New Zealand Dollar Forecast to Remain Firm Until 2016

- Written by: Gary Howes

Those hoping for an imminent and steep decline in the value of the New Zealand dollar exchange rate (NZD) complex will be disappointed.

This is if the latest forecasts issued by NAB prove correct.

Analysts have told clients, in their late-March exchange rate forecast note, that the prospect of significant falls in 2015 are unlikely to transpire because New Zealand’s interest rates will continue to remain attractive on the international financial stage.

As long as holding New Zealand debt-based assets yield superior returns global demand will likely continue keeping the NZD propped up.

However, there remains the chance that the Reserve Bank of New Zealand undermines the local currency by instituting interest rate cuts which will ultimately undermine this advantage.

Indeed, “we think, in the near-term at least, Governor Wheeler is closer to cutting the policy rate than raising it,” warn NAB in their latest research note on the matter.

Where is the New Zealand Dollar now?

The kiwi continues to command high valuations against its peers on a historical basis and is in effect continuing to hover around levels that the RBNZ could deem as being overvalued.

- The pound to NZ dollar exchange rate (GBPNZD) is seen trading at 1.9452. The pair has thus far reached a maximum of 2.0936 in 2015.

- The euro to NZ dollar (EURNZD) is seen at 1.4340. A high of 1.5822 has been achieved since the open of the year.

- The NZ to US Dollar (NZDUSD) is seen at 0.7648. The 2015 maximum reached in January was at 0.7890.

Inflation: The Wildcard that May Undermine the NZD’s Strength

As mentioned, the prospect of a NZD-negative interest rate cut could be the one major driver of a fall in the currency.

Why?

Inflation is the one financial variable central banks are primarily focussed on controlling.

When inflation is high central bankers tend to raise interest rates to stem the flow of inflation-boosting money into the economy.

When it is too low interest rates can be cut as the economy can take a higher supply of money without risking runaway inflation.

NB. that all currency quotes mentioned above refer to the wholesale market. Your bank will affix a discretionary spread when transferring money internationally. However, an independent provider will seek to undercut your bank's offer, thereby delivering up to 5% more currency in some instances. Please learn more.

New Zealand, like the rest of the world, faces low inflationary conditions which would allow the RBNZ to pursue lower interest rates and exchange rates.

“Inflation expectations are the one factor that could push the RBNZ into the policy easing camp. The Bank went so far as to present an alternate scenario, whereby a continued decline in inflation expectations might mandate rate cuts. Unfortunately, NZ’s inflation indexed bond market is not liquid enough to provide a traded measure of inflation,” say NAB.

To be clear, NAB only expect the Bank to consider rate cuts only if there were a need to do 50bps or more suggesting the bar to a cut remains high.

Strength to Persist

Before betting on a NZD decline, it must be noted that the core assumption at NAB is that the Kiwi unit will remain stubbornly firm.

As such strategists at BNZ advise they would consider EUR, AUD, or GBP better vehicles for a long USD position.

“We would consider re-entering a short NZD/USD only near or at 0.7600, but prefer to keep our powder dry until closer to the local Q1 inflation report (20 April). There, we expect the fall in headline inflation (from 0.8% y/y to 0.2%) to spur rate cut expectations. Until then, NZD/USD may remain supported,” says BNZ strategy team.

2016 Forecasts - Lower

Looking ahead into 2016 is where the NZ dollar is likely to strike a bearish tone.

NAB and BNZ tell clients they retain a bearish outlook on the NZD, even as the USD peaks against the other majors.

While other major currencies are picked to rise against the USD in late 2016, BNZ see NZD/USD falling to 0.65 by mid-2017.

This is predicated on a growth slowdown over the coming two years, as the impetus from the Christchurch rebuild and strong migration wane.

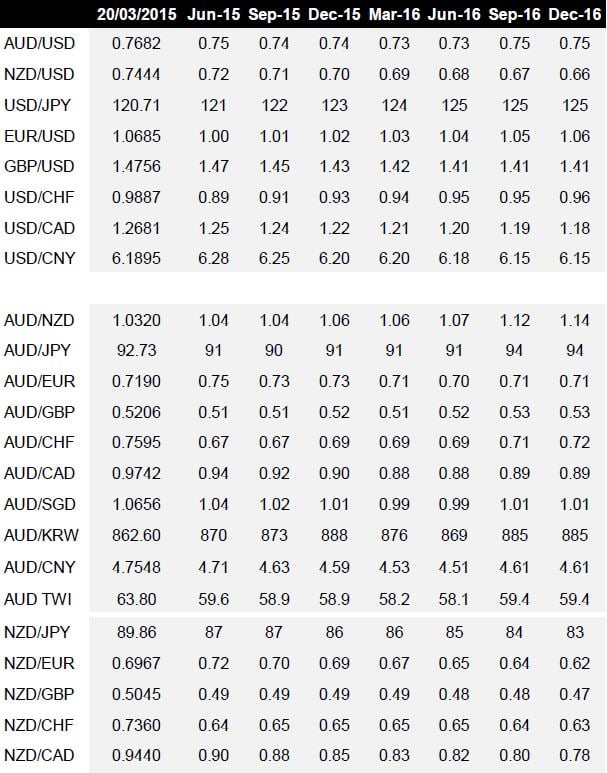

The Forecast Table

Below is the March exchange rate table from NAB: