New Zealand Dollar Week Ahead Forecast: RBNZ Unlikely To Spoil The Party

- Written by: Gary Howes

- GBPNZD locked in tight range

- NZDUSD is constructive

- RBNZ is front and centre this week

Above: RBNZ Governor Adrian Orr. File Image © Pound Sterling, Still Courtesy of RBNZ.

The New Zealand Dollar is soft at the start of the new week, but this underperformance does little to overturn the strong performance witnessed over the past week and month. This week, a looming Reserve Bank of New Zealand (RBNZ) decision offers the prospect of near-term volatility.

Heading into Wednesday's RBNZ, the New Zealand Dollar registers as the second-best performing G10 currency for the previous week and the third-best when screened over the past month.

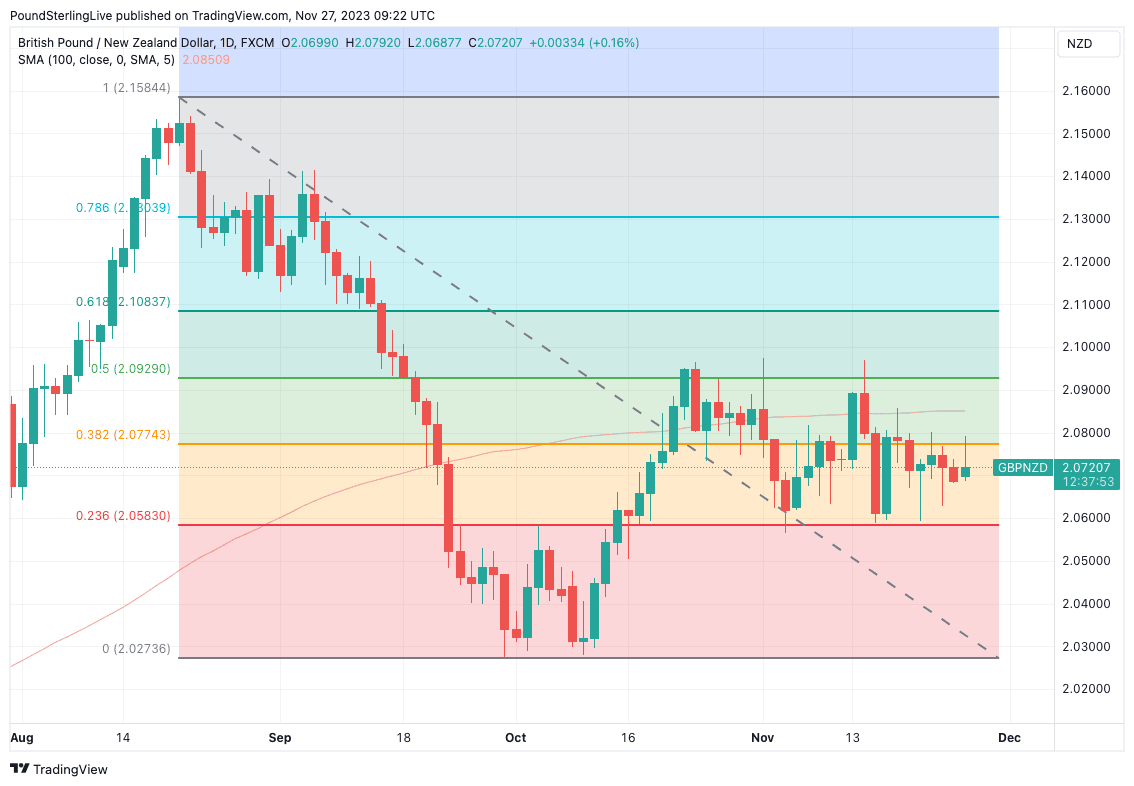

Only the Pound managed to advance against the New Zealand Dollar last week, and this is reflected in the tight range being respected by the Pound to New Zealand Dollar exchange on the charts:

Above: GBPNZD at daily intervals. Track NZD with your own custom rate alerts. Set Up Here.

The above shows GBPNZD to be locked in a tight zone that is formed by the 23.6%-38.2% Fibonacci retracement of the August to October decline. Gains above 2.0775 are likely to be sold into in the near term, while solid support at 2.0583 should limit any downside.

A potential break of this tight formation could result from any surprises out of the RBNZ midweek, where interest rates are expected to be maintained.

The surprise factor therefore lies with how the RBNZ steers the market regarding further policy moves: is another hike likely in 2024, or is it now time to guide the market towards a future of lower rates?

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

If the latter, then the NZD could come under some pressure over the days following the RBNZ's decision.

But more likely, the RBNZ will try to resist expectations for rate cuts, given the market has been quite aggressive in building such expectations, which eases New Zealand's monetary conditions and works against the RBNZ's objectives of bringing down inflation.

"The RBNZ could push back against market pricing for rate cuts and give the NZD a boost," says David Forrester, an analyst at Crédit Agricole.

At the time of the last Monetary Policy Report in August, the RBNZ forecast a small chance of a rate hike in early 2024 as well as a small chance of rate cuts beginning in the final quarter of next year.

"The RBNZ will leave rates on hold next week, leaving the focus for investors on the central bank's MPS and especially its forecast profile for the OCR," explains Forrester. "Steep falls in food prices as well as continued weakness in household consumption and PMI data have led the NZ rates market to bring forward the timing of RBNZ rate cuts to mid-2024. The RBNZ will likely push back against this pricing, which would be good news for the NZD."

Track NZD with your own custom rate alerts. Set Up Here.

David Croy, FX Strategist at ANZ, says the RBNZ is likely to face a communications challenge this week.

"A pause is universally expected, so it'll be their tone and projections that will drive markets on the day. The Committee knows lowering the OCR track or anything suggesting cuts could be sooner than indicated will be met with a big easing in financial conditions, but equally, anything too hawkish could be seen by markets as a bluff," he explains.

ANZ thinks the RBNZ will leave the track much as is and stay in data-watch mode, but with so much easing now priced in, "the risks could be skewed slightly to the upside for the Kiwi on a non-dovish outcome."

Fawad Razaqzada, an analyst at City Index, says past rate hikes have cooled New Zealand's economic activity and reduced inflation "as required."

"But the RBNZ will keep its policy restrictive to ensure that inflation falls back within its 1%-3% target range. If there are no indications of policy loosening in the months ahead, then this might keep the NZD supported," says Razaqzada.

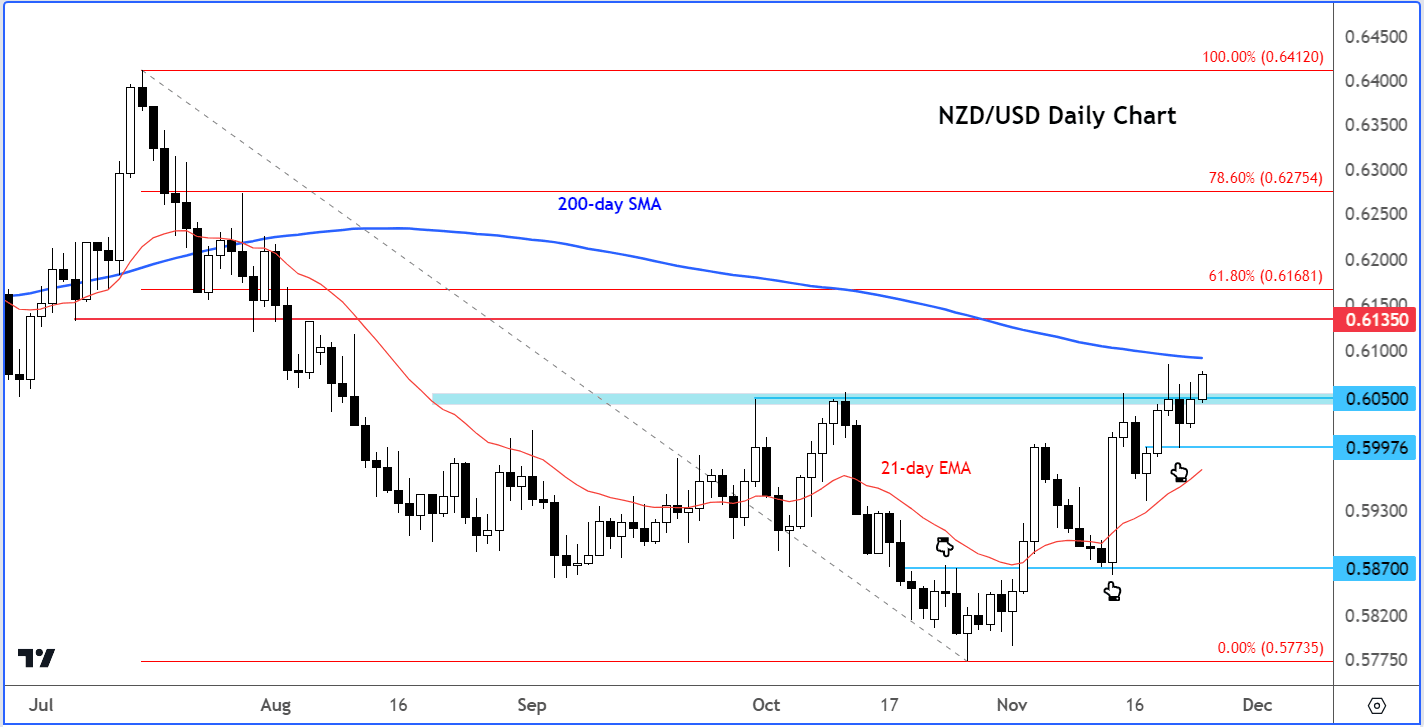

Above: NZD/USD technicals by City Index.

Regarding the New Zealand to U.S. Dollar exchange rate outlook, City Index analysis shows the exchange rate has been finding support from broken resistance levels, as shown on the chart above, making higher lows.

"The key support that needs to be defended moving forward is around 0.6050, which was significant support in the past," says Razaqzada.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes