New Zealand Dollar Could Be an Easy Political Target, Says ING's Patel.

The New Zealand Dollar (Kiwi) is beset by multiple risks factors, including political uncertainty, central bank policy risks and overstretched positioning, according to ING's Viraj Patel.

The currency has already lost ground in August, especially versus the Dollar, against which it has fallen from 0.7510 to recent lows of 0.7132.

It has also lost ground to the Pound - although not as much - reflected in GBP/NZD's rise from the 1.75s to the current 1.80s.

Further loses are possible versus Sterling due to increasing Bank of England (BOE) rate expectations, which were given a fresh blood transfusion by recent comments from BOE's Michael Saunders who said he thought the time had already passed for a 0.25% rate rise.

The Pound side of the pair was supported by UK Manufacturing PMI data which pointed towards resilient growth in that sector, helping to offset Brexit uncertainty.

Looking at a chart of GBP/NZD we see scope for further upside based on technical forecasts.

The pair appears to have recently broken out of a triangle pattern and started moving up towards a target at 1.8200, which is the minimum target for the triangle breakout based on its height.

Election Rejection

ING expect further weakness versus for the Kiwi as the currency begins to price in political risks entailed by the outcome of the September 23 general election.

Patel says that the election may be a lose-lose for the currency since both the two most likely outcomes are likely to be bearish for the Kiwi.

"We note the prospective policies of the next government could be deemed NZD negative in either of the two likely scenarios:" said Patel.

In the first most likely election outcome 'scenario' the current government gets re-elected in a coalition with the anti-immigration New Zealand First party.

The reason this will be negative for the Kiwi is that immigration has arguably been one of the factors behind New Zealand's strong economic growth since immigrants create demand for goods, services, infrastructure and housing.

The second most likely outcome is that the New Zealand Labour party wins.

Labour has promised to cut immigration to 30,000 a year, but from a currency perspective, their key pledge is to reform the Reserve Bank of New Zealand (RBNZ).

The RBNZ is a little different to other central banks in that the governor makes the policy decisions on his own, rather than a committee, but Labour wants to end the governor's omnipotence and bring in a policy by committee.

The second reform they want to implement is even more significant for the Kiwi, however, and that is that they want the RBNZ to widen its mandate to include full employment - like the US Federal Reserve.

Given unemployment is at 4.8%, which is above its long-term average of 3-4% the chances are that a such a new mandate would tilt RBNZ policy - which is currently as neutral as it gets - towards a more accommodative stance, weighing on the Kiwi in the process.

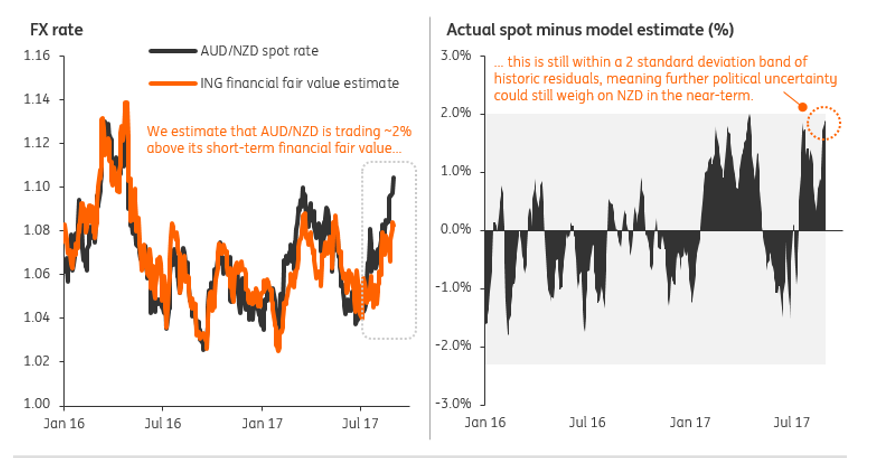

Overall, ING's Patel estimates political risk could skew the Kiwi lower by 1-2% but has barely had any impact so far, suggesting substantial downside is on the cards to correct the matter.

But even without the reforms, the central bank is still a factor weighing on the outlook for NZD.

"The Reserve Bank of New Zealand has been saying no thanks to a strong NZD for a while now and ramped up its jawboning attempts in August by dropping the threat of intervention into the mix," said Patel.

As far as policy on interest rates goes, however, Patel appears to see the risks attached to either a rate cut or hike as outweighing any benefits, so as to endorse the maintenance of the current neutral stance as the most likely going forward.

Financial stability risks from cheap lending are the chief argument against lower rates while a desire to keep the currency weak a bulwark against expecting higher rates.

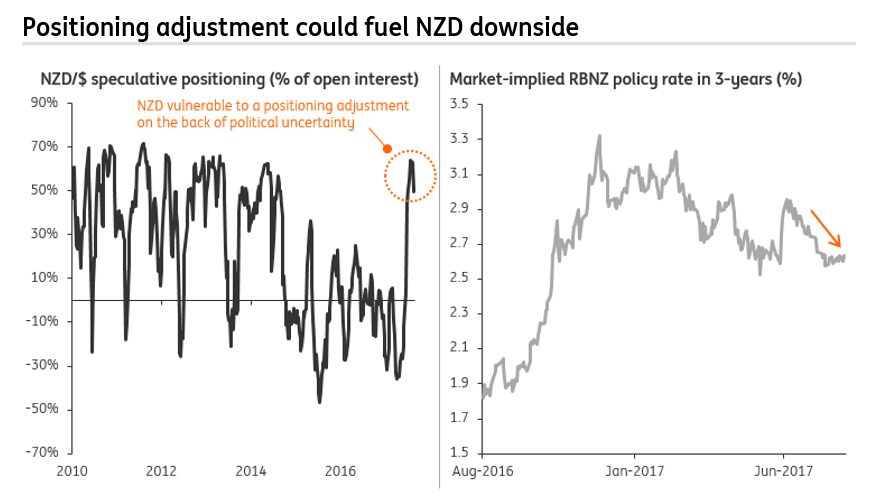

Finally, the Kiwi appears at risk of over bullish positioning in the futures market.

The extent to which investors are long or short currency futures gives a useful indicator of large fund sentiment.

When that sentiment reaches extremes it is a signal that the market is going to go the other way - so overbought futures indicate an imminent sell-off and vice-versa for oversold.

Investors are currently overly bullish the NZD in the futures market, further signaling an imminent bearish slide may be at foot.

Patel sees risks especially associated with a turnaround in the NZD/USD dollar pair, due to an expectation of rising US treasury yields, no doubt associated with increasing Fed rate hike expectations.

"Under a 'perfect storm' of rising developed market bond yields and greater domestic political uncertainty, we think NZD/USD could drop towards the 0.68-0.69 lows seen earlier in the year," said Patel.

Further: "USD sentiment could see NZD/USD temporarily undershoot our 0.71 forecast for 3Q17, with a break of the 200-DMA (0.7130) supporting this view," and Patel's bearish maximum is 0.69 NZD/USD.