Past 24 Hours Have Changed the Outlook for the UK Currency

- Written by: Sam Coventry

The British Pound Sterling (Currency:GBP) is today prone to a bout of profit-taking - an understandable reaction that usually comes in the wake of strong gains. The outlook for the British Pound has certainly changed over the course of the past 24 hours. Today's analysis and coverage at Pound Sterling Live will largely focus on the changed outlook and forecasts pertaining to the UK currency.

Highlights:

@06:11: GBP/USD holds gains

@08:30: Sterling suffers bout of profit taking.

@11:17: Forget 2016 - Interest rate hikes due in 2015

16:37: GBP has greater scope to advance veers the euro

Paul Robson at RBS gives his currency predictions following the Bank of England Quarterly Inflation Report:

"We see greater scope for GBP to strengthen over the short-term against the EUR than the USD. Given today's announcement and the level of inflation in the Euro area, the pressure on the ECB to keep policy accommodative is far greater than it is for the BoE or the Fed.

"It would be unwise to assume that recent strong growth automatically plays GBP positive on an expectation that the unemployment rate will fall. There remain good reasons why a quick fall in the unemployment rate should not be expected and this reduces the positives for GBP from the placement of the Threshold Target relatively close to the current unemployment rate of 7.8%. "

14:11: The fresh GBP rally may be built on shaky ground

Dr. Vasileios Gkionakis:

"We are skeptical about the British Pound rally"

Read the just published story here.

13:52: Further gains for Pound against the Euro?

Just published EUR/GBP analysis: "Continued weakness suggests scope for a larger corrective phase lower"

Read article here.

11:55: GBP still ascending, but a stall could lie ahead

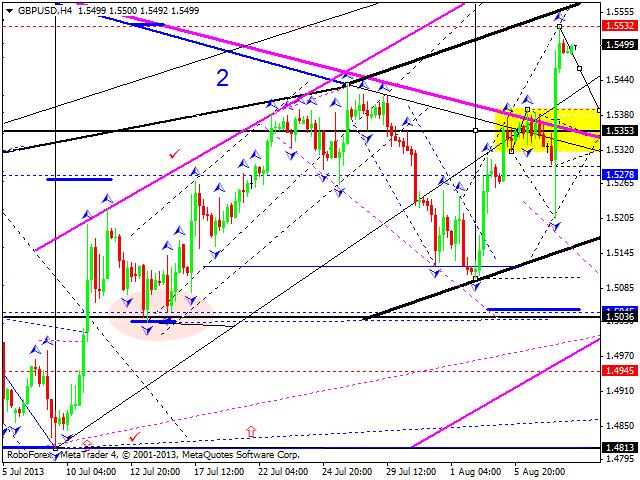

The latest analysis from RoboForex point out that a correction lower in GBP could be due:

"Pound is still forming an ascending structure. We think, today the price may reach the target at 1.5330 and then start a correction towards the level of 1.5400 to test it from above. Later, in our opinion, the pair may start a new ascending movement to reach a local target at 1.5600."

[Click the below chart to expand OR Click here for your own customisable chart to play with.]

11:17: Why is sterling a winner?

Incase you missed it UK interest rates will stay at 0.5 pct until 2016. So why is sterling rallying, particularly if this is a great deal later than expected (ie. Negative-GBP)?

Well, the answer is markets are pricing in an interest rate hike a lot sooner.

Jan von Gerich at Nordea Markets:

"After the recent batch of positive data, money markets price in the first rate hike in around mid-2015, i.e. much earlier than the BoE itself sees. Money market rates should thus have room to fall, but are unlikely to do so as long as strong UK data continue."

Pound Sterling Live believe the British pound will be a great deal more sensitive to the monthly inflation report and monthly employment report going forward.

10:26: GBP powers ahead versus the US dollar

The outlook for the GBP/USD exchange rate remains positive. FinFX say:

"The 20/55 SMA crossover and the RSI pushing to 70 suggests bullish trend development, though the overbought reading in the RSI suggests some intra-session consolidation. A break before 1.53 will be needed to neutralise the bullish outlook which has the 1.56 handle in sight if it extends above 1.5530." (click to enlarge).

08:35: Morning Pound Sterling forecasts

Trading Central have updated their short-term intra-day forecasts for the two major Sterling pairs.

Euro / Pound exchange rate forecast:

"Short positions below 0.8625 with targets at 0.8575 and 0.8555 in extension. Above 0.8625 look for further upside with 0.8645 and 0.8675 as targets. The pair is rebounding but stands below its resistance."

Pound / US Dollar exchange rate forecast:

"Our preference: LONG positions above 1.5385 with 1.5525 & 1.5595 in sight.

"The downside penetration of 1.5385 will call for 1.5305 & 1.525.

"The pair stands above its support and remains on the upside, the RSI stands above its neutrality area."

08:30: The British Pound sees profit taking pressures

The British Pound Sterling (Currency:GBP) is witnessing a bout of profit taking in the wake of yesterday's powerful advance:

- The Pound to Euro exchange rate is 0.13 pct lower on a day-by-day basis at 1.1602.

- The Pound to US dollar exchange rate is 0.04 pct higher at 1.5495.

- The Pound to Australian dollar exchange rate is 0.7 pct lower at 1.7092.

- The Pound to Singapore Dollar is 0.4 pct lower at 1.9557.

Please Note: The above quotes are taken from the wholesale spot markets. Your bank will charge a discretionary spread to the rate when passing on their retail rate. However, an independent FX provider will guarantee to undercut your bank's offer, thus delivering you more currency. Please find out more here.

8:20: Currency markets factoring in an interest rate hike earlier than they had been

Why did the British Pound take yesterday's Bank of England as a major positive?

Michael van Dulken at Accendo Markets says:

"Much debate continues on the forward guidance provided by the Bank of England’s (BoE) new governor Carney. While he pledged to help the economy by saying rates will stay low until mid-2016 when unemployment is seen falling to 7% (still a tall order), this was offset by a trio of caveats/knock-outs such as inflation >2.5% in next 18-24 months (very possible) seeing markets price in a rate hike even earlier then they had been."

08:09: What happened yesterday?

Forex Metal Traders, in a morning brief to clients give a handy summary of recent British Pound price action:

"The British pound grew significantly against major currencies and the GBP / USD pair rose to $ 1.5455, which was associated with the statement of the Bank of England. The issue revealed the plans for the future monetary policy of the central bank, noting that the key interest rate will remain at a record low of 0.5 % until the unemployment rate in the UK will not go less than 7%.

"The comments of the Governor of the Bank of England, Mr. Carney, who said that the gross domestic product will not reach its pre-crisis level in the coming year adding that the Monetary Policy Committee will continue to pursue a policy of securing economic growth helped the currency to strengthen above its competitors."

06:11: GBP's drive higher is held, GBP/USD tipped for gains

FX Market Alerts report:

"GBP starts right up at the high, bullish above the 2 s/t refs 1.5480 & 1.5440. With yesterday's breakout sustained, remain leaning long into 1.57."