GBP/NZD: Possible double-bottom ahead of RBNZ meeting

Central Bankers in New-Zealand will be meeting on Wednesday to agree the base lending and deposit rates for the country. Traders and analysts are currently expecting the RBNZ to cut their lending rate from 2.75% (one of the highest in the developed world) to 2.50%, as a result of subdued inflation and in an attempt to make NZ exports more competitive.

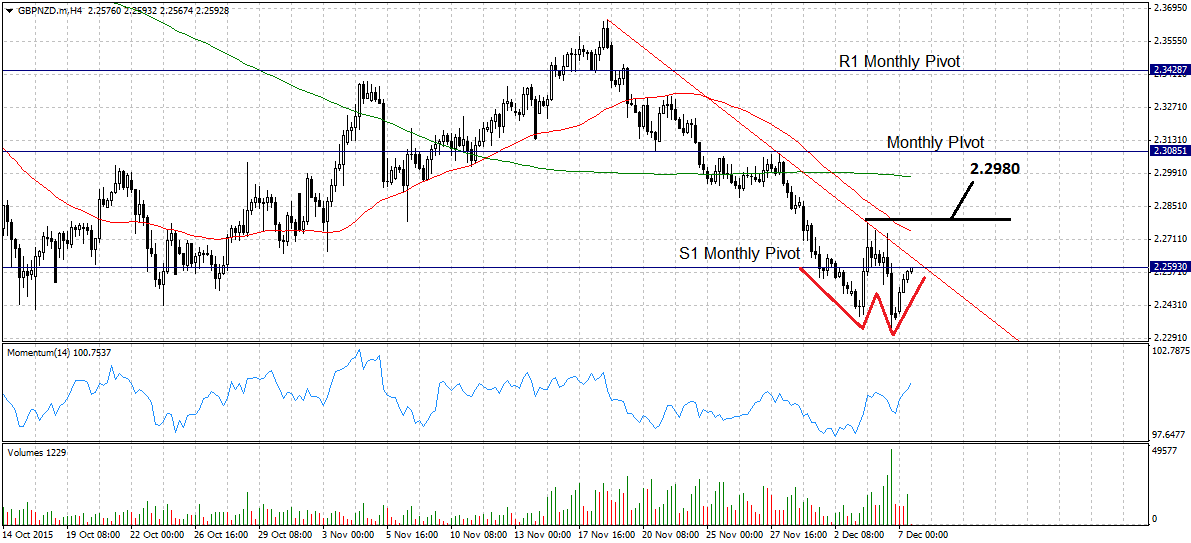

If there is a rate hike as there most probably will be, the end result is likely to be a rise in GBP/NZD. The pair is currently in a short-term down-trend within a broader up-trend - the otherwise strong pound having fallen recently on growth concerns. It may have reached a turning point, however, after finding support at the 200-day MA at 2.2272 and bouncing. It has now formed a rough double bottom with diverging momentum and text-book higher volume on the second low. The conditions are in place for a reversal, however, some significant obstacles stand in the bulls’ way.

First there is the S1 Monthly Pivot which the exchange rate is currently pushing up against, and then the trend-line for the move lower. For a really confident buy signal, therefore I would want to see both these obstacles cleared, and a breach of the neckline of the double-bottom at 2.2790. Such a move would then be expected to target at the 200-4hr MA at 2.2980.