U.S. Dollar Capitulates after Stock Markets Tank at the Opening Bell, Shrugs Off GDP Surprise

- Written by: James Skinner

© Robert Cicchetti, Adobe Stock

- USD reverses course and heads lower after stocks tank at the open.

- USD is now becoming more readily influenced by stock market moves.

- GDP growth surprises on upside in Q3, egging on the Federal Reserve.

The Dollar reversed course and turned lower, resuming earlier losses, Friday after a series of poor corporate earnings reports sent U.S. stock markets sharply lower during the final session of the week.

Earnings misses and downbeat guidance from companies including Amazon and Alphabet, the owner of Google, for the third and final quarters sent U.S. equity benchmarks tumbling Friday.

The S&P 500 was 1.23% lower at 2,647 during the London noon Friday while the Dow Jones was 1.19% lower at 24,563.

Stock markets, long seen as a gauge of investor confidence, are providing important signals to currency markets about investors' outlooks for the U.S. and global economy.

Currency market moves often influence stock prices but stock market moves rarely impact directly on currencies.

However, the Dollar has drawn much of its 2018 strength from President Donald Trump's economic policies, which have enabled the Federal Reserve to raise interest rates while other central banks sit on their hands.

The earlier stock market rally was flagged repeatedly by Trump as a significant illustration of America's 2018 economic outperformance of competitors and this year's Dollar rally was effectively built on that "economic divergence" narrative.

As a result, the Dollar has become more readily influenced by moves in the stock market. It has stalled and in some cases, actually declined, whenever the market has wobbled in recent weeks.

The S&P 500 has fallen by 9% in the last month, taking close to "bear market" territory, which requires the -10% threshold to be crossed.

Moreover, U.S. corporate earnings updates are providing a steady drip of information about the likely economic impact of President Trump's trade war with China.

"Large intra-day moves in equities continue to drive FX. US stocks rallied hard into the close (S&P +1.8%) only to give up much of rise overnight on disappointing tech earnings announcements (NASDAQ future -1.5%)," says Adam Cole, chief currency strategist at RBC Capital Markets. "Stocks are down almost 8% month-to-date which is likely to result in significant hedge-related USD buying when month-end comes into view next week."

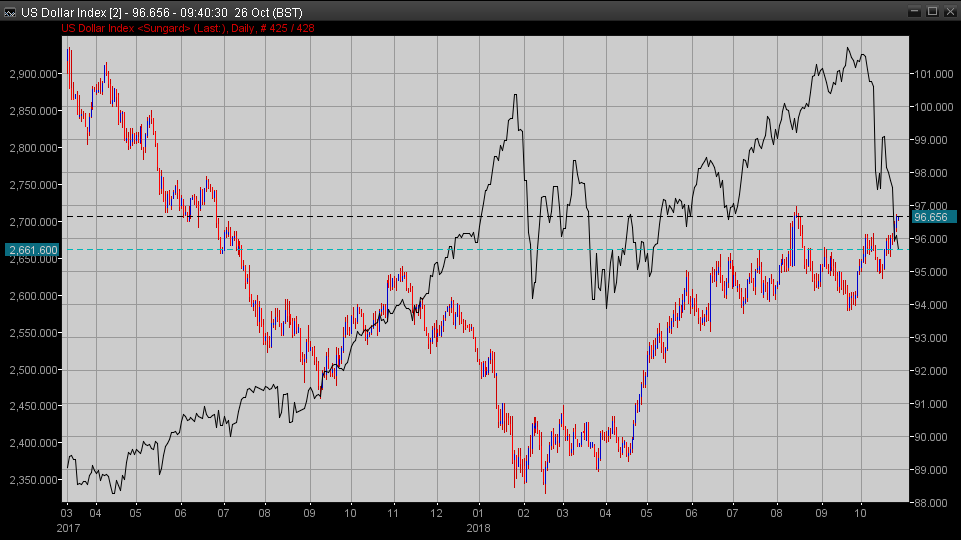

Above: Dollar index with S&P 500 (black) at hourly intervals. Source: Netdania Markets.

The U.S. Dollar index was quoted 0.17% lower at 96.51 following the reversal while the USD/JPY rate 0.69% lower at 111.56.

The Pound-to-Dollar rate was quoted 0.10% higher at 1.2834 while the Euro-to-Dollar rate was quoted 0.06% higher at 1.1382. Both have reversed notable earlier losses since U.S. stock markets opened at 14:30 London time.

Above: Dollar index with S&P 500 (black) at daily intervals. Source: Netdania Markets.

Advertisement

Bank-beating exchange rates! Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

GDP Surprises on the Upside, Fed to Keep on Hiking

The Dollar had enjoyed a brief recovery from earlier losses Friday after official data revealed U.S. economy grew faster during the third-quarter than most economists had anticipated, underlining the divide between a roaring U.S economy and those elsewhere in the world, many of which have slowed in recent months.

U.S. GDP grew at an annualised pace of 3.5% during the third quarter which, although down from the 4.2% pace of expansion seen previously, was ahead of the consensus estimate for growth of 3.3%.

Household spending, inventory investment among companies, government expenditure and business investment all contributed to robust growth during the third quarter.

However, the pace of expansion was tempered slightly by in recent months by a fall in the value of exports and an increase in the rate at which the U.S. is importing goods from the rest of the world, according to the Bureau of Economics Analysis.

"If second quarter growth was a grand slam, the US economy hit for at least a triple in Q3. Growth clocked in at a heady 3.5%, not far off from the consensus estimate of 3.3%. The advance was driven by another strong reading on household spending," says Royce Mendes, an economist at CIBC Capital Markets.

U.S. GDP grew at its fastest pace for more than four years during the second quarter, topping 4%, as companies and consumers opened their wallets in the wake of President Donald Trump's reforms that slashed the corporate tax rate by nearly half and handed an estimated $1,200 of annual income back to the average household.

Since that blowout report, economists have always maintained that the U.S. economic growth pulse would likely slow in subsequent periods. But some pundits are increasingly attuned to the possibility of another solid number given continued robust levels of consumer spending growth during recent months.

Friday's result may come as a relief to some after data released on Thursday suugested there was a risk the consensus had become too optimistic.

"The consensus estimate always looked too low, though we’re a bit disappointed that growth didn’t reach 4%," says Ian Shepherdson, chief U.S. economist at Pantheon Macroeconomics. "Still, nominal GDP growth was a healthy 4.9%, slowing from the unsustainable 7.6% Q2 jump. That’s still fast enough to keep the Fed raising rates, and it points to higher nominal yields across the curve."

The U.S. Dollar index was quoted 0.12% higher at 96.78 following the release, it's highest since mid-2017, after more than reversing an earlier 0.06% loss. The USD/JPY rate whittled a 0.36% loss down to just 0.17% when it traded at 112.14.

The Pound-to-Dollar rate was quoted 0.20% lower at 1.2795, close to its September lows, after extending earlier losses while the Euro-to-Dollar rate was quoted 0.28% lower at 1.1344.

Currency markets care about the GDP data because it reflects rising and falling demand within the US economy, which has a direct bearing on consumer price inflation, which is itself important for questions around interest rates. And interest rates themselves are a raison d'être for most moves in exchange rates.

The Federal Reserve (Fed) has raised interest rates eight times since the end of 2015, and on three occasions in 2018, taking the Federal Funds rate range to between 2% and 2.25%. That rate is expected to hit 3.25% at the end of 2019.

This kind of aggressive monetary policy has seen the U.S. Dollar index convert what was once a 4% first quarter loss, into a 4.29% 2018 gain during the six months or so since the middle of April.

"At 3.5% annualised, GDP growth remained unusually strong in the third quarter, thanks partly to this year’s fiscal stimulus, but there are clear signs that higher interest rates are beginning to have a bigger restraining effect. Once the boost from fiscal stimulus fades next year, we expect economic growth to slow below its potential rate, forcing the Fed to the side-lines," says Michael Pearce, an economist at Capital Economics.

Advertisement

Bank-beating exchange rates! Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here