New Zealand Dollar Rebounds on Easing "Trade War" Fears - Could This Be The Start of a Reversal?

- NZD/USD has risen from 2-Yr lows in mid-August.

- Coincides with signs of a China-US detente on horizon.

- Return to 0.70 level is possible say Bank of New Zealand.

Image © Adobe Stock

The New Zealand Dollar has recovered from two-year lows strongly this week in response to signs of a "trade war" detente between the US and China, but analysts from Bank of New Zealand (BNZ) say it could have further to run in the months ahead.

New Zealand's currency has snapped a 5-day losing streak in recent days, which is the kind of strong start that new bull-trends are made of, in a move which coincided with news of the China detente.

Analysts at BNZ say the 2018 fall below 0.70 to a low of 0.65 represents a "trade war risk premium" for the currency and the Kiwi's rebound in response to the latest China-US trade developments suggests they may be right.

Should America make good its promise to impose 25% tariffs on an extra 200bn of Chinese goods 'fair value' would fall from 0.71 to 0.65 and a move below that "could not be ruled out" for the spot rate. On the other hand, a complete deescalation of trade tensions would see the NZD recover towards 0.70 this year, according to BNZ.

Above: NZD/USD rate shown at daily intervals.

"We see the near-term outlook for the NZD as somewhat binary. If the current proposed 25% tariffs on $200b of Chinese imports don’t see the light of day then that would be clearly NZD-positive," says Jason Wong, a currency strategist at BNZ.

It remains to be seen whether the US will go ahead with the 25% tariff as a decision is not due until after September 5, when a public consultation on the proposed levies draws to a close. But new trade talks due at the end of the August indicates an openness to deescalation among both Chinese and US officials.

Both the US and China have been locked in an escalating "trade war" in recent months, with each imposing a series of tariffs on the other, leading to a deterioration of global investor confidence and risk appetites, while stoking fears of a global economic slowdown.

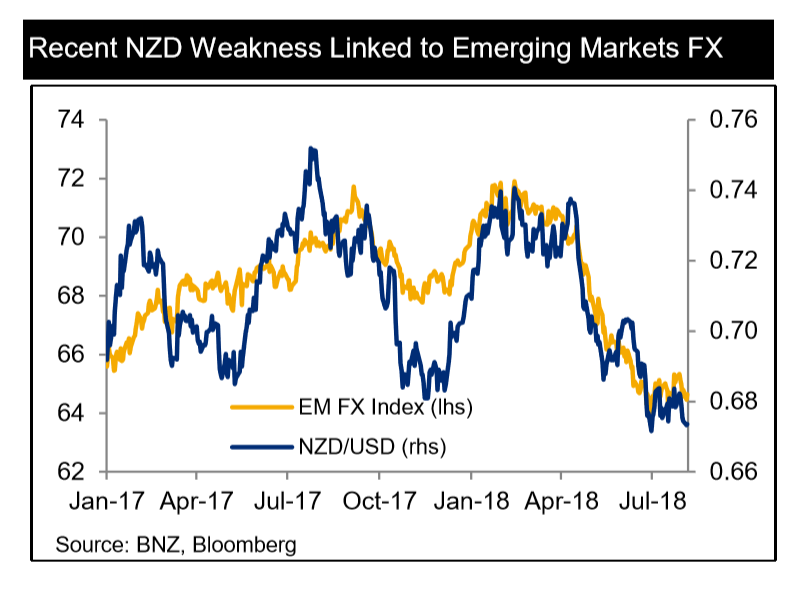

High Correlation With Emerging Market Currencies

The connection between the New Zealand Dollar (Kiwi) and China stems from close trade links between the two countries, which has left the Kiwi highly correlated with the J P Morgan Emerging Market Currency Index, of which the Chinese Yuan is a major constituent.

Above: BNZ graph showing NZD correlation with emerging market currencies.

"The path of the NZD has been closely linked to the fortunes of emerging market currencies this year, which includes the performance of the Chinese yuan. We think that the correlation will remain high over the short term as trade tensions remain a focus for the market," says Wong.

Emerging market currencies have been driven lower recently by a combination of fears that a "trade war" would lead global growth to decline, and the threat that 2018's stronger Dollar poses to developing economies, which carry high levels of Dollar-denominated debt and so have to contend with higher interest bills and repayment costs when the Dollar rises.

The Yuan is not a free-floating currency and its rate is effectively set by the Chinese authorities, who announce an exchange rate band on a daily basis. The Yuan is not allowed to deviate beyond this band by any meaningful amount.

Should the trade war with the US escalate the likely response from Beijing will be to allow the Yuan to weaken again, since that will keep its exports competitive despite the extra tariffs. Although the People's Bank of China is believed to have made little effort to stem the recent 6% depreciation in ts currency.

China is one of the biggest importers of Kiwi exports as its growing middle class and close proximity have made New Zealand an ideal supplier of all things agricultural, including dairy products as well as soft commodities such as wood and wool.

A weaker Yuan will make these more expensive, potentially leading to a fall in demand that would impact negatively on New Zealand.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here