New Zealand Dollar Outlook: Strength Ahead as Expectations for RBNZ Interest Rate Rise Grow

- Written by: Gary Howes

The outlook for the NZ Dollar in 2017 is looking increasingly bullish as expectations for an interest rate rise at the Reserve Bank of New Zealand (RBNZ) are brought forward on the back of data showing inflation is rising at a faster-than-expected rate.

According to Statistics New Zealand, CPI read at 0.4% for the fourth quarter 2016, ahead of analyst expectations for a reading of 0.3%.

The NZD rose on the back of the data ensuring the currency's strong 2017 against the likes of the US Dollar and Euro extended.

Against Pound Sterling the story is a little different however as the heavily-oversold currency stages a relief rally.

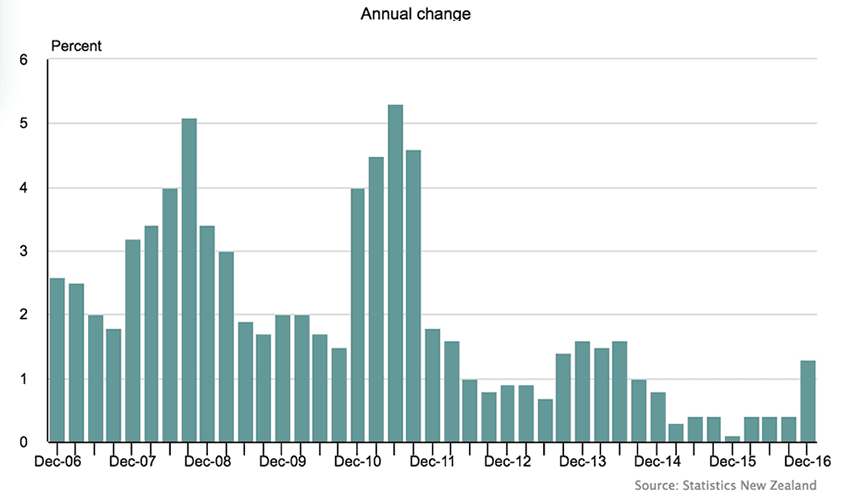

Annualised inflation now sits at 1.3% and is therefore within the Reserve Bank of New Zealand's 1-3% band.

Recall that the RBNZ justified recent interest rate cuts owing to inflation's fall below 1%?

These cuts have helped put a lid on the NZD as foreign investor demand for high-yielding New Zealand cash diminished.

Now that New Zealand, and indeed global inflation, is returning, does the RBNZ now have to embark on raising its already high basic interest rate?

This is a pertinent question as if the answer were to be 'yes' then the NZD could really find some more upside impetus as foreign investors return.

"This has reinforced New Year strength in the currency, which, as alluded to earlier, is something the RBNZ could well fret about all over again, as excuse to run over-easy OCR policy. Until, that is, it gets a more obvious wake-up call from inflation and/or financial stability threats," says Craig Ebert at BNZ.

For the meantime, with the Bank still having to go through its processes, BNZ simply expound the risk of the RBNZ increasing its cash rate as soon as this year, rather than move to this as their base case.

"We certainly think the pressure’s building, however.." says Ebert.