Pound vs. New Zealand Dollar Week Ahead: Sterling Upside Favoured but RBNZ and EU Summit Pose Risks

- GBP/NZD seen going higher near-term but lower as medium-term downtrend reasserts

- RBNZ forms central domestic focus for NZD action this week

- GBP will focus on outcome of key EU summit later in the week

Image © Adobe Stock

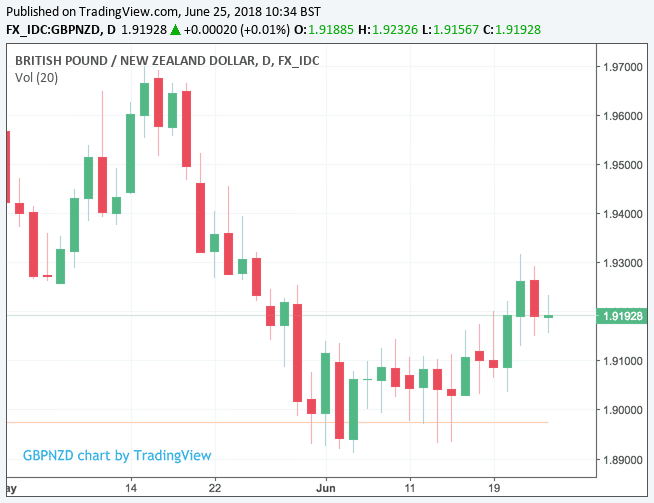

GBP/NZD is quoted at 1.9189 at the start of the new week, having hit an high of 1.9317 in the previous week suggesting immediate action has turned soft.

However, from a technical perspective, there is a good chance that any weakness will prove short-lived based on the uptrend we have seen Sterling enjoy over its Kiwi rival for much of June, indeed, a look at the charts shows the exchange rate has advanced. Short-term momentum signals are broadly positive and advocating for further gains.

However, whether a break of the month's high can be achieved does look questionable based on the strong 'down day' witnessed on Friday, June 22 and therefore any further upside might be limited.

The prospect for a further near-term rally to extend is being pushed by analysts at independent research providers Trading Central, where studies are showing a preference for a "technical rebound towards 1.9253 before a new drop."

It would appear this is based on the view that June's upside action in GBP/NZD must be considered within the broader context of a medium-term downtrend, that should ultimately reassert at some point.

Above image courtesy of Trading Central.

However, Trading Central analysis does suggest that should Sterling push the exchange rate higher to 1.9253 and a break-out occurs, the market could rise to 1.9298 and then potentially 1.9326.

So keep a note on this important technical level.

Technicals aside, it is a busy week ahead for GBP/NZD and it could well be that headlines shake up the technical picture.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.

The New Zealand Dollar's Week Ahead: RBNZ and Trade

It is a relatively interesting week ahead for the New Zealand Dollar on the domestic scene with trade data dominating the docket on Tuesday, June 26 at 23:45 B.S.T.

Look for the May trade balance number (month-on-month) to read at 100M, considering the New Zealand economy is a small and open one, trade matters for then currency.

A beat on expectations would likely signal a bullish stance to NZD, while a miss could disappoint, particularly in the global context of heightened trade tensions.

On Wednesday, June 27 at 02:00 B.S.T. the Reserve Bank of New Zealand delivers its interest rate decision and statement.

Consensus expectations are for no change to the 1.75% basic interest rate set by the Bank.

"This week the key domestic event will be the RBNZ OCR decision. Although we expect no change in message from the RBNZ, we have updated our view on the outlook for the OCR. We now expect the OCR will lift in November 2019, rather than August, consistent with a softer outlook for GDP growth and a more gradual increase in inflation," says Sharon Zollner, Chief Economist with ANZ.

What will be key from a currency perspective is the tone of the communications, particularly in light of rising concerns for global economic growth in light of rising tensions over global trade. There is a chance the RBNZ strikes a cautious tone concerning the outlook which would in turn likely weigh on the NZD.

Indeed, expect trade to dominate sentiment towards the Kiwi over coming days, as has been the case over recent weeks, we don't see the currency breaking the shackles of global risk sentiment just yet.

"One of the key risks to up the ante of late is possible fallout from trade war escalations. The implications for New Zealand are not yet clear. In the short term, New Zealand could benefit. But as a small open economy, we have benefited from the freeing up of global trade in recent years. We could be impacted significantly if this process were to go systematically into reverse or should the Chinese economy slow," says Zollner.

The Pound's Week Ahead: EU Summit

Brexit is front and centre for Sterling in the coming week with the European Council set to meet on June 28-29. Brexit will be discussed on Friday, June 29 from 08:00 B.S.T onwards, so look for headlines concerning the matter to be delivered throughout the day.

We have seen over recent days a further ramping up of Brexit headlines ahead of the summit, with both sides engaged in jockeying, but, remarkably the Pound has hardly moved on the headlines.

Markets are simply looking for concrete outcomes that give a clear view on what the future will look like. Perhaps this week we will get such outcomes.

On the data and domestic events calendar, watch Governor Mark Carney set to make a speech on the morning of Wednesday, June 27. The Bank of England proved to be a big mover of Sterling in the week past when it telegraphed the potential for interest rate rises over coming months, and markets will be looking out for any further information concerning policy matters. We can't however at this stage say whether this scheduled speech will touch on monetary policy.

Data is all second-tier in nature with a revision to Q1 GDP being tipped for Friday. Markets are looking for the 0.1% growth that was initially reported to be confirmed by the ONS.

With the EU summit due on the same day we are confident in suggesting this will matter little for markets.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.