Pound-to-New Zealand Dollar Week Ahead Forecast: A Softer Phase

- Written by: Gary Howes

Image © Adobe Images

The Pound looks to have entered a soft phase against the NZ Dollar.

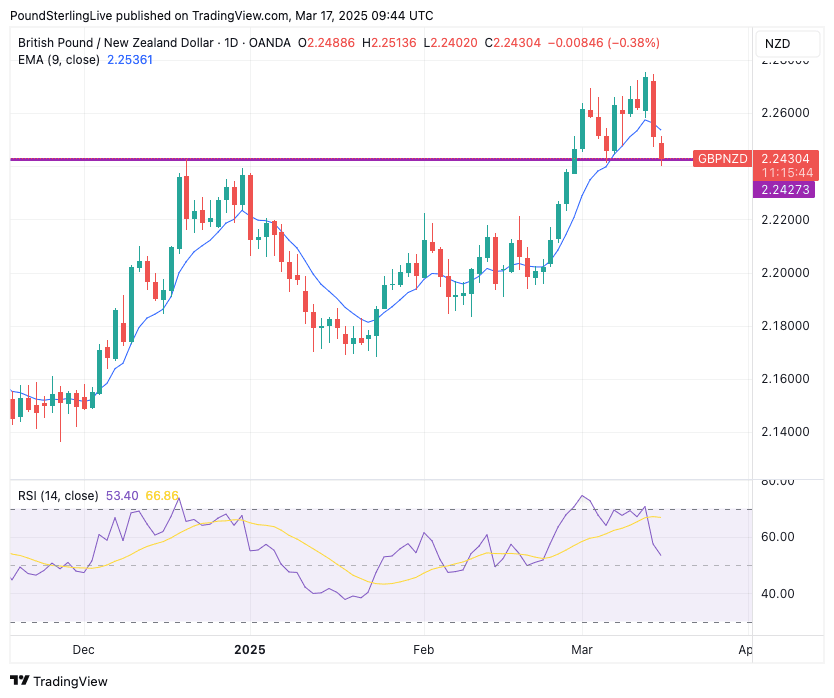

The Pound-to-New Zealand Dollar exchange rate (GBP/NZD) last week reached an interim peak at 2.2754, from where it has retreated to 2.24310 at the time of writing.

We warned in our previous Week Ahead Forecast that the pair was screening as significantly overbought and that a corrective pullback was due.

That pullback did happen, albeit GBP/NZD left us waiting until Friday before fulfilling our prediction.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

The setup for the coming week is to let this setback extend.

The Relative Strength Index (RSI) is no longer signalling overbought conditions and is instead pointed lower and advocating further weakness.

This is backed up by the fall below the nine-day exponential moving average (EMA), which says further weakness is possible over the coming hours and days:

Support is located at 2.2430, and if it holds, we would be inclined to follow a sideways pattern as opposed to expecting a deeper pullback.

Should support break, then a retreat gathers pace to 2.2160.

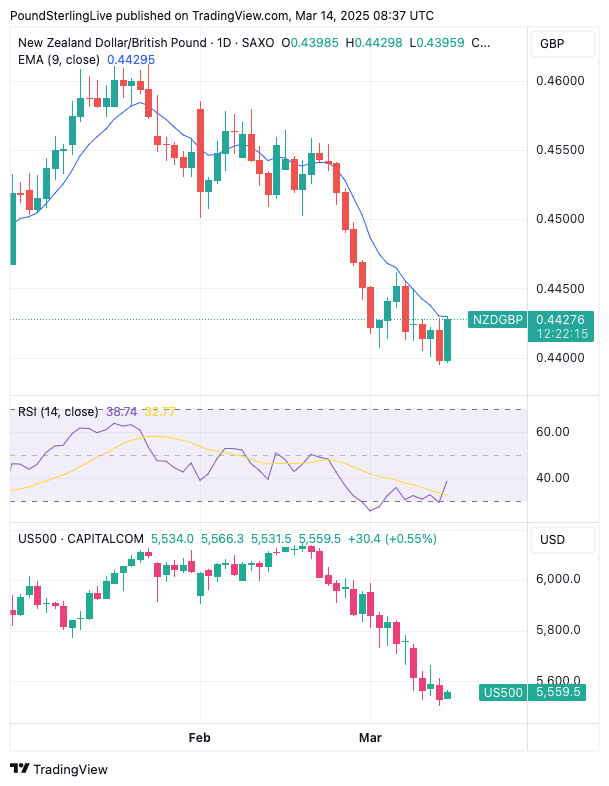

Recent NZD weakness has been concentrated in non-USD pairs, such as EUR and GBP, as Donald Trump pursues an aggressive tariff strategy that has weighed on U.S. stock markets.

GBP/NZD, like its cousin GBP/AUD, displays a positive correlation with the U.S. S&P 500 index by virtue of its reliance on positive investor sentiment, meaning losses in U.S. markets are coinciding with GBP/NZD strength.

If the U.S. equity rout continues on the back of concerns over DOGE employment cuts and tariffs, we would anticipate GBP/NZD weakness to be shallow and the rally to resume soon.

Above: NZD/GBP tracks the U.S. S&P 500 index lower.

🎯 GBP/NZD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

U.S. equities are likely to be nervous heading into the April 02 tariff announcement, where Trump is set to announce his biggest tariff package yet. He told reporters on Sunday that the tariffs are set to be delivered and no exemptions were possible,

But, any meaningful rebound in stocks can contribute to GBP/NZD weakness. If the tariff correction is now incorporated in the price of stocks and currencies, the scope for GBP/NZD upside becomes limited, and the setback can deepen.

In the week ahead, we will be watching Trump's social media accounts. But, the calendar data highlight will be the U.S. Federal Reserve decision, where rates are likely to be left on hold.

The guidance on the outlook for rates will offer the surprise factor, and any hint that the Fed would respond to signs of a slowing economy by cutting interest rates could bolster U.S. equity markets and, by extension, the Australian Dollar.

There's a light calendar in New Zealand this week, but Thursday's GDP Growth figures for Q4 are worthy of attention.

- Expected (QoQ): 0.1%

- Previous (QoQ): 0.3%

- Expected (YoY): 1.5%

- Previous (YoY): 1.9%

A stronger-than-expected GDP print would signal economic resilience, reducing RBNZ rate cut bets and supporting NZD.

A weaker print would increase concerns about economic slowdown, increasing expectations for faster rate cuts, pressuring NZD.

GBP Calendar

It's a busy two weeks ahead for the UK economy, but interest only picks up from Thursday onwards when we get the Bank of England decision and earnings data release.

Thursday, March 20

📌 Average Weekly Earnings (Jan, 3m/12m YoY)

Inc. Bonuses: Expected: 5.8% | Previous: 6.0%

Ex. Bonuses: Expected: 5.9% | Previous: 5.9%

🔹 Market Impact:

A stronger-than-expected reading could indicate wage-driven inflation, reducing rate cut expectations and supporting GBP.

A weaker reading may signal wage growth cooling, increasing BoE rate cut speculation, weakening GBP.

📌 ILO Unemployment Rate (Jan)

Expected: 4.5%

Previous: 4.4%

🔹 Market Impact:

If unemployment rises above expectations, it could indicate labor market weakness, increasing pressure for BoE rate cuts, potentially weighing on GBP.

A stable or lower unemployment rate may support GBP by reinforcing economic resilience.

📌 Employment Change (3m/3m, Jan)

Expected: 95K

Previous: 107K

🔹 Market Impact:

If employment figures exceed expectations, it suggests labour market strength, supporting GBP.

A weaker-than-expected print may indicate hiring slowdown, weakening GBP.

📌 Bank of England (BoE) Interest Rate Decision

Expected: 4.50% (unchanged)

Previous: 4.50%

🔹 Market Impact:

If the BoE signals a cautious stance on rate cuts, it could support GBP.

If the BoE hints at earlier rate cuts, it may weaken GBP.

Friday, March 21

📌 GfK Consumer Confidence (Mar)

Expected: -21

Previous: -20

🔹 Market Impact:

A higher reading (less negative) suggests improving consumer sentiment, potentially supporting GBP.

A lower reading could indicate consumer pessimism, weighing on GBP.

📌 Public Sector Net Borrowing (Feb)

Expected: £7.0bn

Previous: -£15.4bn

🔹 Market Impact:

A higher-than-expected deficit may raise fiscal concerns, weakening GBP.

A better-than-expected print could support GBP by easing fiscal concerns.