New Zealand Dollar Forecasts From Westpac Show GBPNZD Rally to Reverse Over Second Half of 2023

- Written by: Gary Howes

The RBNZ has more work to do says Westpac. Above, file image of RBNZ Governor Orr © Pound Sterling Live, Still Courtesy of RBNZ.

Relief for New Zealand Dollar sellers might be in prospect in the second half of 2023 according to Westpac which has released forecasts showing a recovery against the British Pound.

The New Zealand and Australian lender and investment bank says the Pound will be a laggard over the coming months while the Kiwi currency will find support from further interest rate hikes in New Zealand as house prices prove more resilient than expected.

Westpac says although the Reserve Bank of New Zealand (RBNZ) signalled in June it has most likely completed raising interest rates, more work needs to be done.

"We think that the cash rate will need to rise further from here, especially given the boost to demand from the current surge in migration," says Satish Ranchhod, Senior Economist at Westpac.

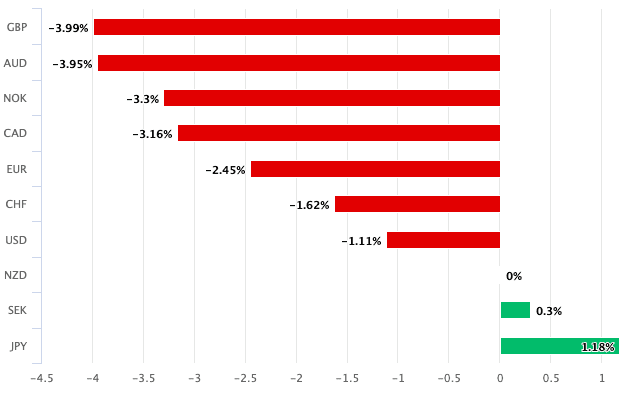

The New Zealand Dollar has been a laggard in the G10 arena over the course of the past month as markets react to the RBNZ's 'dovish' signal at the May 24 policy meeting, an outcome that reflects the foreign exchange market's current strong linkage to interest rate expectations.

Above: NZD performance over the past month, showing the greatest losses have been experienced against the GBP.

The Pound has meanwhile been supported by the elevated expectations in the market for the outlook for UK interest rates, with the Bank of England expected by investors to hike Bank Rate to as high as 6.0%.

Any reboot in RBNZ rate hike expectations could therefore prompt some renewed support for the NZD against the likes of Sterling.

"It's likely that domestic demand and inflation pressures will prove stronger than the RBNZ expects. However, it will take some time – likely not until late this year – before the strength of those pressures becomes obvious," says Ranchod.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

In particular, Westpac says the RBNZ is underappreciating the impact immigration will have on house prices, forecasting a further 3.5% fall in house prices over the next year before they bottom out.

However, the most recent REINZ sales figures hint that the turn in the market may have already arrived, according to Westpac.

"The firming in house prices in Australia – which saw a similar resurgence in net migration earlier on in the piece – should serve as a warning for what might come next here," says Ranchod.

Furthermore, Westpac reckons the RBNZ is underestimating the persistence of domestic inflation pressures. "If the RBNZ does not take the OCR higher from here, domestic inflation pressures will likely linger, meaning interest rates will also likely need to remain higher for longer."

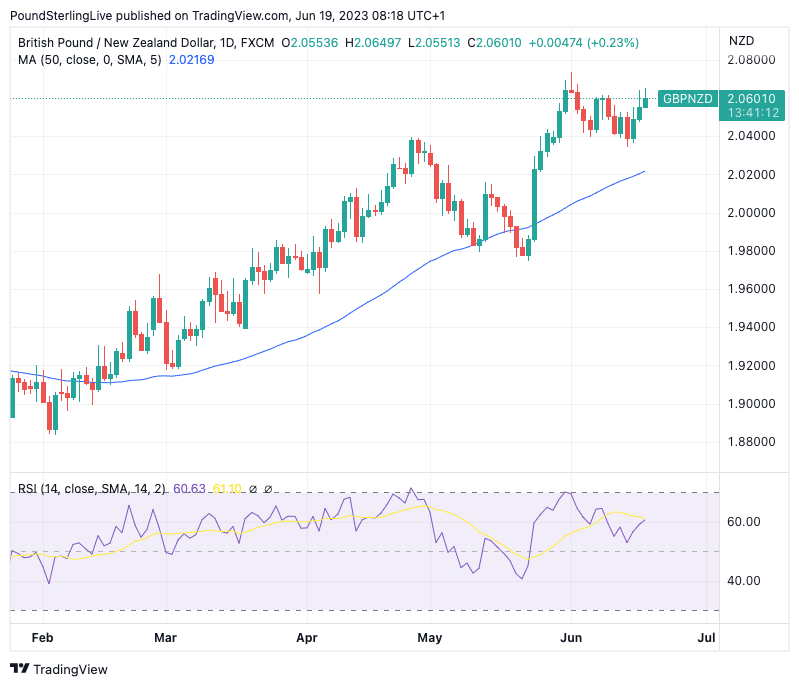

Above: GBPNZD remains in a firm uptrend. See: "GBPNZD Staying Bullish"

Turning to the Pound, Westpac says a "material rise in unemployment" is now expected for the UK. In addition, the country is likely to see higher interest rates built on rising inflation, with little economic growth expected.

For Sterling, this means "the reality of recession" is set to offset "the benefit of rate differentials."

Westpac forecasts the New Zealand to Pound exchange rate (NZDGBP) to recover and reach approximately 0.49 for end-September, 0.49 for year-end, 0.49 for end-March 2024 and 0.50 for end-June 2024. The pair is currently quoted at 0.4829.

This gives Pound to New Zealand Dollar profile of 2.04, 2.04, 2.04 and 2.0, respectively, suggesting a decline from the current level of 2.0700 lies ahead.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes