New Zealand Dollar On Top, China & Retail Sales To Thank

- Written by: Sam Coventry

Image © Adobe Stock

The New Zealand Dollar is the best-performing major currency ahead of the weekend thanks to benign global market conditions, fresh efforts by China to boost the domestic economy, and some heartening domestic retail sales figures.

"An upside surprise in NZ retail sales led to the NZD being the outperforming G10 currency," says David Forester, Senior FX Strategist at Crédit Agricole.

Retail sales volumes registered at 0% quarter-on-quarter in the third quarter, said Stats NZ, which was far better than the -0.8% market expected and a sharp recovery on Q2's -0.9%.

The figures give some hope that the release of GDP numbers on December 14 can come in above expectations, further boosting the NZ Dollar.

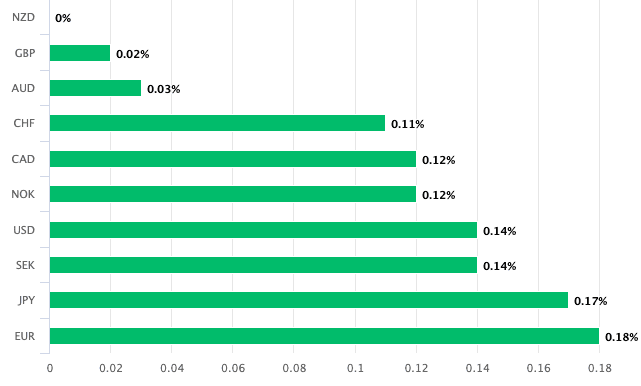

Above: NZD performance on November 24. Track NZD with your own custom rate alerts. Set Up Here.

But the global driver is arguably proving more instrumental in the Kiwi's advance, with November shaping up to be the best month of 2023 for the world's stock markets.

Improvements in investor sentiment traditionally tend to support the NZ Dollar, which advanced against all its peers (besides the Krona) over the course of the past month.

NZD strength has extended in the short-term thanks to a sentiment boost from China, where authorities announced fresh measures to bolster the property sector.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

"After signs of global disinflation and of a U.S. soft landing, China has just made its contribution to the prevailing market optimism, unveiling an unprecedented support plan designed to bolster Chinese property developers," says a note from Natixis, the investment and commercial bank.

China will allow banks to extend unsecured short-term loans to qualified developers which can further underpin the sector.

"In China, we saw an unprecedented policy discussion by the central government to support the real estate sector, as it reportedly planning to allow banks to issue unsecured short-term loans to qualified developers," says Francesco Pesole, FX Strategist at ING.

China is New Zealand's most important export destination, and the health of its economy therefore matters for New Zealand's domestic outlook.

The New Zealand Dollar is often considered a liquid proxy for exposure to China. Therefore, any supportive developments regarding the Chinese outlook have knock-on effects on the NZ Dollar.

But ING's Pesole does caution that this might not yet be the all-clear for Chinese assets (and we read the NZ Dollar, by extension).

"While it is a positive development on paper, it does signal a very concerned mood in Beijing about the developers' crisis," he says.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes