Pound-to-Dollar Rally: The Targets to Watch

Image © RCP, Adobe Stock

- GBP/USD on a tear; now above 1.33

- Combination of easing Brexit risks and USD weakness

- How much higher can it go? We assess the techs

The Pound-to-Dollar exchange rate is seeing a strong rally as markets lower thei estimation of a worse-case-scenario, no-deal Brexit taking place on March 29.

Broad-based U.S. Dollar weakness from downgraded economic expectations is meanwhile seen as a further propellant.

GBP/USD is now in an established short-term uptrend having broken through key moving averages, and is above a major trendline. The outlook is positive for bulls, but how high is it likely to go?

Traders at the UBS foreign exchange trading desk meanwhile confirm they are maintaining a "bias to buy dips," and, "technically the picture remains constructive, a daily close above the 1.3300 (Sep 2018 Highs) would inject fresh impetus to take another leg higher to target 1.3500 ultimately should the news flow continue to erode uncertainty".

According to analysis from trading providers ETX Capital several targets standout as potential stations higher.

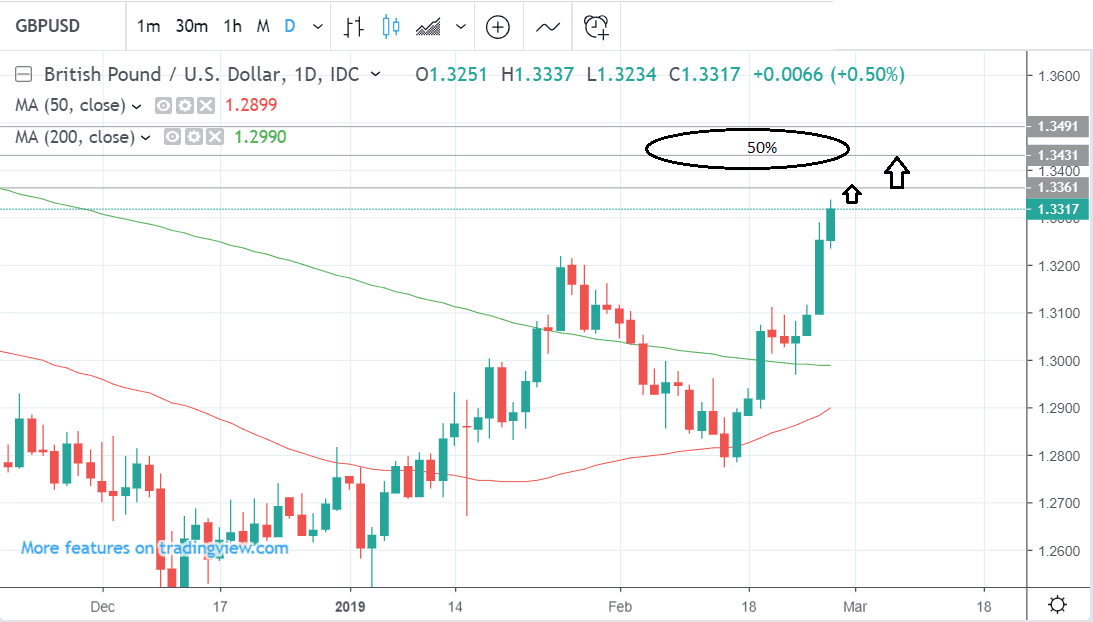

“We now focus on the next levels of defense, areas which were trading mid-way through last year. The July high of 1.3361 followed by 1.3431/92 which contains the 50% fib are strong contenders for possible resistance,” say ETX Capital in a note to clients.

At these levels, there is a risk the pair could pull-back. The 50% Fibonacci level at 1.3431 (circled below), or midpoint of the previous move down from the April ‘18 highs, is a major chart level and is highly likely to act as an obstacle to further easy gains.

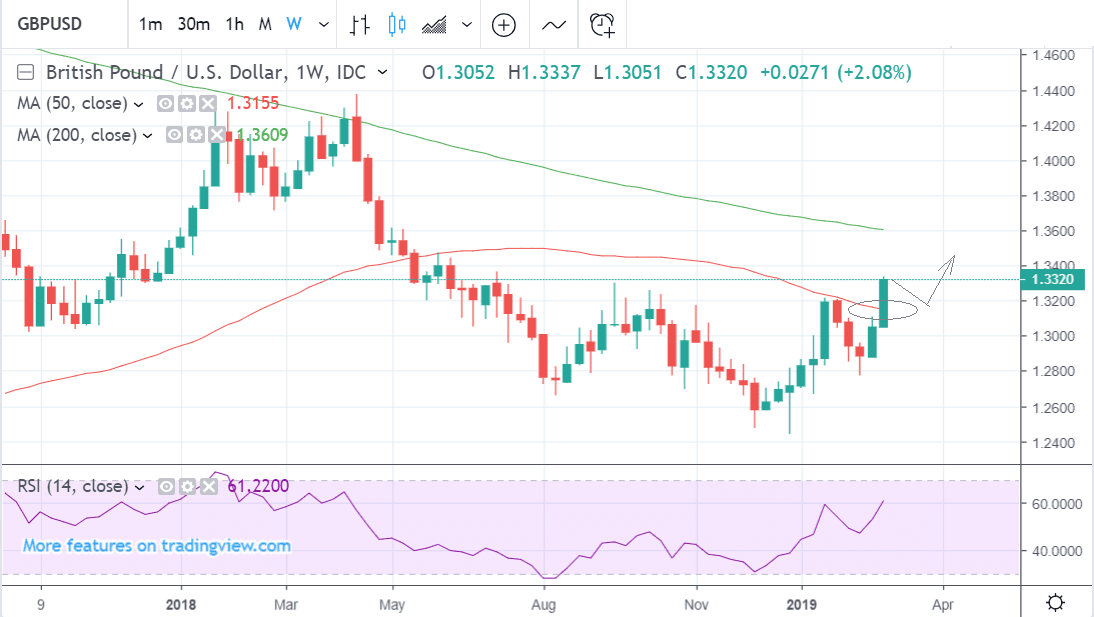

More immediately the pair is also at risk of a correction. The RSI momentum indicator shown in the lower pane of the chart below is edging into the oversold region (>70) and this suggests a higher likelihood of a correction. This combined with the fact the pair has reached the ‘glass-ceiling’ of the September 2018 highs indicates an increased propensity for a pull-back to occur at the current level.

The bull flag pattern which unfolded after the rally from the Valentine's day low looks to have completed - its second leg now of a similar length to the pole. This is a further sign the exchange rate may consolidate as traders are now more likely to take profits, thereby increasing supply.

Such a pull-back might well find support at the 1.32 January highs or the 1.3155 level of the 50-week MA, where it may churn for a while, before resuming its uptrend higher.

All in all, the pair is ripe for a correction, although, longer-term we still see it rising eventually given the now-established short-term uptrend as well as fading Brexit risks.

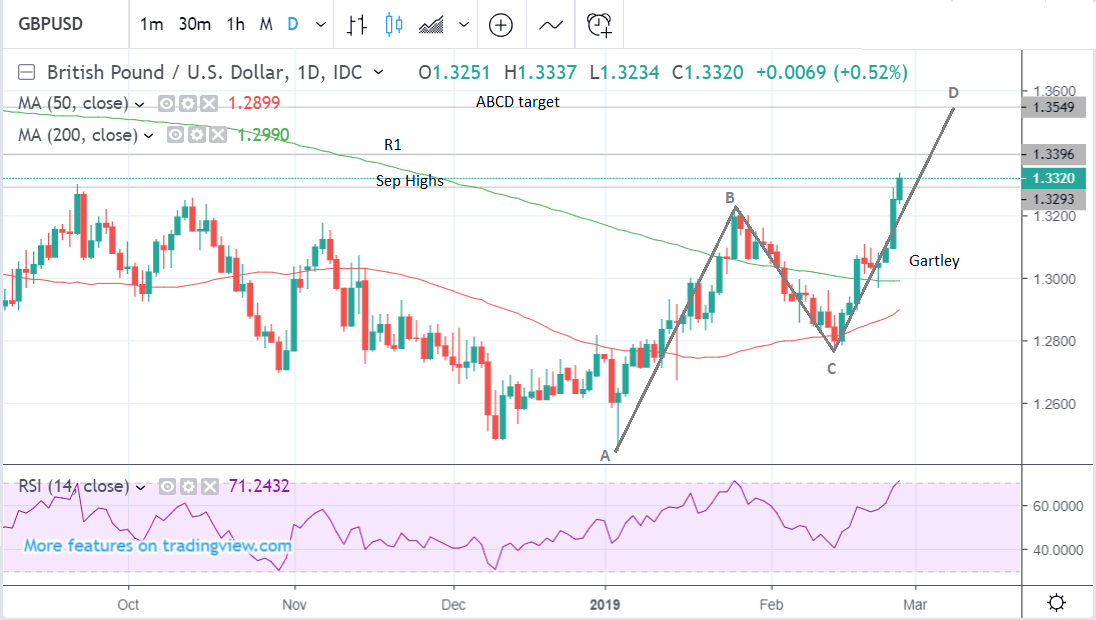

The eventual target may be in the 1.35s. GBP/USD is probably unfolding in an ABCD or Gartley pattern from the January lows. These patterns are like three-wave zig-zags with two trending parts separated by a shorter correction.

Waves A-B and C-D tend to be of similar lengths so the first one can be used to forecast the last.

Applying this principle to the pattern on Cable generates an upside target of 1.3550. This could be a major eventual target for the pair.

The R1 monthly pivot level at 1.3396 as another potential target too. As the name suggests pivots are often the site of major turning points for prices. Technical traders focus on them a lot and fade the trend when they are touched. There is a risk of a pull-back at R1 although possibly not a reversal.

Thus we see the overall outlook as bullish but there is an immediate risk of a pull-back due to the resistance from the September highs and the overbought RSI.

After that the uptrend is expected to resume and reach potential targets at the R1 pivot at 1.3396, the 50% Fib at 1.3431, as highlighted by ETX, and/or the 1.3550 end to wave C-D of the Gartley pattern.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement