BNZ Upgrade New Zealand Dollar Forecasts but GBP/NZD Tipped to Strengthen

Bank of New Zealand (BNZ) have told clients they are upgrading their expectations for the New Zealand Dollar’s performance over coming months.

The move follows a period of strength for the currency with relative performance statistics showing it to be the best-performing G10 currency over the past month-to-date.

The Pound to New Zealand Dollar exchange rate has fallen a an eye-opening 4.22% in this time amidst the broad-based move higher in the NZD and a broad-based fall in the value of GBP.

Againts the Euro the Kiwi is 2.21% higher, against the US Dollar 2.96% and against its Australian counterpart it is 1.0% higher.

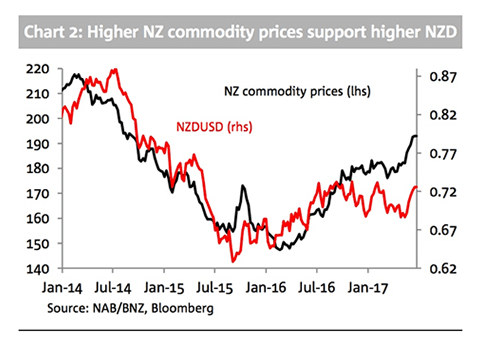

Analysts at BNZ say they are more optimistic of the New Zealand Dollar’s near-term performance noting the country’s terms of trade continue to improve.

“Fundamental support remains for the NZD in the form of rising NZ export commodity prices amidst weaker oil prices, a recipe for taking NZ’s terms of trade to a fresh all-time high,” say BNZ.

ANZ’s New Zealand commodity price index in SDR terms has just increased for the seventh consecutive week.

“That’s a sign of the broadly based rise in NZ’s export commodity basket, encompassing, dairy, meat, horticulture, forestry and seafood,” say BNZ.

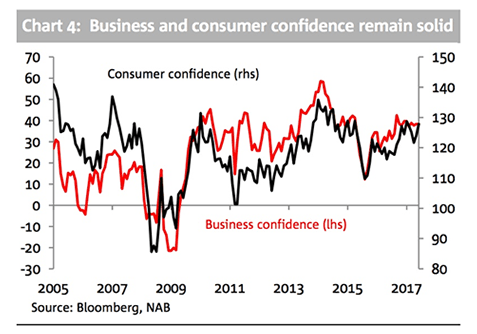

Furthermore, the NZD should find support from an economy that continues to grow at a firm pace.

GDP growth for Q4 2016 and Q1 2017 proved to be on the soft side, but these were weighed down by special factors.

Survey data across business and consumer surveys continue to suggest solid growth momentum.

Both business and consumer confidence remain comfortably above average.

PMI manufacturing and services indicators are currently at 58.5 and 58.8 respectively.

BNZ recently revised upwards their GDP forecasts as a result, supported by a more stimulatory fiscal impulse, irrespective of the make-up of the next government.

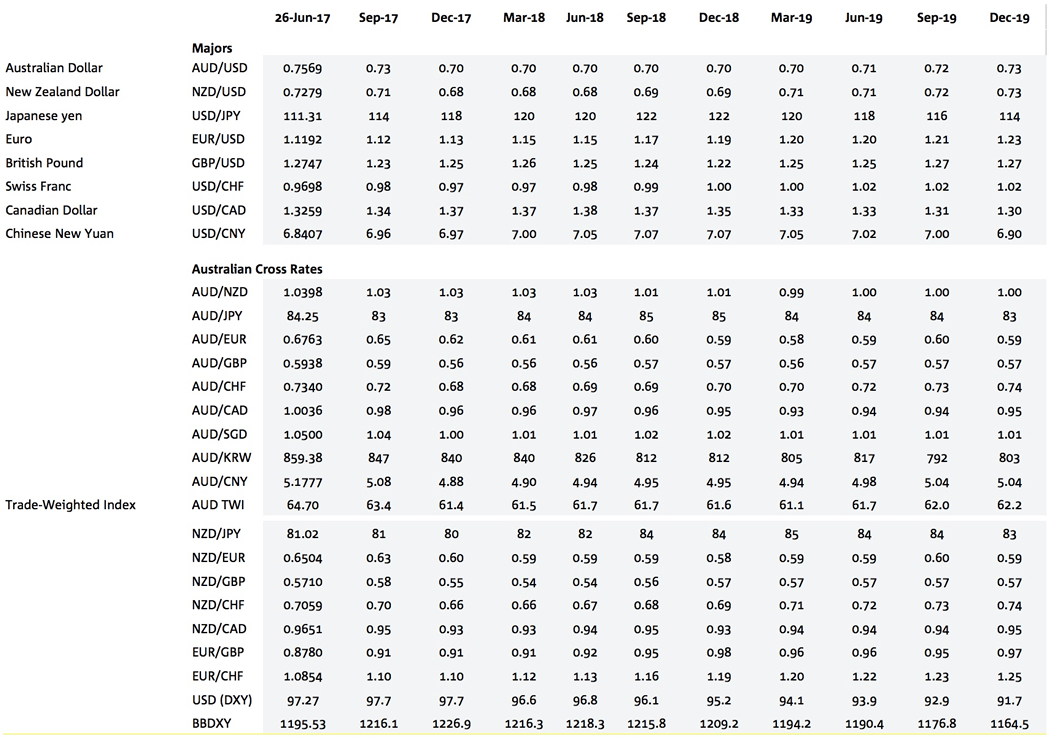

Upgrades are made to the currency’s forecasts against the US and Australian Dollars:

“We therefore push out by a quarter the expected fall in NZD/USD. Our end-Q3 target moves up to USD 0.71 (previously 0.67) and Q4 is nudged up a cent to USD 0.68. Combined with changes to AUD assumptions, the AUD/NZD cross is expected to settle down around 1.03 through the second half. Our longstanding forecast of parity by late-2018, early 2019, is unchanged.”

Above (C) BNZ and NAB.

For those looking for the Pound to New Zealand Dollar forecast, the above NZD/GBP numbers translate into 1.8181 by December 2017, 1.8519 by mid-2018 and 1.7543 by end-2018.

Considering GBP/NZD is presently quoted at 1.7398 it would suggest GBP/NZD actually has some climbing to do over coming months.

Risks to NZ Dollar Skewed to the Upside: Intesa Sanpaolo

Risks to NZ Dollar Skewed to the Upside: Intesa Sanpaolo

Also updating clients on the New Zealand Dollar's outlook are analysts at Italy's Intesa Sanpaolo who say risks to the the currency are skewed to the upside against the Euro and Dollar (i.e the NZD could trade stronger than expected).

“We expect the RBNZ to resume hiking rates in 2019,” says foreign exchange analyst Asmara Jamaleh. “We continue to expect a similar evolution, namely a weakening in the near term followed by a subsequent strengthening.

However analysts suggest that should the NZD rise not be the result of a strengthening economy the RBNZ might cut interest rates with the intention of supressing the currency.

EUR/NZD is seen at 1.62 in three months, 1.56 in six months and 1.53 in 12 months.

The NZD/USD is seen at 0.68 in three months, 0.72 in six months and 0.74 in 12 months.