New Zealand Dollar Forecast: ANZ sees GBP/NZD Sticking Above 2.0, NZD/USD Can Strengthen

- Written by: Gary Howes

- NZD recovery predicted near-term

- As fair-value reversion and 'carry' support

- But NZ faces "day of reckoning"

- As current account and budget deficits linger

Image © Adobe Stock

The New Zealand Dollar can recover some of its recent losses against the Pound, however, any comeback is unlikely to mean the 2.0 level in GBP/NZD is breached on a sustained basis.

This is according to Australian and New Zealand lender ANZ which has released its latest in-depth assessment of the New Zealand Dollar's prospects, revealing a recovery against the Dollar can be expected.

The Kiwi is one of the G10 currency sphere's laggards for 2023 with losses being recorded against all peers apart from the Yen and Krone.

Reasons for the underperformance include the Reserve Bank of New Zealand's (RBNZ) recent signal that it had completed its rate hiking cycle; a development markets were unprepared for.

In addition, the Chinese economic recovery has failed to ignite to the extent economists were expecting at the start of the year when expectations for a post-Covid boom were running high. This has implications for New Zealand exports, such as milk and timber.

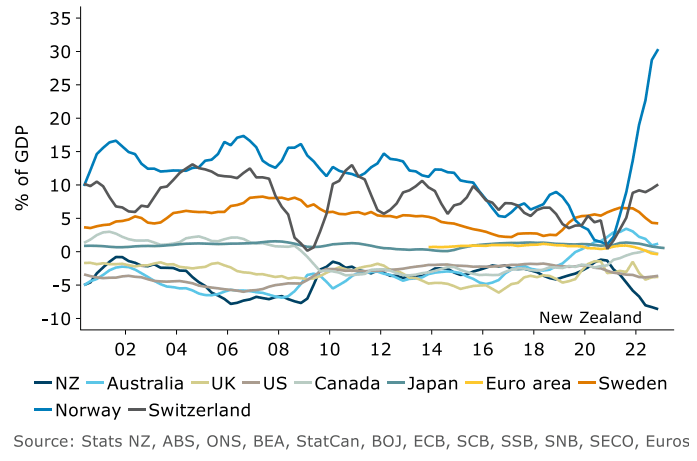

The country meanwhile continues to run a significant current account deficit as it pays out more for imports than it earns via exports.

"We have a record current account deficit and we're running Budget deficits for the foreseeable future. In other words, we've been living well beyond our means and it’s not clear that'll change any time soon," says Sharon Zollner, Chief Economist at ANZ.

Nearer-term Outlook: Recovery Potential

ANZ's analysts say there is however one powerful source of support in the New Zealand Dollar's corner: New Zealand's elevated interest rate environment which makes money-based assets attractive to international investors.

High rates are a result of Reserve Bank of New Zealand (RBNZ) interest rate hikes that have taken the Overnight Cash Rate - the basis for the pricing of New Zealand rates and yields - to 5.5%.

"Carry has been a key consideration for the Kiwi for decades, thanks to the tendency towards higher interest rates in New Zealand, and a tendency for higher-yielding currencies to appreciate," says Zollner.

"In practice, carry – or interest rate differentials – is likely to matter more during periods of relative calm," adds Zollner, "that’s the sort of environment we think we’re entering now that the RBNZ has signalled that it’s comfortable with the OCR where it is at 5.5%."

Furthermore, ANZ finds the NZD to be undervalued relative to the Dollar on a fair-value basis.

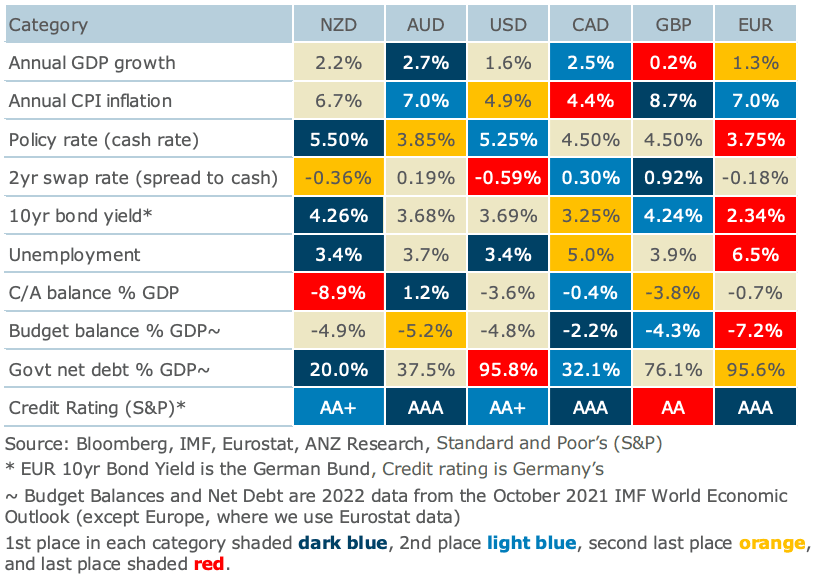

Above: "How does New Zealand score relative to its peers?" - ANZ.

New Zealand Dollar Longer-term Outlook: A Reckoning

ANZ says carry and gravitation towards fair-value point to a higher New Zealand Dollar in the near- to medium-term, however, "down the track we do think the NZD faces challenges," says Zollner.

She points to the record current account deficit and budget deficits that mean "we've been living well beyond our means and it’s not clear that'll change any time soon."

Zollner acknowledges New Zealand has been running deficits for years and rating agencies aren't ringing the alarm bells over the matter.

But, "a day of reckoning is coming," says Zollner, "and when it comes, it could be brutal."

But for now, there is no catalyst to spark this reckoning, "so, while we continue to forecast a gradual appreciation in the NZD, we also continue to fret about when that day of reckoning might come."

Above: Current account deficits amongst the major G10 currencies. Source: ANZ.

The Forecasted Levels

ANZ forecasts the New Zealand Dollar to recover back to 0.50 against the Pound by the end of September, a level that is also pencilled in for December.

However, a decline to 0.492 is seen by end-March 2024, 0.485 for end-June and 0.478 for end-2024.

This gives a Pound to New Zealand Dollar exchange rate profile of 2.0, 2.0, 2.03, 2.06 and 2.09.

For the New Zealand to U.S. Dollar exchange rate, the forecast profile is 0.640 for end-September, 0.650 for year-end, 0.650 for end-March 2024, 0.650 for end-September and 0.650 for end-2024.

The New Zealand to Euro exchange rate forecast profile is 0.571, 0.570, 0.560, 0.551 and 0.542 for these respective timeframes.

This gives a Euro to New Zealand Dollar exchange rate profile of: 1.75, 1.75, 1.78, 1.81 and 1.85.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes