New Zealand Dollar Week Ahead Forecast: Near-term Trend Stays Soft

- Written by: Gary Howes

- GBPNZD near-term trend is soft

- Putting 2.05 in sight of sellers

- But beware a busy calendar this week

- UK inflation, wages in focus for GBP

- U.S. inflation midweek is key for NZD

Image © Adobe Stock

The Pound to New Zealand Dollar could test 2.10 this week if UK domestic data doesn't disappoint and global risk sentiment sours, but technical studies point to a greater likelihood the pair edges lower over the coming days.

This is a busy week for the British Pound that promises heightened volatility and opportunity for those looking to make GBP/NZD payments, with inflation and wage data on tap, while for the New Zealand Dollar, a midweek U.S. inflation release and various Chinese economic prints will be of importance.

The technical setup is marginally favourable to the New Zealand Dollar in the short term as a declining 50-day moving average (DMA) is guiding the pair lower:

Above: GBPNZD at daily intervals, 50-day MA shows momentum is negative near-term. Set up a daily rate alert email to track your exchange rate OR set an alert for when your ideal exchange rate is triggered ➡ find out more.

The above shows the GBPNZD has been declining since October 24 in tandem with the sinking 50 DMA, with any daily break above this line ultimately proving a false flag.

Based on this technical development, those looking to cut out the noise created by data releases and sentiment swings could position for a move to 2.06 and then 2.05 by the time the week is done.

(GBPNZD tends to move by approximately 1.0% in any given week, and this puts 2.10 at the top and 2.05 at the bottom in its range for the coming days).

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$53.50

Free • No obligation • Takes 2 minutes

2.10 becomes the more likely target if GBPNZD is able to close above the 50 DMA on two days in succession, as this would suggest a bullish technical development is underway.

Of course, it comes down to the data to break the trend and for the NZ Dollar, the global picture matters this week owing to a quiet domestic calendar with no front-line releases due.

Chinese releases will be of importance, with markets looking for signs that New Zealand's most important trade partner is seeing improved activity.

Tuesday sees Chinese industrial production at 02:00 GMT; consensus is looking for a 4.3% increase year-on-year in October, down from 4.5% previously.

Chinese retail sales are released at the same time and can give an insight into the Chinese consumer, which is particularly important for New Zealand's consumer-dependent exporters, and a 7.0% y/y increase is expected. Should Chinese data beat expectations, the Kiwi can rally.

Regarding broader sentiment, the U.S. picture will also be of importance. We note how the NZ Dollar was a major beneficiary of the softer-than-forecast U.S. labour market numbers on November 03, which prompted markets to lower bets for further U.S. interest rate rises.

This outperformance was checked just days later when Fed officials maintained guidance that further rate hikes cannot yet be ruled out.

With this in mind, all eyes will be on U.S. inflation figures due midweek, where an undershoot could propel the Kiwi higher.

"FX markets remain very USD-centric, with the latest move being driven primarily by a sudden surge in US bond yields. This week looks to have more of the same in store, with U.S. CPI data taking centre stage early Wednesday NZ time," says David Croy, Strategist at ANZ.

"NZD/USD has retraced around half the recent rally to 0.6000, and momentum suggests a retest of the 0.5800 area is possible during the week ahead. The key event for the week will be US CPI inflation data," says Richard Franulovich, head of FX strategy at Westpac.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$53.50

Free • No obligation • Takes 2 minutes

This week is busy with earnings, inflation and retail sales data on tap for the Pound. Earnings are due at 07:00 GMT on Tuesday, with the consensus looking for a reading of 8.3% in September and should the outcome be above this, the Pound could find some support.

However, the week's highlight is Wednesday's inflation report, due at 07:00, with the market preparing for a sizeable drop to 4.5% year-on-year from 6.7%.

Should the outcome be above this figure, the Pound could be supported, although we would expect any strength to be limited.

"Inflation data is unlikely to change the direction of travel for the Bank of England, and we only expect a minor impact on exchange rates. We hold on to our range-trading theme with a lower limit at the psychological 1.20 resistance level," says Thomas Flury, Strategist at UBS.

Should inflation undershoot, the market would likely boost bets for rate cuts in 2024, resulting in further weakness in the Pound.

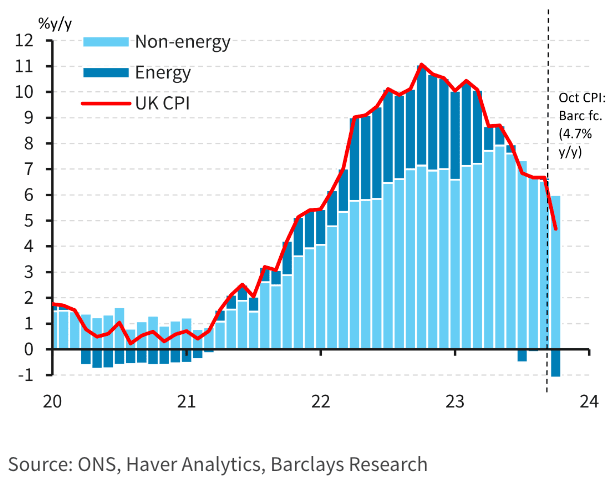

"The fall in household energy bills, coupled with base effects, is set to drive a sharp decline in headline inflation in October, though we also expect moderation in core inflation with both core goods and services easing," says Abbas Khan, an economist at Barclays.

Above: "Falling energy contribution the primary driver of the fall in headline CPI in October; but non-energy components to ease too" - Barclays.

"A drop in the Ofgem Price Cap alongside slowing food and core goods momentum should result in headline CPI dropping by close to 200bps," says Sanjay Raja, Senior Economist at Deutsche Bank.

"More disinflation pressure is building. Our own DB Price Survey Tracker points to another 150bps fall by springtime. And our forecasts continue to show headline CPI printing closer to 3% y-o-y by April 2024," he adds.

Above: What the Bank of England is forecasting. Image courtesy of Deutsche Bank.

"For now, we continue to see some downside risks to the Bank of England's CPI projections, which we think should open the door for modest rate cuts by spring time next year," says Raja.

Retail sales are anticipated to have fallen 1.0% in the year to October and 0.9% in the month.

Should the outcome be above these estimates, the Pound could rise, although gains would likely be limited. Instead, risks are tilted to the downside in the event the outcome is below estimate.

"Retail sales were surprisingly soft in September, dropping 0.9% m/m. But we think this is largely noise and expect a decent rebound in October. September's sharp falls in sales in the non-food and non-store categories look particularly odd, and we expect these sectors to have largely made up those losses in October," says Andrew Goodwin, Chief UK Economist at Oxford Economics.