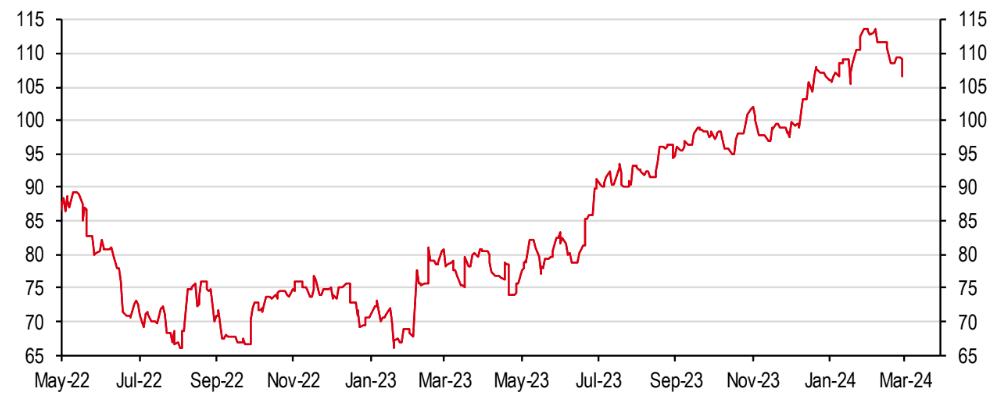

Dollar Strength Questioned as U.S. Data Surprise Index Peaks

- Written by: Gary Howes

Image © Adobe Images

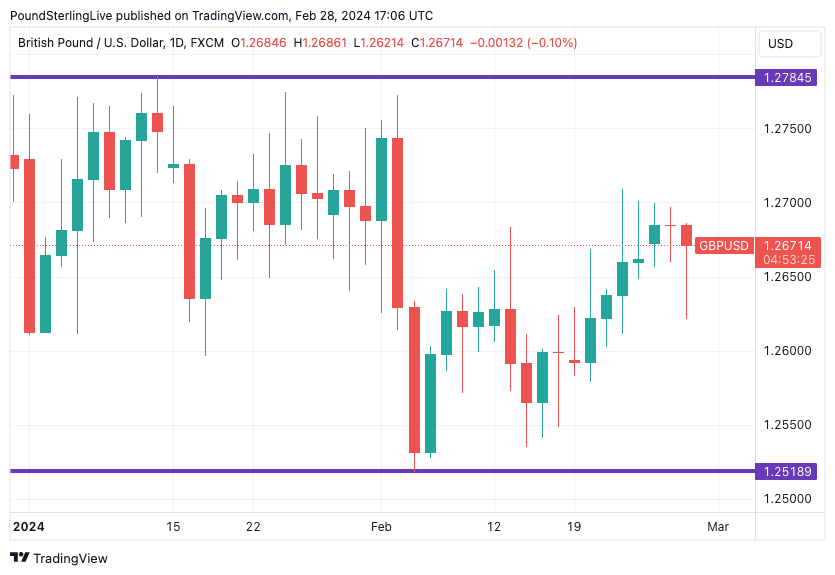

The Pound to Dollar exchange rate (GBP/USD) can maintain its current range as it looks like the U.S. exceptionalism trade is at a turning point.

This is according to HSBC's currency strategy team who see the U.S. economic surprise index potentially peaking.

"The recent downturn in HSBC’s US economic activity surprise index bears watching," says Daragh Maher, head of FX strategy at HSBC. "After a long stretch higher, reflecting activity data which has most often come in above consensus expectations, the index has shown recent signs of turning lower."

Image: U.S. surprise index, HSBC.

Economic surprises are a potent driver of FX, and the U.S. economy's surprisingly strong performance at the start of the new year has prompted investors to fade bets for U.S. Federal Reserve rate cuts.

This has fed a stronger Dollar and made it 2024's strongest performer in G10. But further strength - and GBP/USD downside - will be limited if the Dollar's rally fades from here.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

HSBC says recent disappointments in U.S. economic data prints have been concentrated at the consumer end of the economy, with retail sales, consumer confidence and housing sector data providing the main drags.

"The turn lower in the index needs to be kept in context," explains Maher, "expectations for the U.S. economy have been moving much higher, making them harder to beat, while still signalling robust activity."

He notes consensus expectations for U.S. 2024 GDP growth were 0.6% year-on-year in August 2023. Now, the consensus is for 2.0% growth this year, more than triple the prior expectation.

By contrast, over the same period, the consensus Eurozone 2024 GDP growth forecast halved from 1.0% y/y to 0.5%, and the UK's has dropped from 0.9% to 0.4%. Should the European surprises turn higher while the U.S. surprises turn lower, the USD could fade against EUR and GBP.

"For the FX market, the question is whether it will focus more on the continued relative pace of activity, or how the data lands relative to expectations. On balance, it suggests that while U.S. economic performance may support the USD, further USD gains built on upside surprises may be harder to come by (for more surprise indices, please refer to Surprise indices, 28 February 2024)," says Maher.

Above: GBP/USD should stay contained in its 2024 range if U.S. data surprises turn lower. Track GBP/USD with your own custom rate alerts. Set Up Here