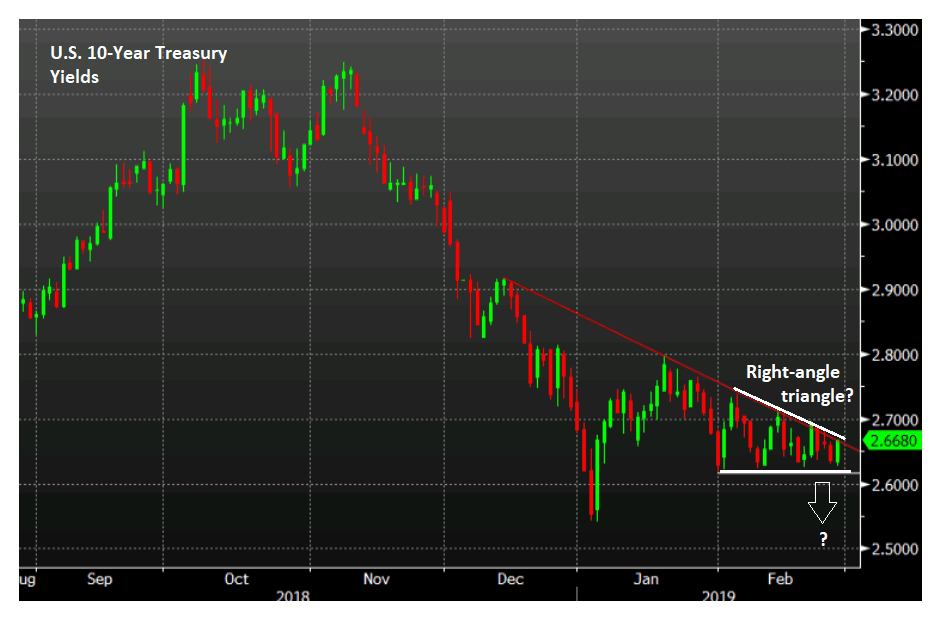

Break-out in U.S. 10-year Yield Looms, Could Inject Volatility into U.S. Dollar Complex

Image © Andrey Popov, Adobe Stock

- Multiple risk factors coming together

- Trump’s lawyer Cohen giving evidence, J Powell testifying, U.S. data dump

- December trade data showed deficit deepen woefully

The risk of an imminent breakout in U.S. 10-year yields could inject a dose of volatility in the U.S. Dollar over coming hours, we believe.

The Dollar is down against counterparts (except versus the JPY where it is higher) and there is a real risk it could spike lower as political risk, mounting evidence from the treasury market and poor economic data combine.

Trade balance data, released on Wednesday, was poor; Trump's former lawyer Michael Cohen is spilling the beans about the President to a Senate hearing, and Fed Chairman Powell is talking policy with the Senate Treasury Committee - with so many risks swirling around anything is possible.

The tension is best reflected in the chart of 10-year U.S. Treasury yields which are coiling into a tight range, suggesting the risk of a volatile spike and breakout either higher or lower.

Yields reflect interest rates which are sensitive to the economic outlook. When the economy is healthy and people are spending more liberally, inflation, interest rates, yields, and the Dollar usually follow suit.

Thus a spike in yields means a similar spike is likely in the Dollar given how closely correlated the two are.

“U.S. 10-year yields are prepping for a big break in one direction or another. This is the chart to watch right now,” says Adam Button, an FX analyst at Forexlive.

With such a busy week for U.S. data and other events, any number of catalysts could provide the source for a breakout.

U.S. trade data for December showed the deficit rising by 12.8% to -$79.5bn from -$71.6bn in November. This was much higher than expected and is likely to impact negatively on GDP.

Q4 GDP is out on Thursday and will reveal how much the weak trade at the end of the year impacted on growth. If GDP is substantially lower-than-expected, as seems possible, it could have severe implications for treasury yields, which would probably break lower, and the Dollar which would also weaken.

Also at the time of writing, Trump’s former lawyer Michael Cohen is being interviewed by a Senate committee about his dealings with the President.

There is real potential for some serious dirt to emerge at this hearing about Trump and the possibility of either a huge loss of face, impeachment or loss of popularity, which could affect him politically.

In his opening statement, Cohen already accused the President being a racist, adulterous, lying, fraudulent, anti-patriotic, cheat, among other things.

The Federal Reserve Chairman, Jerome Powell, is expected to talk about the Fed’s ‘balance sheet’ to the Senate treasury committee on Wednesday, with the risk that he may hint the Fed is considering restarting reinvestment of the proceeds from quantitative easing (QE).

Such a hint would see the Fed’s hand renter bond markets pushing up bond prices and pushing down yields. Powell has already been rather dovish in his remarks so far to the committee, restating the official case for a “patient”, “cautious”, data-driven policy orientation. If he continues in this dovish tone it could prep yields for another downside break in the event of a poor Q4 GDP release on Friday, for example.

From a technical perspective, the right-angled triangular shape of the price pattern on the 10-year yield chart suggests a slight bias to a downside break too, as price tends to prefer breaking down through the horizontal level rather than the ‘angular’ line.

This is also in line with the bearish trajectory of the trend since the November highs and given the old adage that ‘the trend is your friend’ a bearish move is slightly favoured. Such a move would be bearish for the U.S. Dollar too.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement