GBP/NZD Week Ahead Forecast: Uptrend Faces Major Test

- Written by: Gary Howes

- GBP/NZD in an uptrend

- But has struck strong resistance

- Chinese news boosts NZD on Monday

- Watch Bank of England Thursday

Image © Adobe Stock

The Pound to New Zealand Dollar exchange rate remains in an uptrend, but a failure at a major resistance line raises questions raises the prospect of a pullback developing over the coming days.

GBP/NZD has risen 3.75% in 2024 as Pound Sterling competes for the year's best performer crown alongside the U.S. Dollar and the commodity currencies face setbacks from lacklustre Chinese data and rising global bond yields.

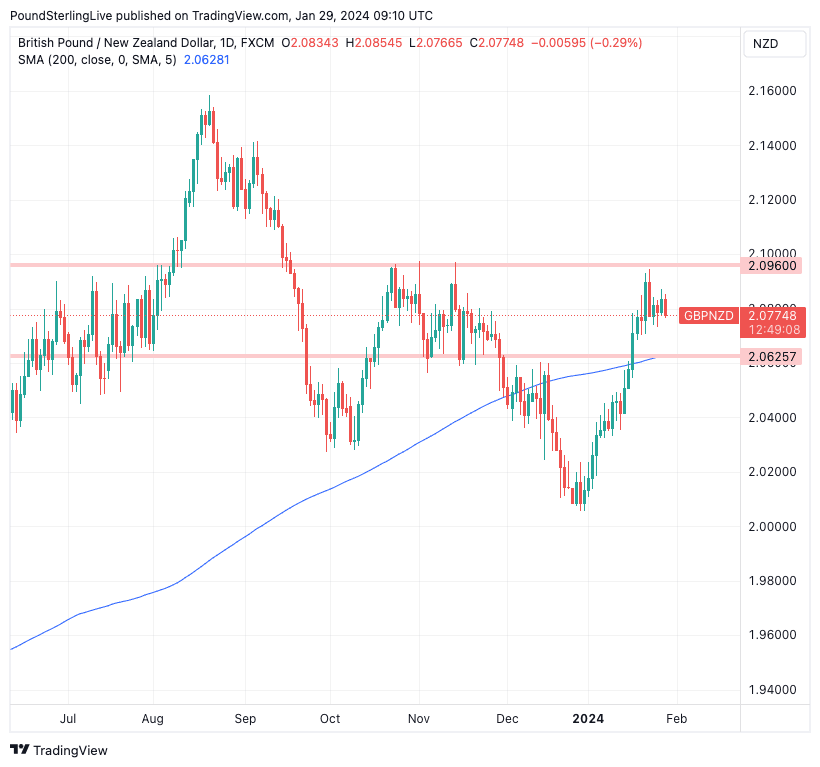

Medium-term setups are constructive, with the exchange rate residing above the 200-day moving average (blue line in the below chart). Therefore, our rules-based approach dictates that when consolidation does resolve, it does so to the upside.

The near term is likely to see GBP/NZD capped at the 2.0960 area, which forms the top of a longer-term range that has accounted for the majority of price action in the pair since June 2023:

Above: GBP/NZD at daily intervals.

The New Zealand Dollar starts the new week on the front foot aided by benign investor sentiment, confirmed by constructive global equity markets and rising commodity prices.

Developments in China remain important for the Kiwi, which was able to fend off the Pound's advances last week thanks to news Chinese authorities are becoming increasingly strident in bolstering the economy.

Plans to cut basic interest rates and boost the domestic stock market were associated with a rally in the Antipodean currencies, which often trade as a proxy to China.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

The new week starts with news of a "milestone" being reached in China's efforts to clean up its property sector, which has been an economic Achilles' heel over the past two years.

China Evergrande Group received a liquidation order from a Hong Kong court that fired the starting gun on a lengthy process of unwinding and spinning off the country's biggest casualty of the property crisis.

As noted by Bloomberg, "Evergrande’s collapse is by far the largest in a crisis that has dragged down China’s economic growth and led to a record spate of defaults by developers."

The development boosts sentiment to China-facing assets and helps the New Zealand Dollar move higher, and we are wary of further follow-on advances in the near-term.

Track GBP/NZD with your own custom rate alerts. Set Up Here

The British Pound will look to the Bank of England for support on Thursday when it delivers its interest rates decision and guidance.

Markets see over 100 basis points of rate cuts coming from the Bank in 2024, and the Pound can advance should these bets lessen.

Such an outcome would require some members of the Bank's Monetary Policy Committee to vote for further rate hikes, although any votes for rate cuts could see markets boost rate cut bets.

Deep cuts to the Bank's inflation forecasts could also weigh on the Pound as this would be an admission that the backdrop is increasingly consistent with rate cuts.

The tone of Bank of England Governor Andrew Bailey's press conference will also be important as it could easily undermine the messages conveyed by the official statement and forecasts.

One only needs to recall that it was an apparent lack of pushback against markets by the ECB's Christine Lagarde last Thursday that saw investors raise bets for an April rate cut, which resulted in a Euro sell-off.

"The reality is that defending a 'higher for longer' stance on interest rates is getting harder to defend as the inflation backdrop shows signs of improving," says James Knightley, Chief International Economist at ING.

ING expects the Bank will drop the suggestion that it could raise rates further, but keep the signal that rates need to stay restrictive for an extended period.

If the Bank can stick to this message, the recent rally in the Pound can extend and maintain the Pound-New Zealand Dollar uptrend for some time.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes