democratic majority is enough to allow the stimulus gravy train to roll and in bigger size than would have been the case in a divided Congress. We will likely see the larger stimulus checks very soon after Biden’s inauguration as a first step, for example," says John Hardy, Head of FX Strategy at Saxo Bank.

NBC and Edison project a win for the Democrat's Raphael Warnock while Democrat Jon Ossoff has meanwhile taken the lead in the other Georgia Senate race according to Edison.

"If Democrats win both Georgia Senate races, the party will have unified control of the White House and Congress. The implication for USD would be mixed. The likelihood of an infrastructure spending boost can attract foreign direct investment flows to the U.S. and underpin USD. But the possibility of lower foreign portfolio equity flows to the U.S. and higher U.S. inflation expectations will weigh on USD. President‑elect Joe Biden plans to raise corporate taxes and the minimum wage," says Elias Haddad, Senior Currency Strategist at CBA.

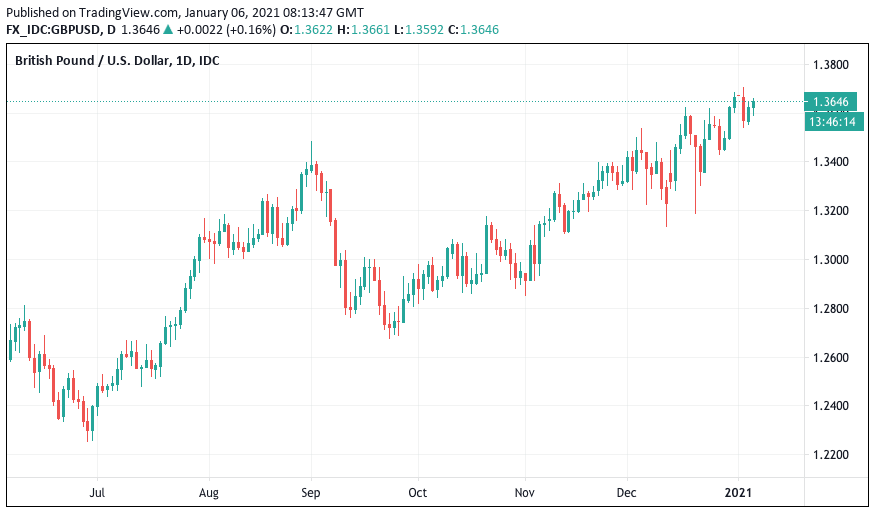

Above: GBP/USD showing upside momentum. Offer: Secure a rate for your money transfer that is just 60 pips away from the market, this can be tightened for large amounts. Find out more.

The Dollar is lower on growing signs that the Democrats could capture the state, and with it ultimately control both Houses of Congress. The assumption amongst market participants is that this will allow Joe Biden and his party to implement sizeable economic stimulus packages when they take control.

The rule of thumb is that strong fiscal stimulus is supportive of the economy and equity prices, which is in turn bearish for the Dollar.

The Pound to Dollar exchange rate trades at 1.3653 at the time of publication and the trend high is at 1.3703, according to Stoneham, a level he believes will add a layer of initial resistance to further advances.

He adds that 14-day momentum is positive and the RSI is rising. The longer-term weekly charts are saying momentum has been positive since June and he is therefore bullish.

"A buy on dips market but we await next signal," says Stoneham.

With one seat called it could be some time yet before the final seat being contested by Perdue and Ossoff is called.

Georgia Secretary of State Brad Raffensperger has said the counting teams were due to take a break:

"They’re probably going to take a break here, I think, in the next hour. Try and get as much work as they can done tonight ... At least, record exactly how many ballots are out there and then get as much scanning done tomorrow. Hopefully by noon we’ll have a better idea where we are."

With an estimated 98% of votes counted, Perdue and Ossoff both have 50.0% of counted vote, according to the Washington Post. FiveThirtyEight says Ossoff leads Perdue by less than a percentage point - or a few thousand votes.

The final race will be incredibly tight.

"Should the Republican party lose the two seats, it will also lose the Senate majority and the capability to systematically block President-elect Joe Biden’s planned comprehensive stimulus programs and general legislative agenda. In such a scenario, the dollar decline can be interpreted as a sign that the markets see a Democrat-controlled Senate as favourable for the global economic recovery, which in turn will favour the flight from the safe haven greenback and lead to investments in riskier assets," says Ricardo Evangelista, Senior Analyst at ActivTrades.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.