British Pound Live on Tuesday the 18th of May: GBP under pressure despite signs that inflationary pressure increased in May... but why is GBP lower?

- Written by: Will Peters

Welcome to our live coverage of the performance of the British pound on the day that the latest inflation figures out of the UK economy are released. There are whispers of inflation coming in above expectations - a decidedly pro-sterling event should it be proven to be correct.

Highlights

@ 16:17: GBP in a hefty sell-off

@ 11:35: We get baffled by technical forecasts

@ 9:30: UK inflation data beats epectations

16:37: Vodafone could be behind GBP weakness

As mentioned @ 16:31 EUR-GBP buying has been cited as being a key reason behind today's GBP selling.

FX Market Alerts say the Vodafone acquisition may be behind heavy sterling selling:

"The market is citing the Vodafone deal for Kabel Deutscheland as the likely reason EUR/GBP is so well supported. However, had the commercial bids held off, we suspect they would have got their EUR's at a much cheaper level, especially with some decent size sell stops noted through .8460 as of last week. Cable is now extending through to fresh lows on the day, but as we alluded to earlier, much of the direction here is coming from EUR/USD, which now seems to have given up on 1.3400 and is testing back to 1.3370."

16:31: EUR-GBP buying blamed for general sterling malaise

Kathy Lien at BK Asset Management, gives an interesting angle to today's GBP sell-off:

"UK consumer prices increased more than expected but the GBP was driven lower by EUR/GBP buying." An explanation clearly short on detail.

16:17: Aggressive losses registered by sterling

The morning's inflation data was taken as the excuse needed to sell sterling; we would suggest this sell-off is positioning ahead of the arrival of Mark Carney at the Bank of England:

GBP/EUR is 0.87 pct down at 1.1661.

GBP/USD is 0.63 pct lower at 1.5627.

GBP/AUD has relinquished earlier gains against an under-pressure Australian dollar and is now flat at 1.6466.

GBP/ZAR is 0.32 pct down at 15.6409.

GBP/CAD is 0.44 pct lower at 1.5950.

Please note that the above are wholesale market quotes; your bank will affix its own discretionary spread. However, an independent FX provider will guarantee to undercut your bank's offer, thus delivering more currency. Please find out more here.

12:45: Adding to our negative technical theme on GBP-USD

We heard from Robo Forex below, in his not to clients today Luc Luyet at MIG Bank says:

"GBP/USD has moved above its recent high at 1.5738 (13/06/2013 high), but failed thus far to hold above it. Coupled with a short-term overextended rise, we do not expect a significant rise from the current levels despite the recent new highs."

11:35: Do you want to get even MORE technical?

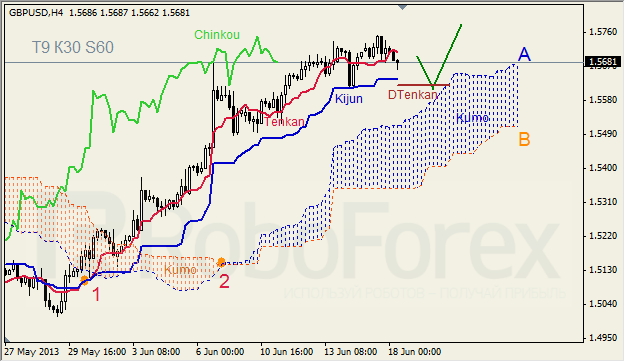

Robo Forex tried to baffle us with their below update (@11:30). If that proved too technical, try their 'Ichimoku Cloud Analysis' on for size:

"GBPUSD, Time Frame H4 – Indicator signals: Tenkan-Sen and Kijun-Sen are under pressure of “Golden Cross” (1); Tenkan-Sen is moving downwards, other lines are horizontal. Ichimoku Cloud is going up (2), Chinkou Lagging Span is above the chart, and the price is in the channel between Tenkan-Sen and Kijun-Sen.

"Short‑term forecast: we can expect the price to fall down towards Kijun-Sen and D Tenkan-Sen."

Here is the graph (click to enlarge):

11:30: Technically speaking, GBP should correct lower

Ahead of today's inflation data we noted that the British pound was already under pressure. This suggests technical considerations are of importance.

Robo Forex say:

"Pound reached only the level of 1.5750, which is the minimum of this ascending wave. At the top, the price is forming diamond reversal pattern. We think, today the pair may start a descending correction towards the level of 1.5320."

9:42: PPI below expectations

CPI has increased at a faster rate than expected - this should have boosted sterling. So why is sterling not higher? Well, there are other numbers that suggest inflationary pressure may be more subdued in some sectors. Thus, the Bank of England could still be more active on the monetary front when Carney takes over. This is the ultimate worry for sterling.

May's Producer Price Index - Output (YoY) - actually came in below expectations at 1.2 pct. Analysts had expected a reading of 1.5 pct.

Producer Prices Index Core Output, which excludes volatile items such as food and energy, also showed less price pressure than expected. The reading came in at 0.8 pct, below expectations for an increase of 0.9 pct.

9:30: UK inflation data beats epectations

The Office for National Statistics said annual CPI rose to 2.7 pct in May from April's 2.4 pct, above economists' forecasts of 2.6 pct in a Reuters poll.

Core Consumer Price Index (YoY) registered an increase of 2.2 pct, consensus estimates were for 2.1 pct. Last month's reading was 2 pct.

This is theoretically a pro-sterling outcome. BUT: There has been no benefit to the UK currency, remember there were a stack of readings released today so there is much data to digest.

GBP-EUR 0.42 pct in the red

GBP-USD 0.24 pct in the red

8:20: Sterling under pressure ahead of inflation data

The British pound sterling (Currency:GBP) has dipped in morning trade:

The pound to euro exchange rate is 0.15 pct in the red at 1.1747.

The pound to US dollar exchange rate is 0.34 pct down at 1.5669.

The pound to Australian dollar exchange rate is 0.45 pct higher at 1.6547.

8:15: Key driver for today will be the release of monthly inflation data

Today is all about inflation. There is a whole host of measures of price stability due for release at 9:30 in London - for the full list see here.

UniCredit Bank tell us they are expecting inflation to tick up:

"UK inflation is expected to accelerate slightly to +2.6% yoy in May from +2.4% in April and this is expected to offer some floor to sterling. Hence, cable is expected to trade above 1.57, while EUR-GBP is likely to stay below the 0.85 threshold."