GBP/NZD Rate: Short-term Outlook Still Constructive

- Written by: Gary Howes

Image © Adobe Images

The Pound to New Zealand Dollar exchange rate looks constructive over multiple time frames, and we expect further advances in the coming days.

The calendars in New Zealand and the UK are quiet this week, ensuring that technical and global developments will remain in control of the exchange rate.

On this count, the NZD could be disadvantaged: GBP/NZD pair has been rising in tandem with fading expectations for U.S. Federal Reserve interest rate cuts, which is unsurprising given the NZD is highly responsive to the global interest rate environment.

Market expectations for a June rate cut took a dive on Monday following the release of above-consensus U.S. manufacturing data, boosting the U.S. Dollar and weighing on the 'high beta' Kiwi.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

We are wary that this week's remaining U.S. data (Wednesday's services PMI and Friday's U.S. payrolls) also beat expectations and further lower the odds of a June rate cut at the Fed.

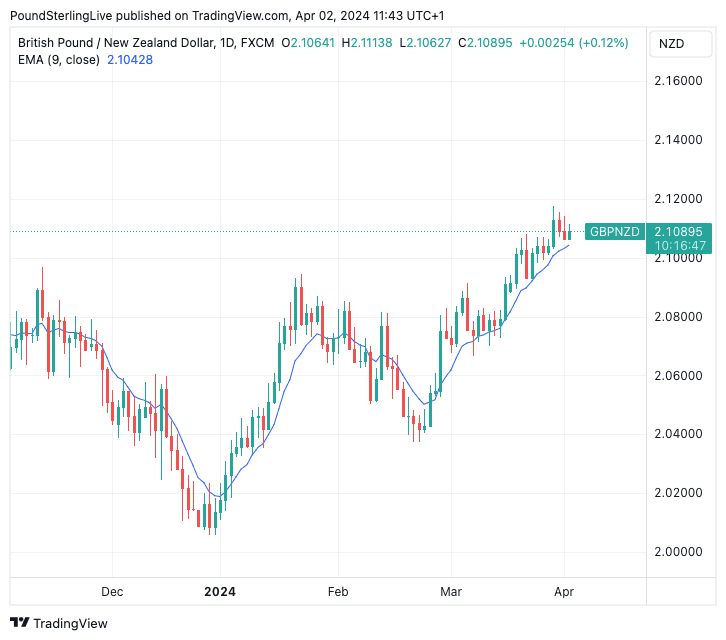

From a technical perspective, GBP/NZD remains constructive on the short- and medium-term timeframes.

The daily chart below plots the nine-day exponential moving average (EMA), showing it to have been a particularly useful indicator in recent times.

Above: GBP/NZD at daily intervals with the 9-day EMA shown. Track GBP/NZD with your own custom rate alerts. Set Up Here

Note that in the current uptrend (since February 26) GBP/NZD has remained above the nine-day EMA, not once closing below it.

We saw a similar pattern in place from January 03 to January 24; it was only on Jan 24 did the pair break below the nine-day EMA and a period of weakness ensued.

From November through December 2023, the exchange rate was capped by this moving average, which provided a solid indicator that further downside was likely.

Only when the pair breaks below its nine-day EMA would we be on alert for consolidation and a potential retracement of recent gains.