Buy the Dips in the Pound-Dollar Exchange Rate

Image © Adobe Images

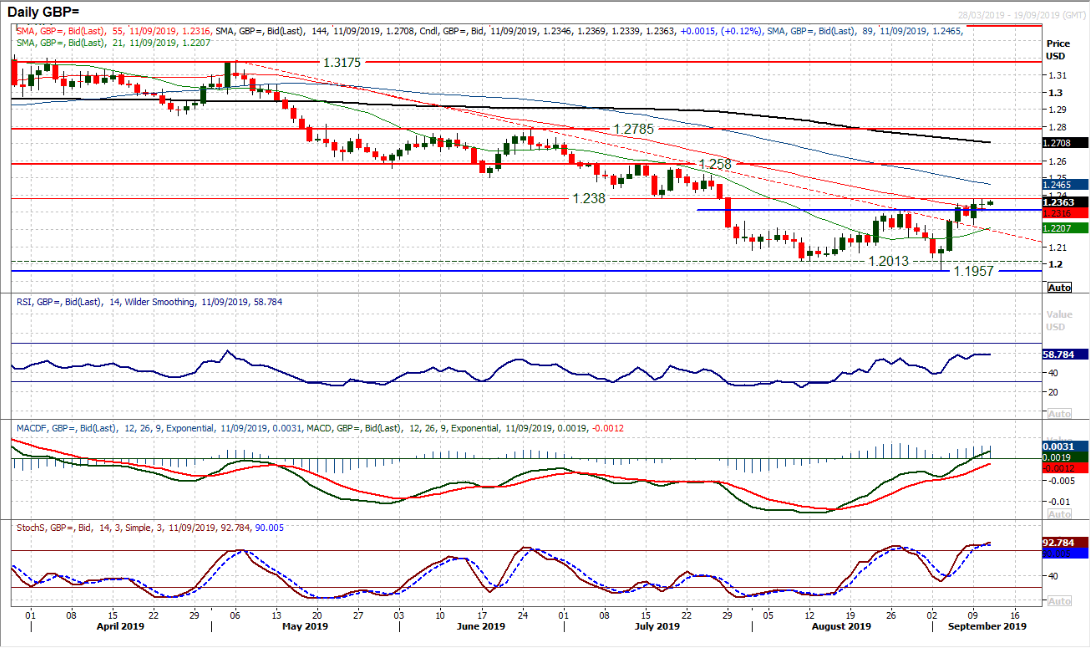

- Break and hold above key 1.23 level significant

- Pull-back to below 1.23 a buying opportunity

- Next resistance level at 1.2380

The Pound-to-Dollar exchange rate looks like it can extend higher, with analysts saying any pull-backs into the 1.2300 zone affording buying opportunities.

GBP/USD has been trading consistently above the important August 27 highs at just above 1.2305 over the course of the past four trading days, as Brexit fears subside following moves by parliament to curb the power of Boris Johnson’s executive and reduce the prospects of a hard Brexit.

The time spent above by the GBP/USD exchange rate above 1.2305 suggests Sterling is “holding its ground” on an “improving outlook,” says Richard Perry an analyst with Hantec Markets.

The pair could now extend its young bull trend, rising quite a bit higher up to an eventual target at 1.2580.

“Trading above $1.2305 implies a recovery is (on the way with a circa) 300 pip target, meaning a retest of the $1.2580 high is realistic,” says Perry.

The next major resistance level baring the way is the old July lows at 1.2380, which has has been restricting markets since the start of the week, however, “a close above would really open the move,” says Perry.

The analyst recommends buying “into weakness for the breakout”.

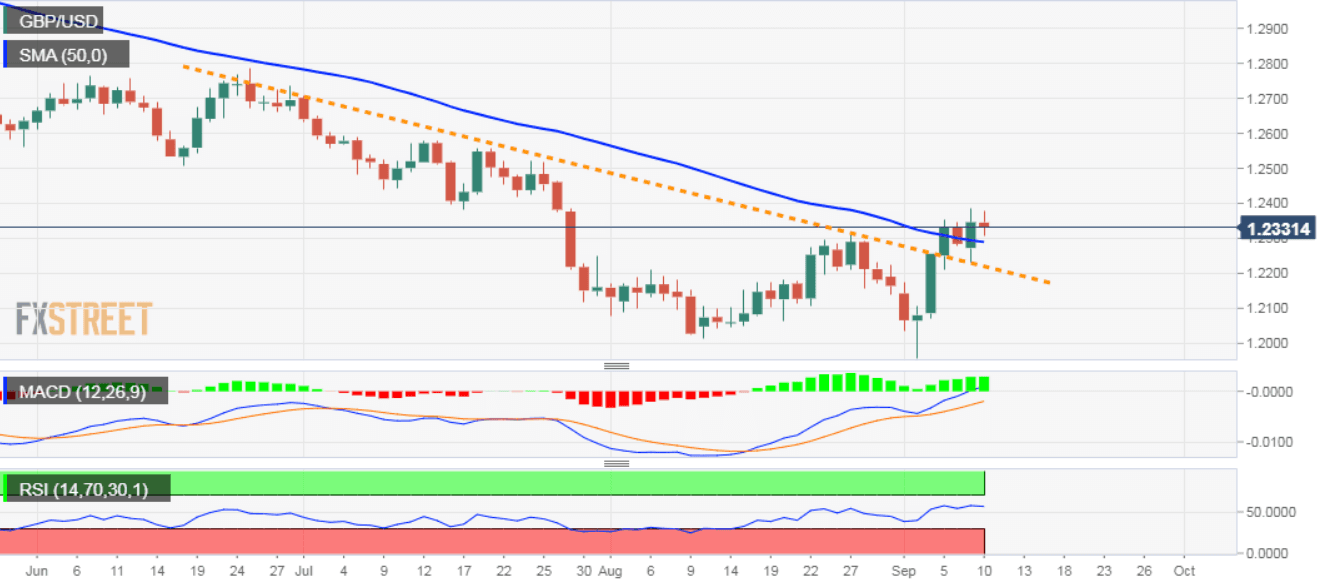

The optimum place to buy is after the exchange rate has pulled-back back down to just below the 1.2300 mark, which is just below the August 27 resistance highs and above the 50-day MA at 1.2282.

“Dips below 1.2300 handle might now be seen as a buying opportunity,” says Haresh Menghani, an analyst at FXstreet.

The 50-day, in particular, is likely to provide a floor under which it will be difficult for the pair to break, and from which it is likely to bounce.

Momentum indicators are strongly supporting the bullish move, with the RSI in the high 50s, MACD lines on the brink of rising above neutral and Stochastics also looking strong, says Perry.

Another bullish sign is that the 21-day moving average (MA) has now decisively started to pull higher after falling or being flat since March.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement