GBP/NZD Week Ahead Forecast: Eyeing Modest Gains, NZ Jobs Report Due

- Written by: Gary Howes

- GBP/NZD can test fresh 2024 highs

- Watch Kiwi labour market stats due midweek

- Chinese equity markets a concern for NZD

- Higher interest rate environment also challenging

Image © Adobe Stock

The Pound to New Zealand Dollar exchange rate can edge higher over the coming days owing to a broadly constructive technical setup and a difficult global backdrop.

Chinese stock markets plunged on Monday as investors grappled with deflationary pressures facing the country's exporters and a domestic property crisis.

China's CSI 1000 index declined 8% on the day, taking it 30% lower in the first month of 2024. Over the last 10 days, China's CSI 1000 index is down a massive 21% as the market catches up with the woes facing the country's struggling property sector.

The NZ Dollar and Aus Dollar often trade as proxies to China, and the week would have started poorly for the two Antipodeans had Chinese authorities not intervened and said they would commit further support to markets.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

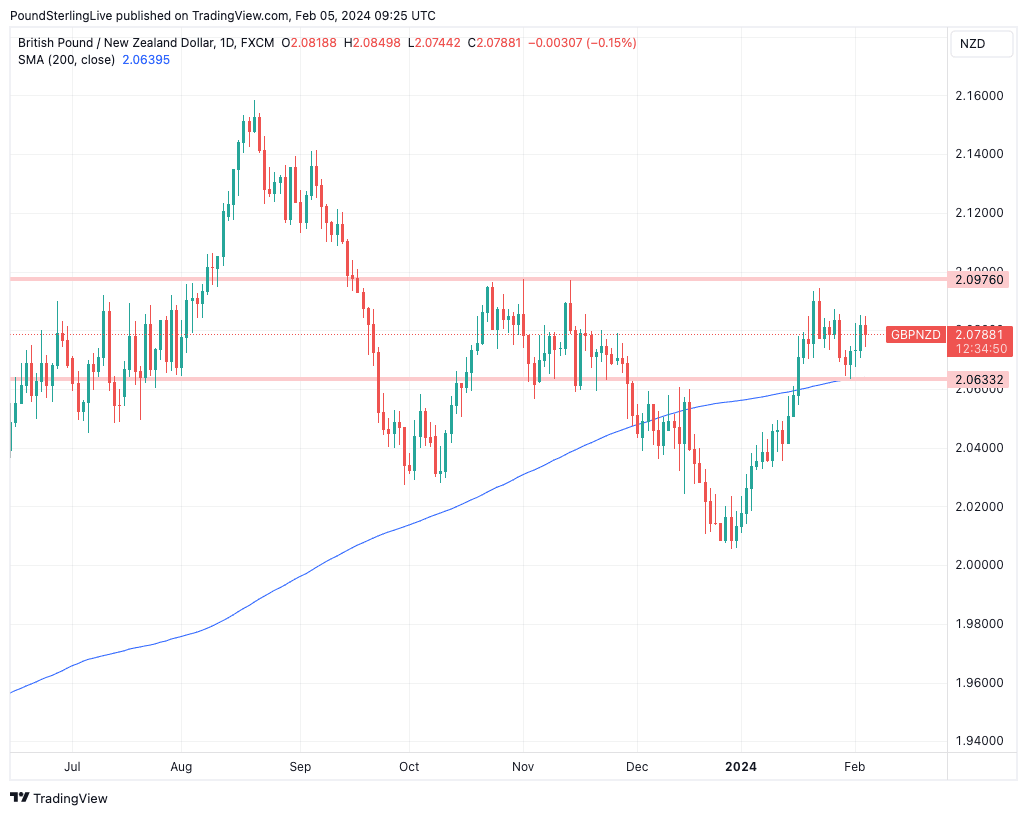

The Pound-New Zealand Dollar's daily chart shows steady upside progress that could mean the 2.0976 highs of late-2023 come back into play.

The exchange rate is meanwhile supported at 2.0630 where the 200-day moving average and horizontal support line comes into play.

We see the odds of a test of the upside of the range as being a higher likelihood event than a decisive break below the support level at 2.0630 in the near term.

Above: GBPNZD at daily intervals showing key levels to watch. Track the NZD with your own custom rate alerts. Set Up Here

A break above 2.0976 opens the door to the 2023 highs near 2.16, but we reckon this is a story for the coming weeks and months that requires the current global setup to remain in place.

The domestic calendar is dominated by the releaes of New Zealand labour market numbers for the fourth quarter, due for release on Wednesday.

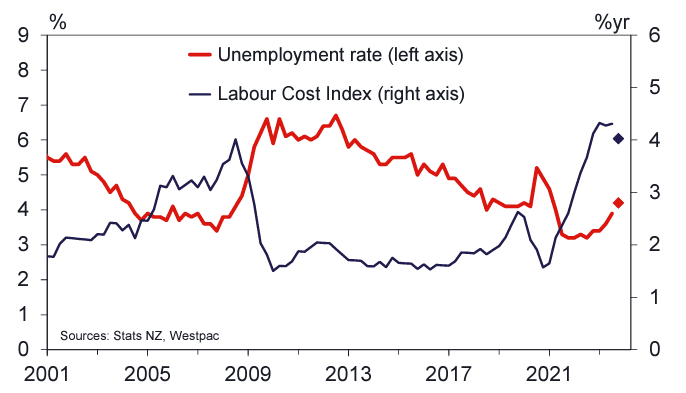

The market looks for the unemployment rate to have risen to 4.3% in the final quarter of 2023 from 3.9% in the third quarter as a slowing economy and record immigration cause labour market slack.

Image courtesy of Westpac, showing historical levels and Westpac's forecast.

The employment change is expected to have shown a 0.3% increase in the final quarter while the labour cost index is seen easing to 3.7% year-on-year in Q4.

Should the data beat expectations, the Kiwi can be supported through the midweek session.

That said, the global backdrop will likely matter more for the New Zealand Dollar, which has tended to struggle as markets scale back expectations for interest rate cuts at the U.S. Federal Reserve in 2024.

"Recent weeks have seen markets challenged on their very strong view that now central bank policy rates have peaked, there should be a sudden significant reduction in policy interest rates," says Kelly Eckhold, Chief Economist for NZ at Westpac.

"The challenge to these views is coming on two fronts: firstly, on the timing of the first policy rate cut; and secondly on the extent of policy easing in 2024 and beyond," she explains.

Track the NZD with your own custom rate alerts. Set Up Here

The odds of a March rate cut at the Fed evaporated last Friday following a bumper U.S. jobs report, which sent the Dollar surging and high-beta currencies such as the NZ Dollar were amongst the biggest G10 FX losers.

But downside pressures on the New Zealand Dollar will likely be limited as the market is also sceptical that the Reserve Bank of New Zealand (RBNZ) will lower interest rates aggressively.

This can ensure the NZD can benefit from a relative interest rate advantage that sees global capital flow into New Zealand as investors seek higher returns.

The RBNZ has indicated a reluctance to consider cutting interest rates as core inflation remains stubbornly high.

Last week, the RBNZ confirmed this after its chief economist said non-tradable inflation still hovers around 6% and is falling only very slowly.

Paul Conway said in a speech that capacity pressures in the New Zealand economy matter most for inflation, and the recent downward revisions to New Zealand's GDP do not imply lower capacity pressures.

The comments prompted markets to lower expectations for a first interest rate cut as early as May, which offered relative support to New Zealand bond yields and the currency.

The global backdrop is difficult for the NZD, but it would be far more challenging if markets were to raise bets for the timing and scale of RBNZ rate cuts.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes