BNZ Lower New Zealand Dollar Forecasts, but Eye Some Respite

- Written by: James Skinner

- NZD forecasts downgraded at BNZ

- But don't become "overly bearish" on the Kiwi we are told

- NZD/USD rill rise modestly in 2018/19 but so too will the GBP/NZD.

© Rafael Ben-Ari, Adobe Stock

According to the latest forecasts from Bank of New Zealand (BNZ), the worst may now be over for the Kiwi currency following months of heavy losses.

New Zealand’s domestic economic picture continues to deteriorate with weak business confidence suggesting the slowdown highlighted in first quarter GDP data are likely to continue, justifying the Reserve Bank of New Zealand to become more dovish.

These domestic clouds are likely to continue to hang over the NZD and many analysts are expecting the currency to struggle. The forecast update at BNZ follows a tumultuous first half of the year that has left the Kiwi currency trading on a 4% loss against the Dollar and down by 2% against the Pound.

Even these losses dramatically understate the ferocity of the sell-off seen in the second quarter because the Kiwi currency had notched up a 6% gain over the Dollar and 2.5% profit from Sterling during the first three months of the year.

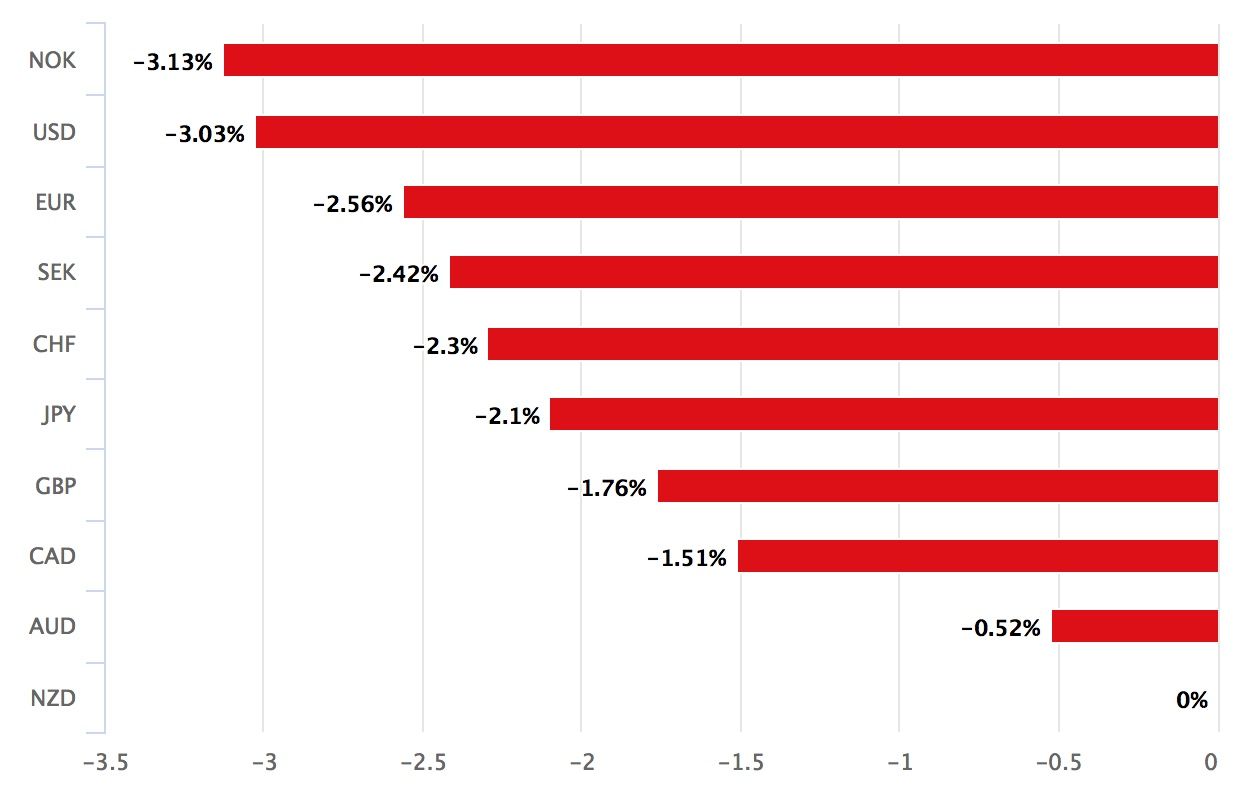

Above: The NZ Dollar's performance over the past month.

Strategists at New Zealand's second-largest bank have downgraded their forecasts for the NZD/USD rate this week and upgraded their projections for the GBP/NZD rate in light of the recent NZD weakness which has prompted a paring back of expectations.

The NZD/USD target is still however higher than current spot rate, reflecting BNZ's view that we should not become "overly bearish" on the NZD outlook.

"We began the year with a negative outlook for the NZD trade weighted index and we maintain that view for the medium term," says Jason Wong, an FX strategist at Bank of New Zealand, a division of National Australia Bank. "Our forecasts show some stabilisation in the TWI over the second half before slipping again through 2019 and 2020. However, our current forecasts don’t incorporate some of the downside risks that have emerged for the NZD over recent weeks."

An ongoing slowdown in Kiwi growth is seen cementing the Reserve Bank of New Zealand into its "on hold" interest rate stance until well into the 2019 year, with pricing in overnight-index-swaps markets implying a March 21, 2019 cash rate of just 1.81%. The Kiwi cash rate has been at a record low of 1.75% since the end of 2016.

This suggests little more than a 20% probability the RBNZ will have raised interest rates by then, which is a problem for the Kiwi currency given the US economy is growing strongly and other central banks are also raising their interest rates.

The Kiwi has long enjoyed support from interest rates that were typically higher than those elsewhere in the developed world but now the US Federal Funds rate has overtaken its Antipodean counterpart, while the gap between Kiwi borrowing costs and those elsewhere in the world is also expected to narrow over coming quarters.

This means that investors are incentivised to sell Kiwi Dollars and to buy the greenback in order to invest in the American bond market rather than vice versa, which is the opposite of how the so called carry trade used to work. But there are other interest rate factors to take into account too.

"This cycle for the NZD is looking very much like the mid-1990s and late-1990s cycles, where tighter global monetary policy led to a weaker NZD TWI. The theory is that tighter global monetary policy eventually leads to weaker global growth which the NZD is sensitive to," Wong says.

At the end of the 1990s, spanning the 1999 and 2000 years, the New Zealand Dollar fell by more than 30% against the US Dollar, to a low point of $0.38 by November 2000. This price fall not only coincided with a steep rise in US, UK and European interest rates, but was also the last time that interest rate or yield differentials favoured the US Dollar and other currencies.

"The NZ-US 1-year swap spread has been trending lower and has recently fallen close to zero, a reflection of the RBNZ keeping monetary policy unchanged while the US Fed maintains a gradual pace of tightening," Wong writes, in a breifing Thursday. "We see the outlook for all the model drivers to the downside. In a more uncertain global outlook with escalating trade wars, risk appetite probably deserves to trade lower."

Forecasts for the New Zealand Dollar

The NZD/USD rate was quoted 0.41% higher at 0.6787 Thursday while the Pound-to-Kiwi-Dollar rate was 0.45% lower at 1.9478.

While Wong and the BNZ team have downgraded their forecasts for the Kiwi and upside for the currency is not only limited, but also tentative, the worst does however now appear to be over for the Kiwi relative to the US Dollar.

They predict the NZD/USD rate will rise steadily to 0.69 by the end of September and 0.70 by the time the year is out.

The Pound-to-New-Zealand-Dollar rate on the other hand, is projected to rise steadily toward 1.92 by the end of September and 1.96 before year-end.

"While much of this note has expressed the challenges for the NZD ahead, there are good reasons not to become overly bearish," Wong concludes. "The global theme of the past month of significant downside pressure on commodity prices including agricultural products hasn’t really applied to NZ commodities, but the NZD has been sold down regardless. NZ’s terms of trade likely remain close to a record high."

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here