PPI Blowout Stokes Dollar Rally

- Written by: Gary Howes

Image © OkFoto.it, Adobe Images

The U.S. Dollar rally extended ahead of the weekend thanks to a better-than-forecast PPI number out of the U.S.

The Producer Price Index - the average change over time in the selling prices received by domestic producers for their output - jumped 0.6% on a month-on-month basis in October.

Markets were only expecting a reading of 0.2%.

PPI matters for the Dollar as it is a leading indicator of the more important CPI inflation reading. In short, this suggests inflationary pressures are building in the U.S. economy which in turn justifies the U.S. Federal Reserve's aggressive stance on wanting to raise interest rates over coming months.

Recall it is that promise of higher interest rates that is feeding the Dollar rally.

The Pound-to-Dollar exchange rate trades at 1.3027 following the data having been as high as 1.3173 earlier in the week. The Euro-to-Dollar exchange rate trades at 1.1352 having traded as high as 1.1466 earlier in the week.

The Dollar index - a measure of broad-based Dollar strength - has over the course of the past 24 hours seen its largest one-day rise since October 2017.

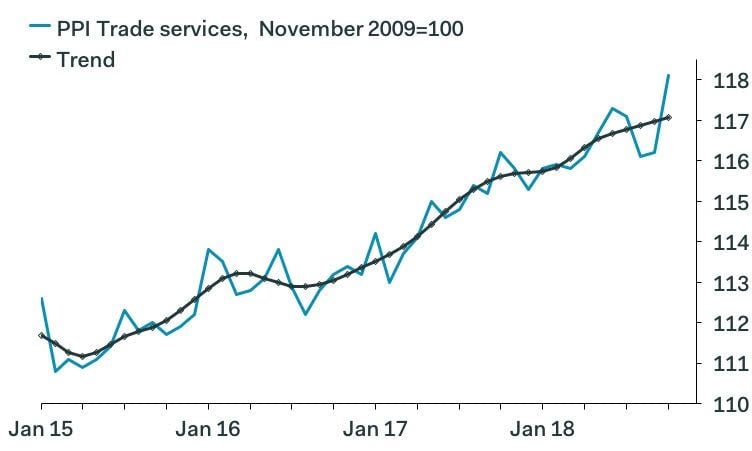

Economist Ian Shepherdson with Pantheon Macroeconomics says the overshoot to consensus is in the wildly volatile trade services component, which measures margins in retailing and wholesaling and accounts for 23% of the core.

"We expected a rebound after a run of soft numbers but the 1.6% m/m jump was bigger than we expected; it likely will correct in November," adds Shepherdson.

Even if the number does come down in November the trend is clear, PPI is moving higher and the Federal Reserve is therefore justified in pushing interest rates higher:

"PPI isn't typically much of a market factor, but today's data were far enough above expectations to have us sit up and take notice," says Avery Shenfeld at CIBC. "Whether this is capturing tariffs, rising wages, or simply a hot economy, it joins the wage series from the last payrolls report in adding to hints that growth is finally starting to translate into price momentum."

While the fundamental thrust of the U.S. economy supports further Dollar gains, we hear from one analyst that chasing the Dollar higher at this juncture might not pay.

The Dollar is likely to correct downwards against a basket of currencies before year-end, according to technical analysts at Bank of America Merrill Lynch, who've warned the U.S. currency could be in for "much more pain" if a key level of support gives way over the coming months.

Bank of America's call comes as the Dollar rebounded from election-induced losses seen Wednesday. The currency appeared Friday as if it's on a collision course with early November highs, which were last seen in mid-2017.

Price action over coming days will confirm if the greenback is in the process of forming what is known in some parts of the financial world as an "ABC correction" on the charts.

For the full analysis, please see that article here.

Advertisement

Bank-beating USD exchange rates: Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here