GBP/NZD Week Ahead Forecast: 50 DMA Puts Up a Valiant Fight

- Written by: Gary Howes

Image © Adobe Images

The Pound to New Zealand Dollar exchange rate is battling to maintain a constructive feel, thanks to an improved global investor sentiment.

The New Zealand and Australian Dollars were some of the key winners of last week's Jerome Powell speech, which saw the Federal Reserve Chair effectively signal U.S. interest rates would be cut next month.

Yet the British Pound is another outperformer in the current environment, helped to a degree by a speech from Bank of England Governor Andrew Bailey that confirmed the UK's central bank would proceed with caution when cutting interest rates.

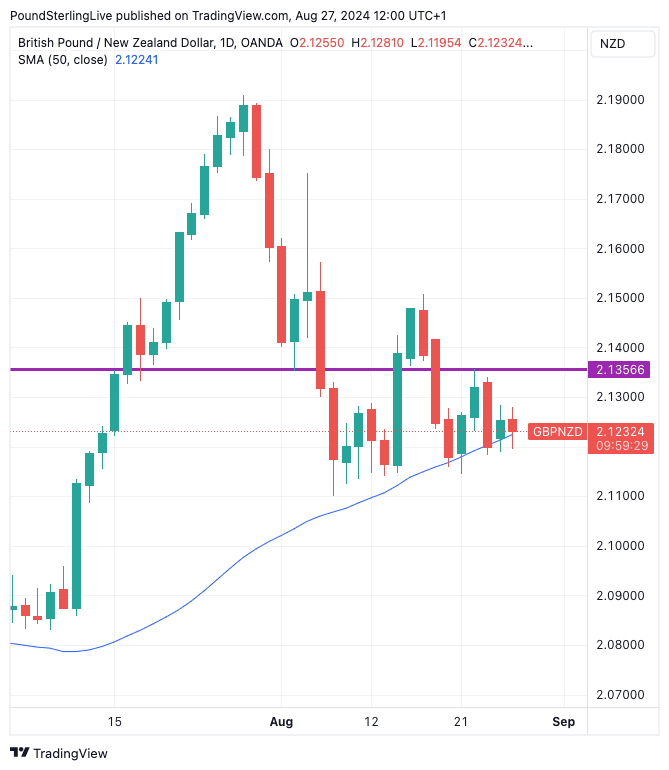

The next result is a Pound to New Zealand Dollar exchange rate (GBP/NZD) that is looking relatively static. But, a closer inspection of the daily charts shows an interesting technical battle is underway, one that is centred on a rising 50-day moving average (DMA):

Above: GBP/NZD at daily intervals, showing strong technical support at the 50 DMA.

As can be seen, GBP/NZD pullbacks are being arrested by this level, which suggests this is a key support level to watch in the coming days. Because the 50 DMA is sloping higher, it also suggests that a slight uptrend is in place.

We think this support level can hold, frustrating GBP/NZD sellers in the coming days, allowing for a test of 2.1356, which was last week's peak.

Beware, however, that a failure of the 50 DMA support could represent a notable short-term development and follow-through selling pressures could evolve, risking a deeper selloff. Under such a scenario, the August low at 2.11 would be tested ahead of July lows at 2.08.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

There are no market-shaking data due from New Zealand or Britain this week, meaning price action will be determined by global sentiment shifts. With sentiment in charge of NZD, bear in mind we get a trading update from AI darling Nvidia on Wednesday.

"Nvidia is slated to release its fiscal second-quarter results tomorrow afternoon, and high-beta currencies - like the Australian and Canadian dollars - are very likely to move in response as risk appetite shifts," says Karl Schamotta, Chief Market Strategist at Corpay. "Nvidia has become a bellwether for the global capital investment cycle."

[Click here for the year-end GBP/NZD forecast from over 30 of the world's leading banks and institutions.]

NZD rose sharply against the USD and the majority of G10 peers last Friday after Federal Reserve Chair Jerome Powell effectively greenlighted a September interest rate cut, saying: "The time has come for policy to adjust," said Powell in a speech to the Jackson Hole symposium.

The speech was surprising in that it made repeated references to fears that the labour market is at risk of deteriorating, which signals the Fed that it needs to cut rates to protect jobs. Markets hiked expectations that the Fed could kick off its rate cutting cycle with an outsized 50bp cut.

Dollar trade in the coming week will be determined by how expectations for a 50bp cut evolve: if they increase, NZD/USD can rise, potentially helping the majority of NZD exchange rate pairings higher. If they fade, the exchange rates can pull back again.

The global data highlight will be Friday's release of the PCE deflator, which is a measure of inflation impacting consumers. The Fed tends to watch it closely, but we think there is a limited chance of it throwing up the kind of surprise that would shift the broader narrative.

Powell said in his Jackson Hole speech he was confident inflation would not make a surprising return and that he was now much more focused on the labour market. This suggests that the early-September release of the U.S. non-farm payroll report will be the next major event for the Dollar.

The next major U.S. data release will be next Friday's U.S. job report. But, also be aware that we are approaching month end. This can throw up some unusual newsless currency market action, and we would not see any unusual moves as a signal that current trends are changing.