New Zealand Dollar Boosted by Soothing Federal Reserve, But Bullish Story Remains Elusive

- Written by: Gary Howes

Image © Adobe Stock

The New Zealand Dollar was a winner amongst the major currencies after the Federal Reserve's latest policy decision and update opened the door to a fresh breeze of investor optimism.

The Kiwi was up against the majority of its peers after the Fed confirmed a further rate hike in September was not a done deal, instead preferring to base its next decision on the flavour of incoming data.

The outcome was consistent with an improved investor sentiment linked to expectations that the interest rate hiking cycle in the U.S. has come to an end; a sentiment which tends to support the New Zealand Dollar.

"The words of Jerome Powell struck a chord with investors, with optimism taking over the markets in a dynamic that penalises the haven dollar," says Ricardo Evangelista, Senior Analyst at ActivTrades.

The New Zealand Dollar accordingly advanced against the U.S. Dollar, pushing NZDUSD to 0.6253 in the process, and signalling the recent July pullback is potentially fading.

The Pound to New Zealand Dollar exchange rate (GBPNZD) was lower by a third of a per cent as post-Fed optimism entered the Asian and European trading sessions on Thursday, offering the Kiwi a boost.

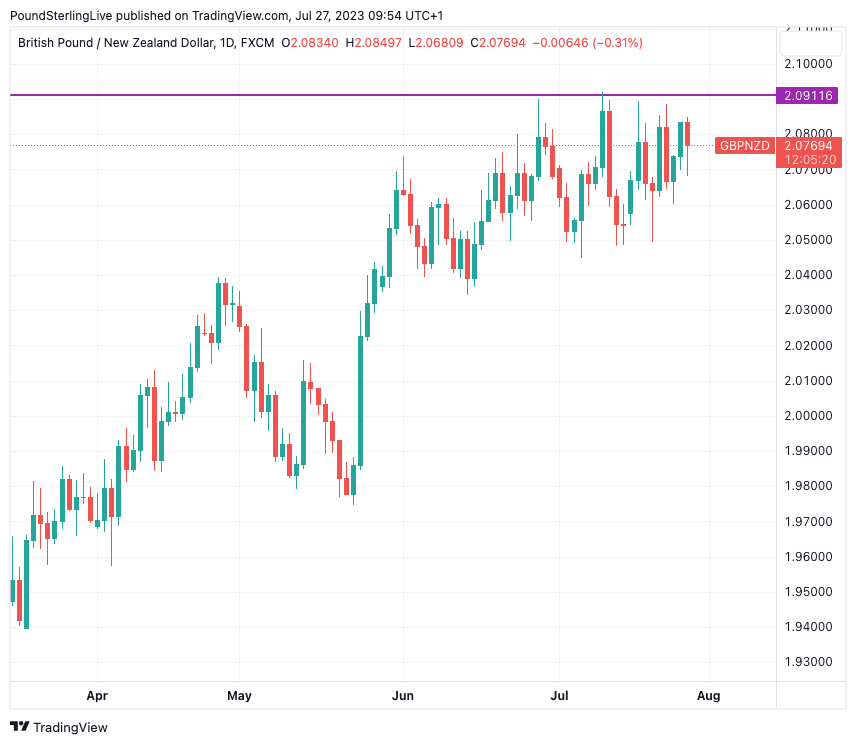

GBPNZD is now at 2.0769 which confirms it to be in a consolidative phase, albeit not far from multi-year highs located in the vicinity of 2.09:

Above: GBPNZD is consolidating below the 2.09 ceiling.

A breakthrough above the 2.09 ceiling will potentially reignite the uptrend, however, resistance levels can be hard to crack and could ensure further sideways trading.

Regarding the GBPNZD outlook, David Croy, Strategist at ANZ, says "GBP price action constructive".

"The Kiwi rallied a touch following Fed Chair Powell’s post-FOMC press conference, which saw US bond yields fall," he says. "With no major local data for the remainder of the week, the focus remains on offshore events."

The short-term bounce in the NZ Dollar reflects optimism about the global economy and that the major central banks will be able to bring down inflation without weakening labour markets too much.

However, economists remain wary that many of the advanced economies, including the U.S., will face a recession because of the central bank tightening delivered so far.

A weak global outlook would weigh on the New Zealand Dollar outlook, particularly since central banks such as the Fed and Bank of England will catch up to the RBNZ's base interest rate at 5.5%, diminishing the NZD's carry advantage.

"With the Fed policy rate now on a par with the OCR, the NZD no longer has carry in its corner either," says Croy. "It's becoming harder to build a bullish NZD story, and perhaps stability is the best that might come."

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes