New Zealand Dollar Underperforms on Inflation Undershoot

- Written by: Gary Howes

Image © Adobe Stock

The New Zealand Dollar was softer across the board after quarterly inflation figures came in below expectations and lowered the odds of a further rate rise at the Reserve Bank of New Zealand (RBNZ).

"We no longer expect the RBNZ to increase the OCR at the November Monetary Policy Statement," says Kelly Eckhold, an economist at Westpac. "The RBNZ has indicated a high bar to tighten before the end of this year and today's below-forecast CPI will leave them comfortable with that judgement."

According to figures released by Stats NZ on October 17, New Zealand's consumer price index inflation increased 5.6% in the 12 months to the September 2023 quarter.

The market expected a rise of 5.9%, down from 6.0% in the previous quarter. Inflation rose 1.8% on a quarter-on-quarter basis, which was below 2.0% expected and up from 1.1% previously.

The RBNZ sectoral core inflation measure stood at 5.2% y/y in the third quarter, down from 5.7% previously.

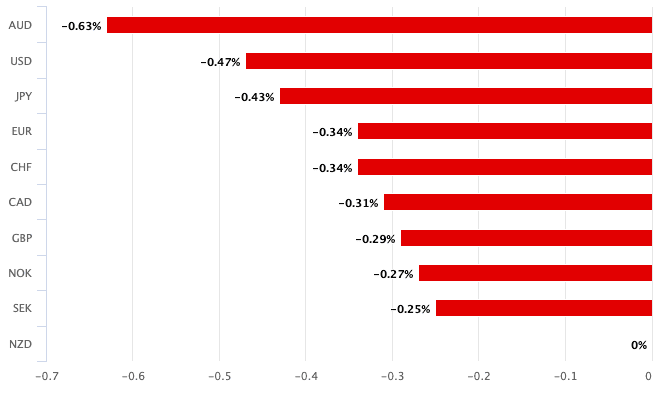

The impact on the New Zealand Dollar was notable, with the currency coming under pressure against all its G10 peers:

Above: NZD movement against the G10 currencies on October 17. Set up a daily rate alert email to track your exchange rate OR set an alert for when your ideal exchange rate is triggered ➡ find out more.

The Pound to New Zealand Dollar rose 0.30% in the hour of the data release, with further follow-through gains taking it to a peak of 2.0707 on Tuesday. The New Zealand Dollar-U.S. dollar conversion dipped by a similar margin to quote at 0.59 at the time of writing.

The New Zealand Dollar came under pressure through the July-August period as the market moved to lower the odds of further rate hikes, but the currency recovered poise in September and October, particularly against the likes of Sterling and the Euro.

Some of the improvement came amidst building odds of a November rate hike, given some robust data and persistent inflationary pressures. But this latest release could push back against any recent improvement.

Eckhold says the RBNZ's high hurdle to shift interest rates before next year meant it was going to take an upside surprise to the CPI – particularly in the core inflation measures – to push the central bank into a November rate hike.

"We didn’t see that upside surprise in the numbers released today," he says.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes