New Zealand Dollar Benefits as Risk Sentiment Improves, Move Could Extend

- Written by: Gary Howes

Global investors are once again brave enough to take some risks it would appear, creating the kind of conditions the New Zealand Dollar likes.

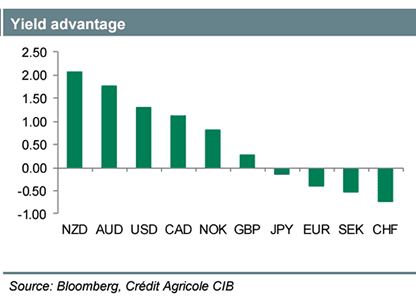

High-yielding currencies such as the Kiwi and Aussie tend to benefit when investors are deploying more risk-on strategies. Note how the recent US-North Korea standoff played against the two antipodeans.

With geopolitical risks fading, flows are finding their into New Zealand.

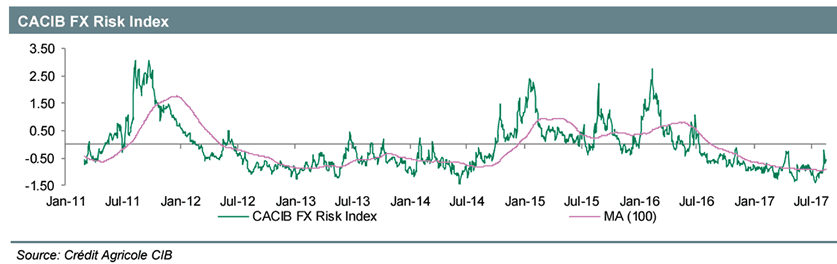

European financial services giant Credit Agricole report that at -0.56 (vs -0.21 on 10 August) their Risk Index has moved back into more risk-seeking territory.

“This is mainly due to somewhat lower geopolitical tensions. Falling expectations regarding the Fed being ready to consider higher rates any time soon may have helped too,” says Manuel Oliveri at Credit Agricole.

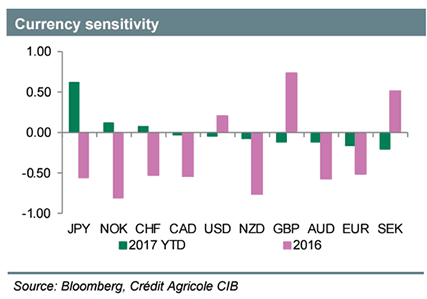

The sentiment shift has allowed the New Zealand to go from one of the worst-performing currencies of the past month to one of the better-performing currencies on the past week.

The Pound to New Zealand Dollar exchange rate has fallen down to 1.7618, the Euro to NZ Dollar is down to 1.6057 and the NZ Dollar to US Dollar conversion is up at 0.7314.

Higher-yielders such as the NZD have become increasingly sensitive to risk sentiment” and therefore we consider further upside cannot be ruled out in the weeks to come,” says Oliveri.

As the above shows, the New Zealand Dollar offers the best yield advantage thanks to the Reserve Bank of New Zealand's high basic interest rates.

Yigh yielding currencies tend to benefit when investors are feeling confident.

The above shows that the NZD has become far more responsive to overall sentiment on global markets in 2017.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.