New Zealand Dollar Faces Decline in 2024 Says BCA Research

- Written by: Gary Howes

Image © Adobe Stock

One of the world's oldest independent research houses says the New Zealand Dollar "faces a much bigger risk of a decline in 2024" as the economy "is primed for recession".

BCA Research - founded in 1949 - says the Reserve Bank of New Zealand will keep interest rates unchanged at 5.5% for an extended period, which would disappoint a market that appears increasingly expectant of another rate hike.

RBNZ rate hike bets grew following last month's RBNZ update, which proved more 'hawkish' than expected as policymakers expressed frustration with New Zealand's stubborn inflation rates.

"The tone surrounding the announcement was surprisingly hawkish," says Chester Ntonifor, Foreign Exchange Strategist at BCA Research.

However, "the RBNZ is unlikely to deliver on that threat of additional interest rate increases in 2024," he cautions.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

In fact, BCA Research reckons the economy will show a material slowdown in 2024 as previous interest rate hikes make their presence felt, which could have negative impulses for the New Zealand Dollar.

So not only is the RBNZ likely to disappoint those expecting a hike (NZD negative), but the scale of the economic slowdown could also be underestimated (also NZD negative).

"It takes between 6-9 quarters for changes in interest rates to have the maximum impact on New Zealand inflation. If that holds true in the current cycle, the greatest downward pressure on New Zealand inflation from the RBNZ’s rate hikes will begin to be felt in 2024," says Ntonifor.

The New Zealand Dollar is one of 2023's G10 laggards but has picked up some value over recent weeks. In fact, it is the third strongest performer when screened over a one-month period.

Track NZD with your own custom rate alerts. Set Up Here.

Much of this is down to the broader improvement in global investor sentiment and the 'hawkish' recalibration in RBNZ expectations.

But looking to 2024, Ntonifor emphasises that interest rates are restrictive in New Zealand.

"This makes New Zealand an economy primed for recession. So, while the NZD will continue to benefit from some tailwinds today, it faces a much bigger risk of a decline in 2024," warns Ntonifor.

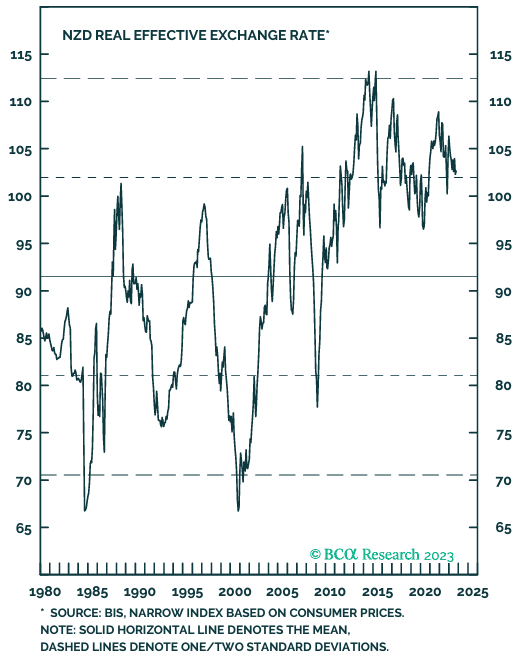

Above: "The Kiwi is expensive" - BCA Research.

More fundamentally, BCA Research says the deterioration in New Zealand's trade balance (the country spends more than it earns) suggests that the currency is becoming uncompetitive.

On a rolling 12-month basis, the trade deficit clocked N$15BN; "part of the deterioration in New Zealand’s trade balance also comes from the currency. NZD is the most expensive currency in the G10, after the USD".

An adjustment is therefore needed, and this "adjustment needs to come internally via lower unit labor costs, and more domestic savings, or externally via a lower currency, to improve competitiveness," explains Ntonifor.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes