New Zealand Dollar Recovery Could be About to Run Out of Road: Rabobank

- Written by: Sam Coventry

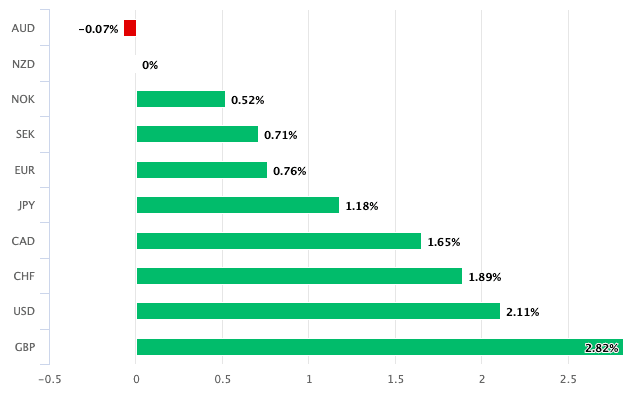

Above: The NZD is 2025's second-best performing G10 name.

The New Zealand Dollar (NZD) is expected to face a challenging road to recovery despite recent optimism about the country’s economic outlook, according to Jane Foley, Senior FX Strategist at Rabobank.

Rabobank forecasts NZD/USD to remain under pressure, targeting 0.55 over the next three months, as the Reserve Bank of New Zealand (RBNZ) continues its aggressive rate-cutting cycle.

“The market is positioned for 109 basis points of further easing over the next year, with 75 basis points expected in the next three months,” Foley explained. This follows a 125-basis-point reduction since August 2024 as the central bank moved to stimulate the economy after inflation pressures subsided.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

While the RBNZ’s monetary policy adjustments are intended to support growth, Foley remains cautious about the currency’s ability to rally significantly in the near term, citing the anticipated resilience of the U.S. Dollar. “We expect the USD to remain firm this year, which will make it difficult for the NZD to gain momentum despite improving economic indicators,” she noted.

New Zealand’s economy is projected to recover from its recent recession, with GDP expected to contract by -0.2% in 2024 but rebound to 1.2% in 2025 and 2.6% in 2026. Foley emphasized that government initiatives, such as a newly announced investment entity to boost fintech, manufacturing, and critical infrastructure, could bolster confidence. Stabilization in the housing market and improved consumer spending are also positive signs for the economy.

🎯 GBP/NZD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

Despite these encouraging factors, Foley warned that external risks, such as potential volatility in global markets and uncertainty regarding U.S.-China trade relations, could temper the NZD’s recovery. She also highlighted the upcoming RBNZ meeting on February 19, where critical economic data - such as Q4 labour market figures and inflation expectations - will guide the bank’s next moves.

Although the NZD has been the second-best performing G10 currency year-to-date, this recent strength serves as background to a broader narrative of subdued medium-term prospects. “The aggressive easing trajectory is key to supporting growth, but significant rallies in the NZD are unlikely in the face of ongoing USD strength and global uncertainties,” Foley concluded.

This outlook sets a cautious but hopeful tone for the New Zealand Dollar as it navigates 2025.