RBNZ Could Give New Zealand Dollar Unintended Boost at September's OCR Meeting

- Written by: James Skinner

Politics aside, the week's big event for the New Zealand Dollar will be the RBNZ's September policy decision where any surprises are expected to be on the supportive side.

Economics, election uncertainty and a soon-to-be rudderless central bank mean it's a near certainty the cash rate will stay at 1.75% for September when the Reserve Bank of New Zealand deliver their September OCR review on Thursday, September 28.

An under-pressure New Zealand Dollar is unlikely to garner any support as the RBNZ is seen holding a neutral stance amid a changeover of the guard both within the central bank, and in New Zealand politics.

However, any surprises are tipped to be supportive of the NZD.

"With a new acting Governor in place, policy uncertainties in abundance, and nothing much changed since the MPS, it would be a real surprise if there was any hint of a change. If there is, it would have to be to the more hawkish side," says Stephen Toplis at BNZ.

Toplis cites a pro-NZD surprise being possible having observed the global economic outlook improving, commodity prices remaining robust, domestic fiscal policy easing and inflation forecasts likely to be revised higher (albeit that they won’t be published).

"The market has already priced in a full hike by September 2018 – more than a year in advance of the RBNZ – but any suggestion of a hawkish tilt would still likely see fixed interest markets sell off and the NZD rally," says Toplis.

However, the analyst adds the RBNZ will do its utmost to avoid sending ripples of any kind across the market.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Don't Rock the Boat

Kiwis are yet to hear of the final result from Saturday’s election, expected on October 07, although strategists and politicos see the most likely outcome being a coalition between the incumbent National Party and New Zealand First.

“We expect the RBNZ to once again leave the OCR at 1.75%,” says Cameron Bagrie, chief economist at ANZ Research. “Economic developments, election proximity, and RBNZ leadership changes all mean this decision will be somewhat of a ‘non-event’.”

Adding further to the case for an RBNZ on hold, Governor Graeme Wheeler departs the Reserve Bank of New Zealand at the end of September and will be replaced on a short term basis by his deputy, Grant Spencer.

Unlike at most other central banks, it is the governor of the RBNZ alone that determines the NZ cash rate and, given his anticipated short tenure at the top, it is unlikely Spencer will want to make any changes.

Wheeler has left the cash rate unchanged at 1.75% for five consecutive meetings after cutting it from 2% in November 2016.

“Our bias is still that the OCR will be lifted late next year. Potential shifts in fiscal policy and a lower NZD are major factors nudging us towards the OCR moving up,” says Bagrie.

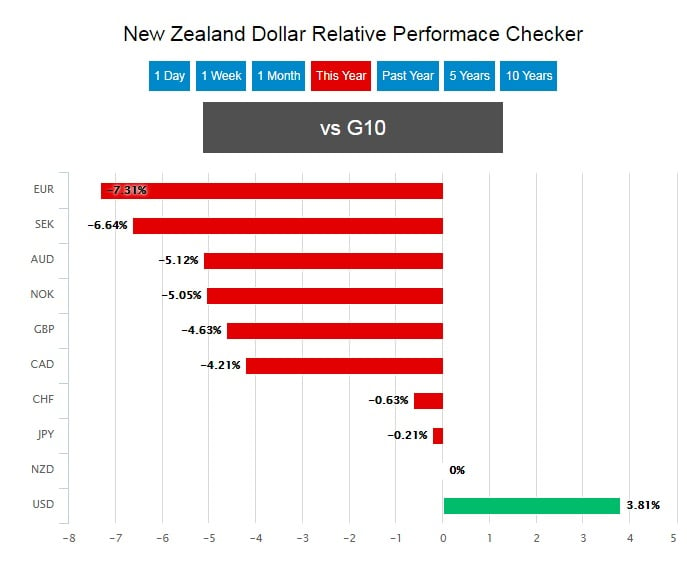

The New Zealand Dollar has been among the weakest performers in the G10 basket during the year to date as uncertainty over the election, and the likely cocktail of policies it will deliver, drove speculators to bet heavily against the currency.

Above: The New Zealand Dollar has had a poor year having only advanced versus the US Dollar in G10.

“New Zealand First holds the balance of power and will decide, in due course, which way it will lean,” says BNZ's Toplis, referring to the nationalist political party that emerged from the Saturday election as kingmaker, with the third largest share of the vote.

Policies on everything from tax to immigration meant markets were always going to punish the Kiwi Dollar in the short term over any electoral outcome that didn’t afford the incumbent National Party a clear majority.

In coalition with NZ First, the Nationals will now likely have to agree to a more sizeable reduction in net immigration, something which economists warn will lead to inflation and hit long term growth, and restrictive measures on overseas ownership of residential property - something which may deter investment.

“We think that there is sufficient momentum in the economy currently to ensure that New Zealand continues to experience solid growth for the next three years even if politicians, of all colours, try to mess things up,“ says Toplis, departing from the pessimistic tone adopted by many other pundits.

The New Zealand Dollar was quoted more than 1% lower against the US Dollar, at 0.7186, during noon trading Tuesday, although the greenback is down close to 4% against the Kiwi so far in 2017. The Pound-to-New-Zealand-Dollar rate was quited 0.82% higher, at 1.8677, meaning the beleaguered UK currency has now gained more than 5% on the Kiwi during the year to date.