Pound-to-Dollar Rate Week Ahead Forecast: Technicals Hint Uptrend Might be Resuming

Image © Adobe Stock

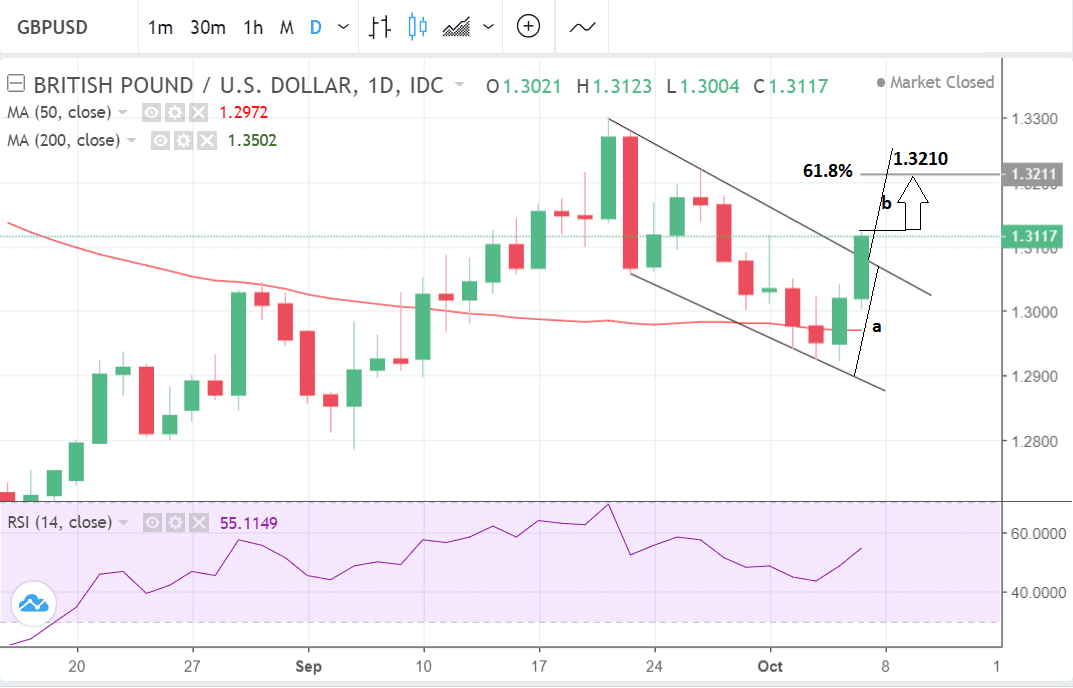

- GBP/USD closed above trendline and chart is looking bullish

- Sterling faces volatile week with Brexit headlines likely to dominate

- USD eyes inflation data this week

It is a testament to the turnaround in market perceptions of the Pound that it outperformed the U.S. Dollar last week, despite the fact that the Dollar has been one of the strongest currencies in the G10 of late.

GBP/USD rose mainly on easing Brexit concerns after more headlines suggested a Brexit Withdrawal Agreement can be reached in either October or November with talk of a December deadline also being a possibility.

The U.S. Dollar traded higher on the surge in U.S. Treasury yields and expectations for further Federal Reserve interest rate rises, which attracts inflows of foreign capital which in turn bid up the value of the Greenback.

The GBP/USD advance registered a high at 1.3124, having been as low as 1.2921 at one point in the week, suggesting the correction back from the September 20 highs has ended and the dominant uptrend is probably resuming.

According to consensus forecasts, the GBP/USD is now more-or-less in line with forecasts for three and six month timeframes, any further weakness could risk the currency pair becoming undervalued. A full assessment of the consensus forecasts and individual investment bank targets have been compiled by Horizon Currency Ltd and can be downloaded here.

Most significantly from a technical perspective, the pair has now broken above the upper trendline of the channel encompassing the correction, on a closing basis, and this is a strong sign the uptrend is probably resuming and the move has higher to go.

The usual method for forecasting a breakout is to take the height of the channel (a) and extrapolate it after the break (b). A conservative estimate uses the 61.8% percentage of the height of the channel and leads to our base case upside forecast of 1.3210.

The fact the pair stopped and reversed after hitting the 50-day moving average (MA) at the early October lows, and that it was in an uptrend previous to that, is a strong positive sign for the pair and further suggests the uptrend is resuming.

The RSI indicator in the lower pane is also rising quite strongly and is supporting the upswing in the exchange rate.

Advertisement

Lock in Sterling's current levels ahead of potential declines: Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

The U.S. Dollar: What to Watch this Week

The main release for the U.S. Dollar in the week ahead is inflation data as measured by CPI.

Headline CPI is forecast to show a 0.2% rise in September from 0.2% previously.

Core CPI is expected to rise by 0.2% from 0.1% previously. Both are scheduled to be released at 13.30 B.S.T on Thursday, October 11.

On a yearly basis, this translates into a forecast of a 2.8% increase in headline CPI and 2.5% for Core CPI.

Core inflation has been trending down over recent months due to the impact of the strong Dollar but analysts expect it to rebound in September.

In the previous month of August core inflation increased a modest 0.1% but followed a strong reading in July.

Core goods prices fell for the first time in three months, as apparel prices fell 1.6%, reflecting renewed downward pressure on core goods prices owed to recent dollar appreciation.

Core services inflation softened during the month to 0.2%. Physician services and hospital prices edged down.

Analysts maintain a view that inflation should continue to steadily trend upward, however, there is little indication that inflation will accelerate and force the Fed to raise rates sharply.

Another key inflation-related release for the US Dollar in the coming week is PPI or producer prices data out on Wednesday at 13.30, which is forecast to show a rise of 0.2% month-on-month compared to September.

Michigan Consumer sentiment for September is expected to inch 4 basis points higher to 100.05 when it is released at 15.00 on Friday.

Several Federal Reserve speakers are also set to speak in the week ahead. These include Williams at 14.15 on Wednesday and Bostic at 23.00 on the same day.

Investors may scrutinise what they say for signs of convergence with chairman Powell's recent comments about rates probably surpassing the neutral rate in the future. If they back him up it will support the Dollar higher; if they raise doubts it could weigh on USD.

The neutral rate is a hypothetical level interest rates need to be at to balance the economy. On average officials think it lies at 3.0%. Powell's comments suggest US interest rates could eventually rise above 3.0% from their current 2.25% and were bullish for the Dollar.

The Pound: What to Watch this Week

All eyes now turn to a meeting of European leaders at a dinner on October 17 when they review the state of negotiations with the U.K. ahead of the October European Council summit commencing on October 18.

"In October we expect maximum progress and results in the Brexit talks. Then we will decide whether conditions are there to call an extraordinary summit in November to finalise and formalise the deal," European Council President Donald Tusk said at the Salzburg informal summit.

Expect market nerves to remain piqued over the next week as headlines, rumours, optimism and disappointment create an unstable environment for traders to navigate.

"Brexit remains the key driver for the GBP and uncertainty related to the outcome is likely to keep the GBP volatile," says Mikael Olai Milhøj, a foreign exchange strategist with Danske Bank.

The president of the European Commission, Jean-Claude Juncker, has meanwhile said on the weekend he is sure a Brexit agreement could be reached in November, if not sooner.

Jean-Claude Juncker told three Austrian newspapers that Brexit without a deal "would not be good for the UK, as it is for the rest of the union".

He added:

"I assume that we will reach agreement on the terms of the withdrawal agreement.

"We also need to agree on a political statement that accompanies this withdrawal agreement - we are not that far yet.

"I have reason to think that the rapprochement potential between both sides has increased in recent days, but it can not be foreseen whether we will finish in October.

"If not, we'll do it in November."

At the moment there appears to be a lot of support for a Canada +++ arrangement even from within Theresa May's Conservative party, so if the proposal is broadly well received, it could be a big moment for negotiations and a concomitant rise in GBP.

Of course, the risk of a rejection is also quite high, and, therefore, a fall in GBP.

The question of the Irish border remains a sticking point but the UK has said it will propose a solution in the week ahead so there may be movement from news about that too.

On the data front, the main release is probably going to be GDP data, which is forecast to show a 0.1% rise in August, when it is released at 9.30 B.S.T on Wednesday. In July GDP rose 0.3%. A higher than expected result would help GBP.

"Things are looking rosier for the third quarter and there should be more evidence of this from the monthly GDP estimates due on Wednesday. UK GDP is expected to have expanded by 0.1% m/m in August, to produce an annual figure of 1.5%," says a preview from FX broker XM.com. "On a 3-month basis, growth is forecast at 0.6%, which would match July’s rate and point to growth of a similar amount for the third quarter."

Another major release for the Pound is likely to be the trade balance in August, which is expected to show a -10.9bn deficit when it is released at the same time on Wednesday.

Industrial and manufacturing production are also out at the same time and are both forecast to show a 0.1% in August compared to the previous month.

Finally, the Royal Institute of Chartered Surveyors (RICS) house price balance is out just after midnight on Thursday morning and the retails sales monitor for September is released by the Consortium of British Industry (CBI) just after midnight on Tuesday morning.

Advertisement

Lock in Sterling's current levels ahead of potential declines: Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here