New Zealand Dollar: Don't Read Too Much Into the Soft Jobs Report

- Written by: Sam Coventry

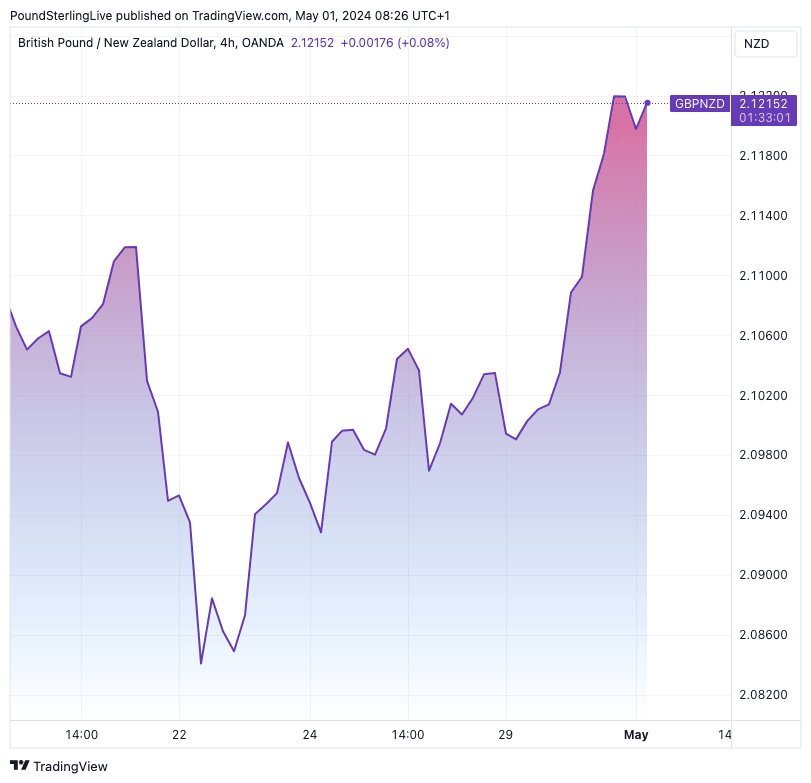

Above: GBP/NZD at four-hour intervals, showing fresh highs following soft labour market figures from New Zealand.

The Reserve Bank of New Zealand won't be swayed by the soft Quarter 1 employment figures and is still on course to cut interest rates for the first time in 2025. The view, if correct, speaks of potential support for the Kiwi currency going forward as current weakness is faded.

This is the view of a currency analyst in response to New Zealand's latest labour market statistics that revealed employment fell by 0.2% quarter-on-quarter in Q1 2024, and the unemployment rate rose to 4.3%.

The figures were a significant disappointment to a market that was looking for employment to grow 0.3%, and explains why the New Zealand Dollar fell in response.

"NZD/USD is currently trading near 0.5880. Weaker than expected NZ labour market data for Q1 24 was a weight on NZD/USD," says Kristina Clifton, a strategist at Commonwealth Bank of Australia.

The Pound to New Zealand Dollar exchange rate rallied to its highest level since September 2023 at 2.1261.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

Despite the fall in jobs, private sector wage growth remained firm at 0.8% q/q and 3.8% y/y.

Economists say firm wage growth leads to strong demand in the economy, which keeps inflation elevated, meaning these firm wage data could convince the RBNZ to keep interest rates at current levels for a longer period.

Economists at New Zealand bank ASB expect the first RBNZ interest rate cut in February 2025.

Financial markets are more dovish and are currently pricing around 60bps of cuts by February. If ASB is correct, then a windback in pricing for RBNZ cuts can provide some support to NZD, says Clifton.