GBP/NZD Rate Comfortable in New Range

- Written by: James Skinner

"NZD/GBP may have topped out. Talk of the BoE needing to possibly take policy to 7% might see renewed GBP strength while the RBNZ is dug in" - ANZ

Image credit: Lux Tonnerre. Sourced: Flickr. Licensing conditions: CC 2.0.

The Pound to New Zealand Dollar exchange rate was little changed near seven-day lows in the penultimate session of the week and appeared comfortable within its recent range spanning the gap between roughly 2.04 and 2.09 even as some global market correlations were turned on their heads.

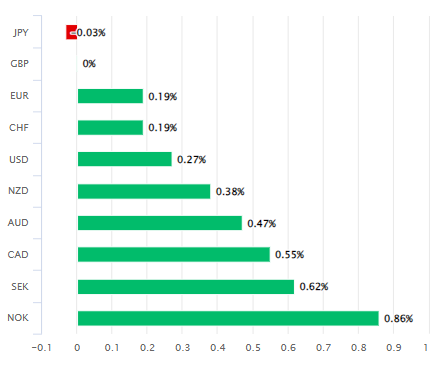

Sterling was close to the best-performing currency in the G10 contingent on Thursday as it lagged behind only the Kiwi Dollar and Japanese Yen amid widespread losses for stock and bond markets globally and a mixed picture for commodities of all kinds.

Thursday's price action was unusual for its contrast with more typical correlations, which tend to see Sterling and the Kiwi falling while the Yen and U.S. Dollar rise.

"The USD is generally inversely correlated with the global growth cycle and so far this quarter we are seeing the opposite play out," writes Brad Bechtel, global head of FX at Jefferies, in Thursday market commentary.

"Typically, with global rates backing up you would see growth expectations declining and the USD rallying, but so far this quarter that has yet to take hold and can help explain why the likes of EUR, GBP and JPY remain supported," he adds.

Above: Pound Sterling performance relative to G10 currencies on Thursday.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

The contrast between currencies was replicated in stock and bond markets where there was a positive correlation in place of one that is normally divergent.

Government bonds play the role of 'safe assets' and so rising prices normally tend to push yields lower when stock markets fall and vice versa.

"It has held its own on key crosses, only losing ground to GBP on chatter about higher policy rates there and to JPY on what looks like a technical pullback," says David Croy, a senior FX strategist at ANZ, in relation to the Kiwi Dollar.

"NZD/GBP may have topped out. Talk of the BoE needing to possibly take policy to 7% might see renewed GBP strength while the RBNZ is dug in," he adds.

Pound Sterling's gains built further after Automatic Data Processing Inc said its measure of private sector employment rose by 497k in June, up from 267k and far above the economist consensus suggesting a 226k increase was more likely.

Above: Pound to New Zealand Dollar rate shown at daily intervals alongside NZD/USD.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

"Consumer-facing service industries had a strong June, aligning to push job creation higher than expected. But wage growth continues to ebb in these same industries, and hiring likely is cresting," says Nela Richardson, chief economist at ADP.

"Job stayers saw a year-over-year pay increase of 6.4 percent, down from 6.6 percent in May. For job changers, pay gains slowed for the 12th straight month, to 11.2 percent, the slowest pace of growth since October 2021," she adds.

It's possible that Thursday's simultaneous losses in stock and bond markets were a reflection of investors and traders contemplating how much higher interest rates might be raised by central banks in the U.S. and elsewhere as they seek to bring inflation back to their respective targets.

Many analysts did attribute the Pound's outperformance on Thursday to speculation suggesting the Bank of England (BoE) Bank Rate "would have to rise a further 2 percentage points as prices continued to climb."

This would be part of the BoE's effort to bring UK inflation back to the target level of 2% but there was not actually a forecast of 7% made by the lender concerned; J.P. Morgan, which tips the Bank Rate to peak at 5.75% by year-end.