Sterling to US dollar rate today: USD Suffers As the "Carry Trade" Returns

- Written by: Gary Howes

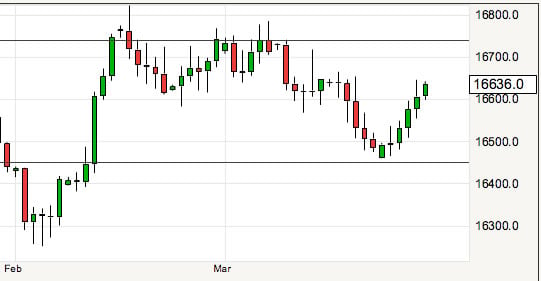

Momentum has swung back in favour of the pound dollar rate once again. We look at today's latest news and look for clues as to where the next possible levels lie.

Pound to US Dollar Exchange Rate Today: The pound to US dollar exchange rate is today trading 0.11 pct higher on a day-to-day basis at 1.6627.

"Important support at 1.6470 was tested earlier this week and prompted a bounce which is now approaching resistance at 1.6599. A break above this would open the way to 1.6684," says a note from UBS released today.

The rally in the UK pound comes after what has been a trying month of March for GBP-USD; all indicators suggest that we are likely to see momentum return back in favour of the UK unit through month end.

As we note further down in this article, the carry trade appears to have come back in favour and this is the prime reason support has been sucked out of the USD over the past week or so.

Note all quotes are reflective of the inter-bank market. Your bank or payment institution is free to levy a rate at their discretion. However, FCA-registered independent providers guarantee to undercut your bank's offer, thus delivering up to 5% more FX.Please learn more here.

British pound exchange rates today

The UK released the final 4Q GDP growth this morning. The UK GDP grew 0.7% q/q and 2.7% y/y in line with market expectations.

However, the current account printed GBP -22.4B deficit versus GBP -14.0B expected, the total business investments accelerated from 8.5% to 8.7%. UK data failed to push GBPUSD above 1.6647 – week high.

On Tuesday, the CPI data confirmed the extension of weakness in inflation figures below BoE’s 2.0% target.

On Thursday, the February retail sales unexpectedly increased to 1.7% from -1.5% contraction a month ago. UK closes the week with 2.7% GDP growth in the fourth quarter.

The above-stated data stream lead to a higher GBP versus USD and EUR this week.

US dollar exchange rates today: The carry trade is back

Once again the USD was a comparative sideshow yesterday, gaining against the EUR, CHF, JPY and SEK but falling against the higher yielding G10 currencies, suggesting once again that the carry trade is on.

The carry trade refers to the scenario where investors seek out locations with higher yielding rates; Australia, New Zealand and Canada all have more competitive interest rates than does the US, thus you will see USD flow away.

"This makes some sense given the exceptionally low levels of FX volatility – both implied and realised – though the similarly low level of yield spreads rather diminish the rationale for carry," say Lloyds Bank Research.

Note though that the USD did manage more substantial gains against the EUR yesterday, helped by modestly encouraging US data in lower jobless claims and a rise in the Kansas City Fed index, though these were to some extent offset by the weaker than expected pending home sales data.

"USD gains against the EUR from here are likely to be tougher to achieve, with technical support in the 1.3720 region and the possibility of some position squaring ahead of the weekend," say Lloyds Bank Research.