The U.S. Dollar Index is a Buy says RBC Capital Markets, Target the Two-year High

- Written by: James Skinner

© kasto, Adobe Stock

© kasto, Adobe Stock

- USD breakout from triangle pattern to draw buyers says RBC.

- A two-year high is now in sight for USD index, RBC tells clients to buy.

- Cluster of support levels below market to draw fresh buying interest.

The Dollar index is on course to reach a two-year high over the coming weeks, according to technical analysts at RBC Capital Markets, who say a breakout above the top an ascending triangle pattern has cleared the way for the greenback to return to levels not seen since late April 2017.

U.S. GDP data for the first-quarter will be released on Friday and economists have been nudging their estimates for the number higher all month, with currency markets gradually beginning to take note.

That's boosted the Dollar throughout April and, despite leaving it vulnerable to disappointing economic data that might emerge over the coming days and weeks, the RBC team say the technical set-up on the charts should attract buying interest for a while yet.

The Toronto-headquarterd investment bank told clients Thursday they should consider betting on a further increase in the index.

"DXY has pierced key triple top resistance at 97.71, taking out the 61.8% retracement of the January 2017-February 2018 bear market at 97.87 in the process. The bullish resolution of the ascending triangle pattern favours additional gains toward 98.50 and 99.89 initially, with a 76.4% retracement located just above here at 100.15," says George Davis of RBC.

Davis says support levels located at 97.71, 97.09 and 96.75 could attract fresh buying interest given the breakout above the top of the triangle pattern. He refers to 96.22 as "pivot for the current uptrend", which means if the Dollar index falls below there then the trade idea will be null and void.

Above: RBC Capital Markets graph of Dollar Index (DXY), with support and resistance levels.

The Dollar index was 0.17% higher at 98.22 during the noon session Thursday and has now risen 2.3% for 2019. It represents changes in the value of the Dollar relative to the currencies of America's most significant trade partners

This performance has come despite a market consensus that had argued as far back as September 2019 that this year would be the end of the U.S. Dollar rally that began in April 2018.

Above: U.S. Dollar index shown at weekly intervals.

The analysis from RBC's Davis takes account of only technical studies of charts, which often consider all manner of things from gauges of momentum in a market to short as well as long-term price trends. Most technical analysts might easily agree on the above analysis, although there will always be divergence among fundamental analysts.

Financial markets are focused on economic growth differentials between major economies, and at a time when the U.S. economy appears to be puttering along at a reasonable pace while the Eurozone is struggling to demonstrate any growth at all.

However, the end of April and beginning of May could mark an inflection point for the global economy and time will tell whether it will.

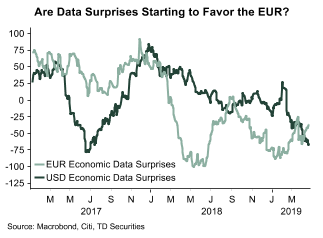

"With the USD now trading at fresh highs against most major currencies, we think it could be increasingly exposed to any data disappointments - particularly as the US data surprise index continues to falter," says Mark McCormick, head of FX strategy at TD Securities.

Above: Relative economic data surprises. Source TD Securities.

Economic growth differentials are often a reasonable predictor of the gap between yields on short-term bonds of two countries and those yields have significant influence over currencies because international capital tends to flow in the direction where the outlook for relative returns is most favourable.

Growth differentials impact the bond market because of what the various economic numbers might mean for central bank interest rate policies across the world. Consensus still suggests the U.S. economy will slow sharply in 2019, ending the Federal Reserve rate hiking cycle in the process, and that a pick-up in growth across other parts of the world will put interest rate rises back on the table in Europe and elsewhere.

Such an outcome would be a death knell for the 2018-2019 Dollar rally that has helped keep the Euro-to-Dollar pair and many other exchange rates under the thumb during recent months, only the 2019 story thus far has not panned out in the way the market had imagined it would.

Federal Reserve rate setters moved to the sidelines in January after an economic slowdown in Europe and China, as well as volatility in emerging world financial markets, stoked concerns about the U.S. economic and inflation outlook. Now many say the U.S. economy appears to be slowing.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement